Pionex Crypto Trading Bot User Guide — Chapter 4.1 — Bullish Bots

The Grid Bot for Bullish Markets

4.1 The Grid Trading Bot for Bullish Markets

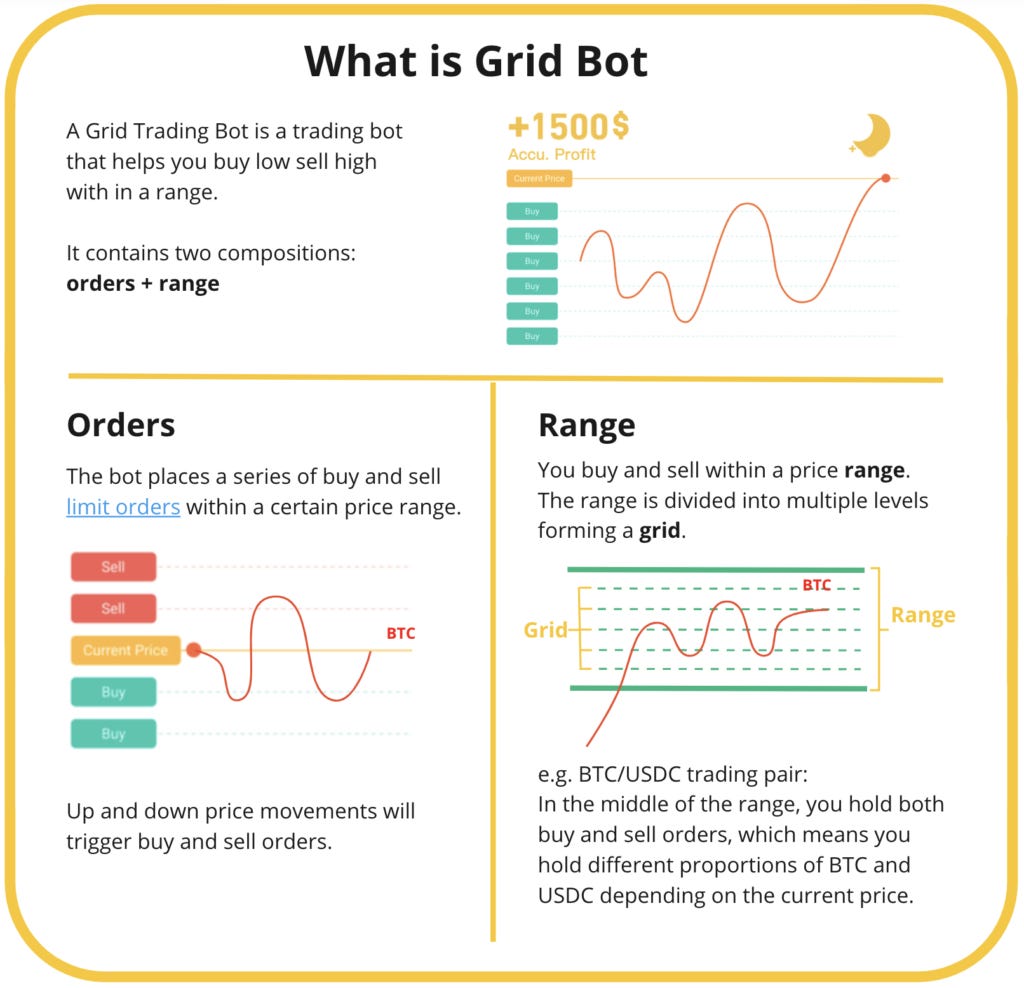

We covered the Grid Bot already — it is the most basic trading bot underlying many other strategies, and there is no need to rehash the entire concept here.

This section will only focus on the use of a Grid Bot in Bullish market conditions.

In a bull market as prices trend upward, they do so often with higher volatility and occasional pullbacks. Grid bots can work well here, but you’ll need to configure them differently because the upward trend reduces the frequency of buy orders being filled at lower grid levels.

You’ll need to adjust the configuration to account for the trend and avoid being stuck holding sell orders too far below the market price.

Configuration for Bullish Price Action

Grid Range: Set a wider range to account for larger price swings and the upward trend. Adjust the price range slightly above the current price to capture pullbacks and rallies.

Grid Spacing: Use wider grid intervals to accommodate larger price movements and reduce the risk of selling too soon during volatile spikes.

Order Size: Allocate slightly larger orders on the buy side (fewer grids) to take advantage of dips, with smaller sell orders to lock in profits during rallies.

Stop-Loss/Take-Profit: Set a trailing stop which is a dynamic range adjustment to follow the upward trend, preventing the bot from being left behind as prices rise.

Number of Grids: Use fewer grids to reduce exposure to lower price levels that may not be revisited.

Example:

Asset: BTC/USD

Market Context: Bitcoin is in a steady uptrend, moving from $65,000 to $75,000 over the past month, with pullbacks of 5%-10%.

Grid Range: $68,000 (lower bound) to $78,000 (upper bound).

Number of Grids: 10 grids.

Grid Spacing: ($78,000 — $68,000) / 10 = $1,000 per grid.

Order Size per Grid:

Buy orders (lower 5 grids): 0.015 BTC per grid.

Sell orders (upper 5 grids): 0.01 BTC per grid.

Total Investment: ~0.125 BTC (~$8,750 at $70,000/BTC).

Stop-Loss: Pause bot if price drops below $66,000 (indicating a potential trend reversal).

Take-Profit: Close positions if profit exceeds 8% ($700), or adjust range upward if price breaks above $78,000.

Chapter 4.1 Key Points:

Wider Grid Range: Set a broader price range to capture larger price swings and follow an upward trend with your Grid Bot.

Larger Grid Spacing: Use wider intervals (e.g., $1,000) to account for increased volatility and avoid overtrading.

Fewer Grids: Reduce the number of grids (e.g., 10) to focus on significant price levels and limit exposure to lower prices.

Dynamic Adjustments: Implementing trailing stops shifts grid range upward to stay aligned with a bullish trend.

Continue to the Next in this series:

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

A.I. Lifestyle

Lifestyle Income Automation Solutions. "There is always a solution for everything!" A few years ago I automated my…www.youtube.com

#bitcoin #tradingbots #pionexguide #userguides #automatedtrading #tradingbotguide