Pionex Crypto Trading Bot User Guide — Chapter 4.2— Bullish Bots

The Rebalancing Bot

4.2 The Rebalancing Bot

The Rebalancing Bot is the master of re-adjusting the allocation of assets within a cryptocurrency portfolio to maintain a degree of risk exposure, or just for simple diversification purposes and capturing strong bullish movements that may occur with different coins at different times.

It entails regularly selling and purchasing or disposing of cryptocurrencies within the portfolio in order to preserve the desired ratio of assets to other assets.

This technique can be used with two coins, or multiple coins and different ratios.

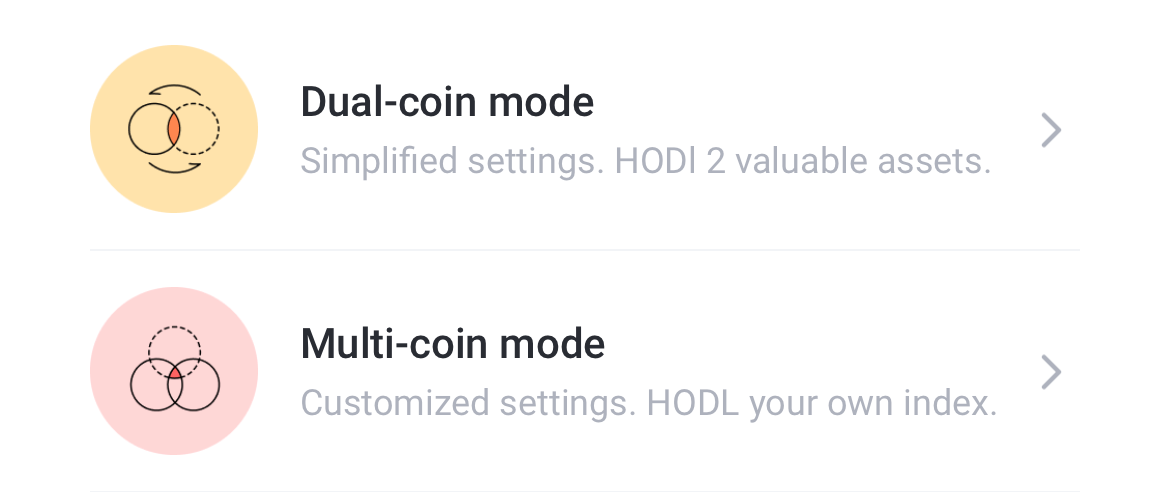

When you select the Rebalancing bot, you will be presented with two options:

Dual-Coin Mode

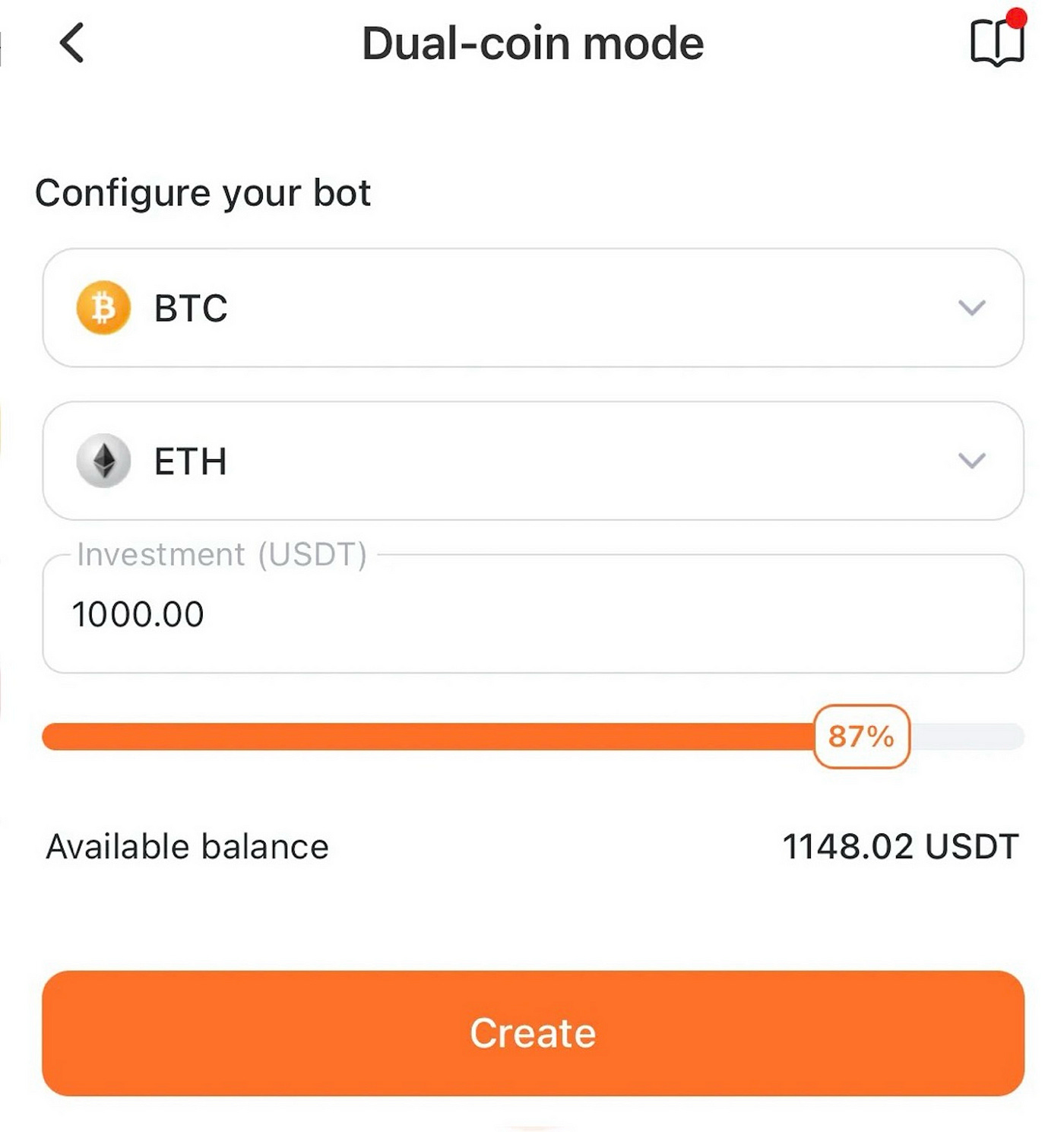

If you build a rebalancing and select dual-coin mode with BTC and ETH, the bot will distribute your holdings at a 1:1 ratio.

The dual coin mode will purchase equal amounts of Bitcoin and Ethereum based on the current market price. The bot will check in every five minutes, adjusting it’s position to reflect changes in the two coins’ exchange rates and maintaining a 1:1 position ratio at all times. If you invest $1,000, then it will put $500 into BTC and $500 into ETH.

Gain Balancing

When your BTC value has increased to $600 USDT and your ETH value has remained relatively stable at $500 USDT, the rebalancing bot will sell $50 USDT of BTC and purchase $50 USDT of ETH in order to maintain the position ratio at 1:1.

You now have $550 USDT in BTC and $550 USDT in ETH.

When it comes to strategy, the rebalancing bot has an edge over hoarding coins since it can take advantage of changes in prices to engage in rebalance arbitrage.

Note : the leveraged tokens are high-risk derivatives, please be careful while selecting those currencies.

Loss Balancing

If one currency in the portfolio experiences a decline in value while the other maintains a relatively stable value, the same remains true — the bot will take action to keep things level.

Let’s say your BTC falls to $400 USDT value and ETH stays at $500 USDT.

In this instance, the initial 1:1 ratio between Bitcoin and Ethereum is no longer upheld, as Bitcoin now makes up a smaller share of the portfolio than Ethereum.

The bot will sell some ETH and use the proceeds to buy BTC in order to bring the portfolio back to the intended 1:1 ratio.

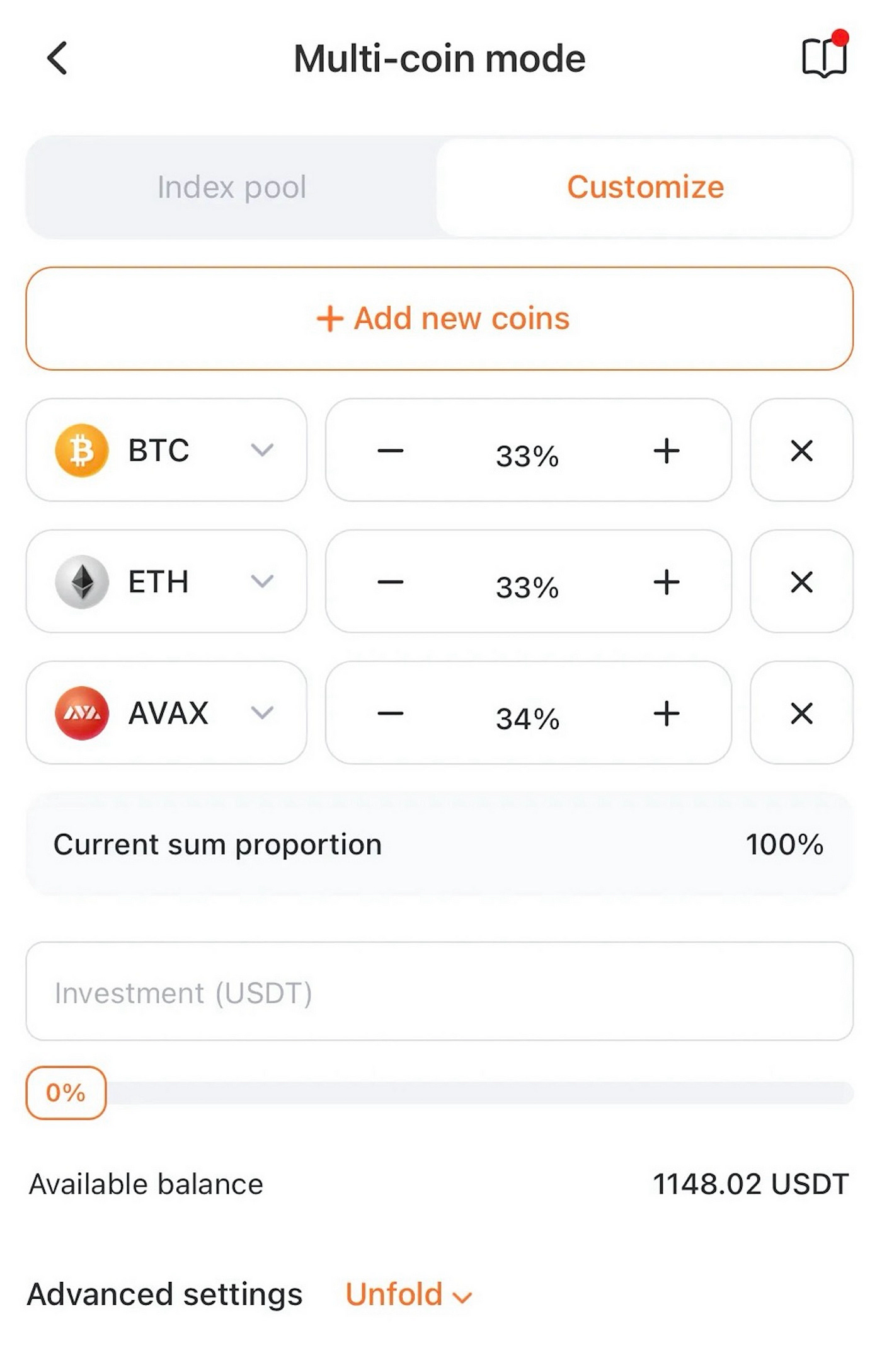

Multi-Coin Mode

Up to ten coins can be allocated in the “Multi-coin mode.” Their allocation will be equal and proportional. So 3 coins will be 33% each, and 4 could be 25%, and so on.

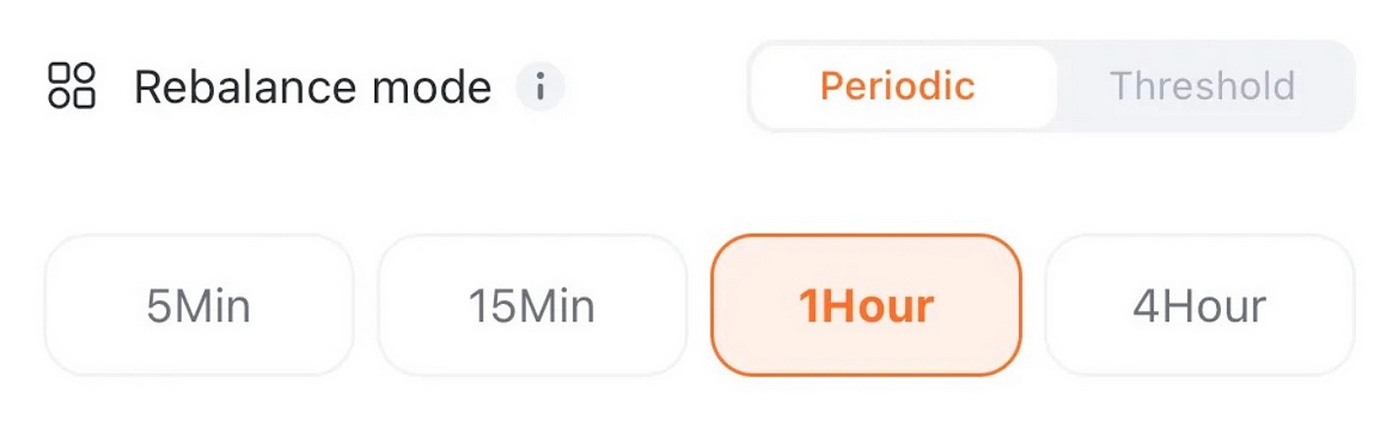

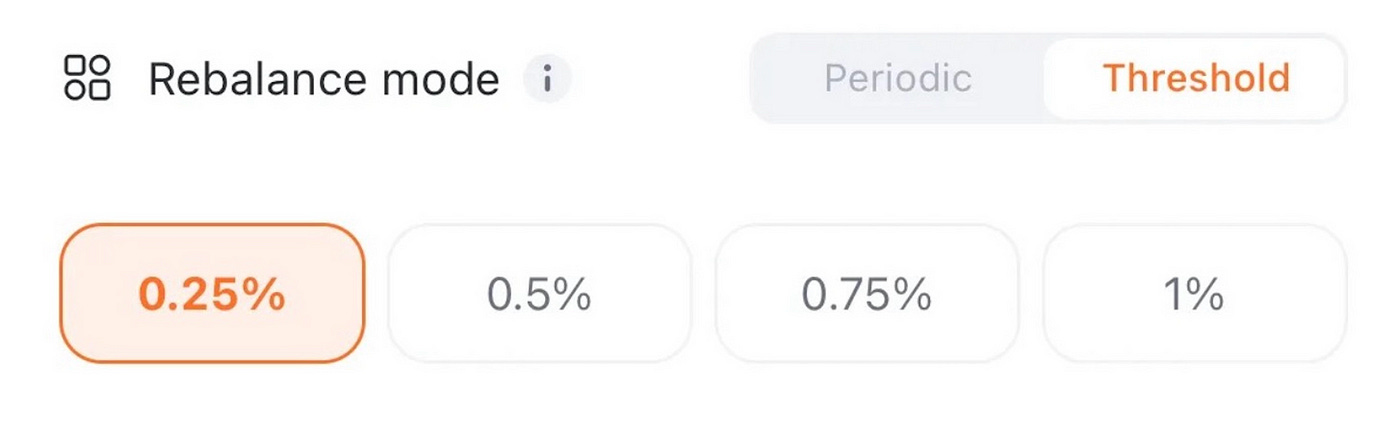

Rebalance Mode: This option will determine if you are rebalancing according to time intervals, or specific price fluctuations.

Periodic: Periodic rebalancing will check your ratio according to the time interval you select.

Threshold: Threshold Rebalancing will rebalances when a coins price hits the gain % threshold you select.

Can I lose money with a Rebalancing Bot?

Absolutely. As with any investment or any bot, there is always risk. Price swings in cryptocurrency marketplaces are sometimes erratic and unpredictable. The rebalancing bot may purchase or sell assets at a loss if the prices of the assets in your portfolio fluctuate significantly over a brief period of time.

Advantages of a Rebalancing Bot

Versatility: A rebalancing bot is actually a pretty useful tool. They can be used with the motivation of minimizing your exposure to risk, or keeping an even allocation of funds across a handful of cryptos while holding them. They are almost like creating your own bundled ETFs out of multiple currencies.

ETFs are just groups of stocks in a larger portfolio where everything is managed by other people but you are allotted a percentage of the yield based on your capital contribution, and on the back end, they are doing a rebalancing to maintain your desired portfolio distribution in your account. In the case of a rebalancing bot, you package together two or more cryptos and they continually maintain a ratio, giving you profit while keeping your portfolio balanced and growing.

Disadvantages of a Rebalancing Bot

Inaccurate Market Predictions: In short, if you are holding a bag of cryptos that do not do well over time, the bot itself will only maintain your balance ratios and might not yield much profit.

The rebalancing method is predicated on the idea that the market will behave a specific way or that one or two of the cryptos you are holding will increase in value. The perfect scenario would be prices bouncing widely and constantly correcting among the coins you are holding.

The rebalancing bot may execute trades that degrade the performance of the portfolio if these forecasts prove to be inaccurate, or if there is not enough volatility between coin prices to move your overall balances upward.

The Rebalancing Bot is a tool designed to help you manage a portfolio of multiple cryptocurrencies by automatically keeping their proportions in line with your chosen ratios.

It’s like having a diligent gardener who trims and replants to keep your investment “garden” balanced, aiming to capitalize on price swings while sticking to your long-term strategy.

Why use a Rebalancing Bot?

The Rebalancing Bot is built for investors who are optimistic about several coins and want to hold them for a while, betting on their overall growth. Instead of just buying and holding (HODLing), it actively adjusts your portfolio to maintain a specific allocation — like 50% BTC and 50% ETH — by buying and selling as prices change. This “buy low, sell high” approach tries to profit from volatility while keeping your risk profile steady. It’s less about chasing quick trades and more about disciplined, long-term portfolio management.

You start by picking your coins (up to 10 in Multi-Coin Mode, or just two in Dual-Coin Mode) and deciding how much of your investment goes to each, like splitting $1,000 equally across BTC, ETH, and SOL. The bot checks prices regularly (every 5 minutes by default) and rebalances if the proportions drift too far from your target.

For example, if BTC’s value grows faster and becomes 60% of your portfolio, the bot sells some BTC and buys more ETH or SOL to get back to your set ratios. This process repeats, aiming to lock in small profits from price swings while keeping your portfolio aligned with your plan.

How It Works in Practice

Imagine you invest $1,000 in a Dual-Coin Rebalancing Bot with BTC and ETH, split 50/50 ($500 each). At the start, BTC is $50,000, so you buy 0.01 BTC, and ETH is $2,000, so you buy 0.25 ETH. A week later, BTC rises to $60,000 (your 0.01 BTC is now $600), but ETH stays at $2,000 (still $500). Your portfolio is now $1,100, but it’s skewed — 54.5% BTC, 45.5% ETH. The bot steps in, selling 0.00167 BTC ($100) to bring BTC back to $500 and buying 0.05 ETH ($100) to bring ETH to $550.

Now, you’re back to a 50/50 split, and you’ve pocketed a small gain by selling BTC high and buying ETH low. If ETH later pumps while BTC dips, the bot does the reverse, and over time, these trades aim to grow your total coin count.

This bot doesn’t care if the market is up or down — it just keeps your ratios steady!

In a bearish market, it might buy more of a coin that’s dropping faster, averaging down your cost. In a bullish market, it sells coins that spike to lock in gains. The catch is that profits come from volatility between coins, not just price increases, so it works best when your coins don’t move in perfect sync.

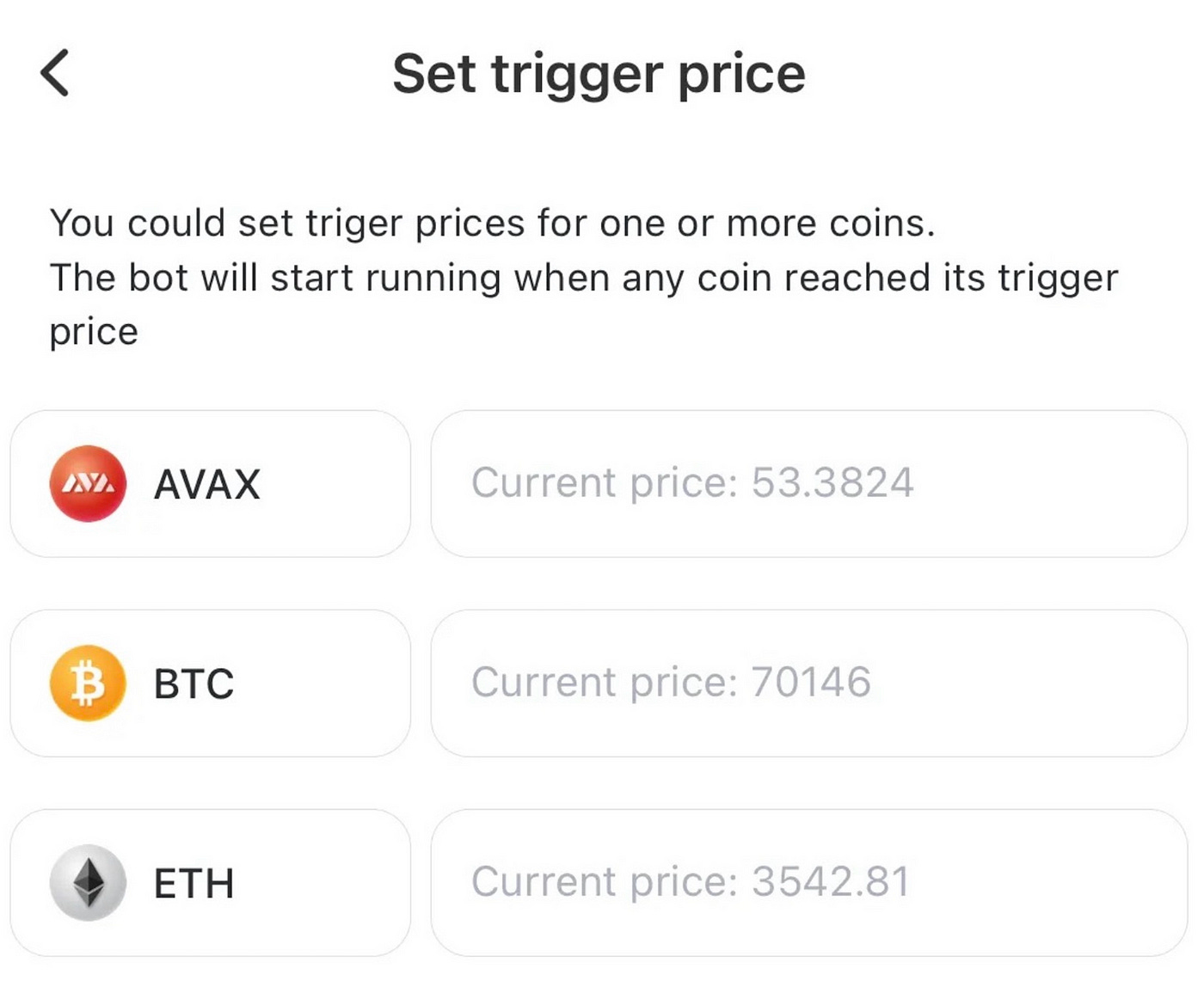

Trigger Price

The Trigger Price is the market price at which the bot kicks into action. Until one of your chosen coins hits its trigger price, the bot sits idle, holding your funds without trading. For instance, if you’re setting up a BTC/ETH bot and think $45,000 is a great entry for BTC, you set that as the Trigger Price. If BTC is at $47,000, the bot waits until it drops to $45,000 before buying and starting the rebalancing process.

This lets you time your entry, like waiting for a dip or a breakout, ensuring the bot doesn’t start in a market you’re not ready for. Say you set a Trigger Price of $3,000 for ETH with a $1,800–$2,200 range for rebalancing — it only begins when ETH hits $3,000, then maintains your ratios within that range.

For example, with a BTC/ETH bot and a Take Profit Price of $70,000 for BTC, if BTC hits $70,000, the bot sells all BTC and ETH, ending the session. This is handy in a strong bull run to avoid holding through a potential crash. If your range is $40,000–$50,000 and you set $55,000 as the Take Profit, the bot exits at $55,000, capturing both rebalancing profits and the price surge.

Rebalance Mode

This setting controls how and when the bot rebalances your portfolio, offering two options: Periodic or Threshold.

Periodic mode rebalances at fixed time intervals, like every 5 minutes, 1 hour, or 4 hours, regardless of price changes.

Threshold mode rebalances only when a coin’s proportion deviates by a set percentage, like 0.25% or 1%, from your target ratio.

Periodic is simpler and keeps things consistent, but it might trade too often, racking up fees. Threshold waits for bigger shifts, potentially saving on fees but missing smaller opportunities.

For example, with a 50/50 BTC/ETH bot and a 1% Threshold, if BTC grows to 51% of the portfolio, the bot rebalances; in Periodic mode at 1 hour, it rebalances every hour no matter the shift.

For a $1,000 BTC/ETH bot, USDT Only spends $1,000 USDT to buy $500 BTC and $500 ETH at $50,000 and $2,000. With Both, if you have 0.005 BTC ($250), the bot uses that plus $750 USDT to hit the $500/$500 split.

How These Settings Work Together

Picture a Multi-Coin Rebalancing Bot with BTC, ETH, and SOL, each at 33.3% of a $1,500 investment ($500 per coin).

Trigger Price: $45,000 for BTC

Take Profit: $60,000

Stop Loss: $35,000

Threshold Rebalance: 1%

The bot waits until BTC hits $45,000, buys $500 of each coin and starts rebalancing if any coin’s share drifts by 1% (e.g., BTC grows to 34.3%). If BTC hits $60,000, it sells everything for a profit; if it drops to $35,000, it sells to limit losses.

Tips for Using Advanced Settings

Try starting with a Trigger Price to time your entry and a Stop Loss to protect against crashes — those are the easiest to grasp. Use Threshold Rebalance for volatile coins to save on fees, or Periodic for steadier ones to keep things active.

If you’re holding coins already, Test with a small amount, like $100 per coin, to see how the settings play out before going big.

The Rebalancing Bot is like a portfolio manager that never sleeps, keeping your crypto investments balanced through market chaos. It’s a hands-off way to profit from volatility while staying true to your long-term asset holdings plan, making it a solid choice for anyone looking to diversify without constant tinkering.

Chapter 4.2 Key Points:

Rebalancing Maintains Portfolio Balance: Automatically adjusts your crypto holdings to match a target allocation (e.g., 50% BTC, 30% ETH, 20% USDT).

Buys Low, Sells High: Sells over-performing assets, capturing profit, and buys underperforming ones to rebalance, aiming to profit from price fluctuations.

Runs Periodically: Executes trades at set intervals (e.g., daily, weekly) to keep your portfolio aligned with your strategy.

Reduces Exposure/Risk: Minimizes exposure to volatility by ensuring no single asset dominates your portfolio.

Continue to the Next in this series:

(To be Continued)

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

#botlife YouTube playlist: