Pionex Crypto Trading Bot User Guide — Chapter 3.3 — Sideways Bots

The Smart Trade Bot

3.3 The Smart Trade Bot

The Smart Trade is a simple bot that executes 1 Buy, and 1 Sell, with the option to include a Trailing Sell. When comparing it’s behavior to a grid bot, it can be thought of as a bot that executes 1 Grid.

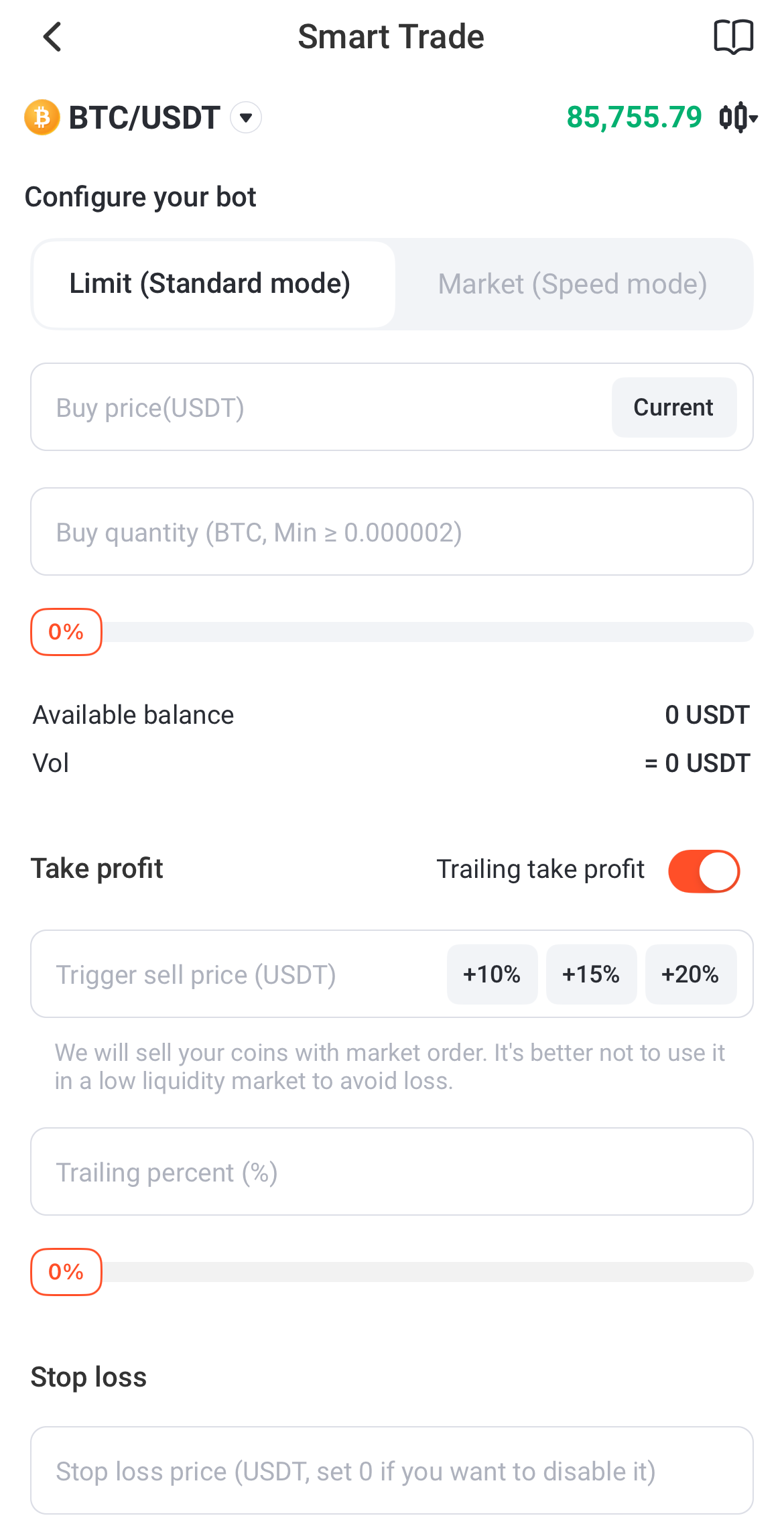

The Smart Trade Bot has two modes: Limit (Standard mode) and Market (Speed mode).

Limit (Standard mode)

Buy Price: You tell the bot when and how much crypto to buy. It can buy at a specific price (Limit mode) or right away at the current market price (Market mode). For example, you might say, “Buy $100 of Bitcoin when it hits $50,000.”

Take Profit: You set a goal for when to sell and take your profit. This sells when the price hits a exact number you pick, or if you select any of the preset gain levels (+10%, +15%, +20%).

So far, we have a simple Automated Limit Order.

Trailing Percent : Waits for the price to climb higher, then sells after it dips a little (e.g., 0.5% from the peak), aiming to grab more profit if the price keeps rising. This allows you to maximize your profit and avoid selling too soon during an upward market trend.

If you use the Trailing Percent, it is identical to the Trailing Mode in Martingale Trailing Mode.

Stop Loss: You set a safety net to sell if the price drops too far, limiting your losses. For example, “Sell if Bitcoin falls to $49,000” to cap your loss at 2%.

Once you set these rules, the bot runs executing your plan even when you’re asleep or busy, and will not deviate from your desired goal.

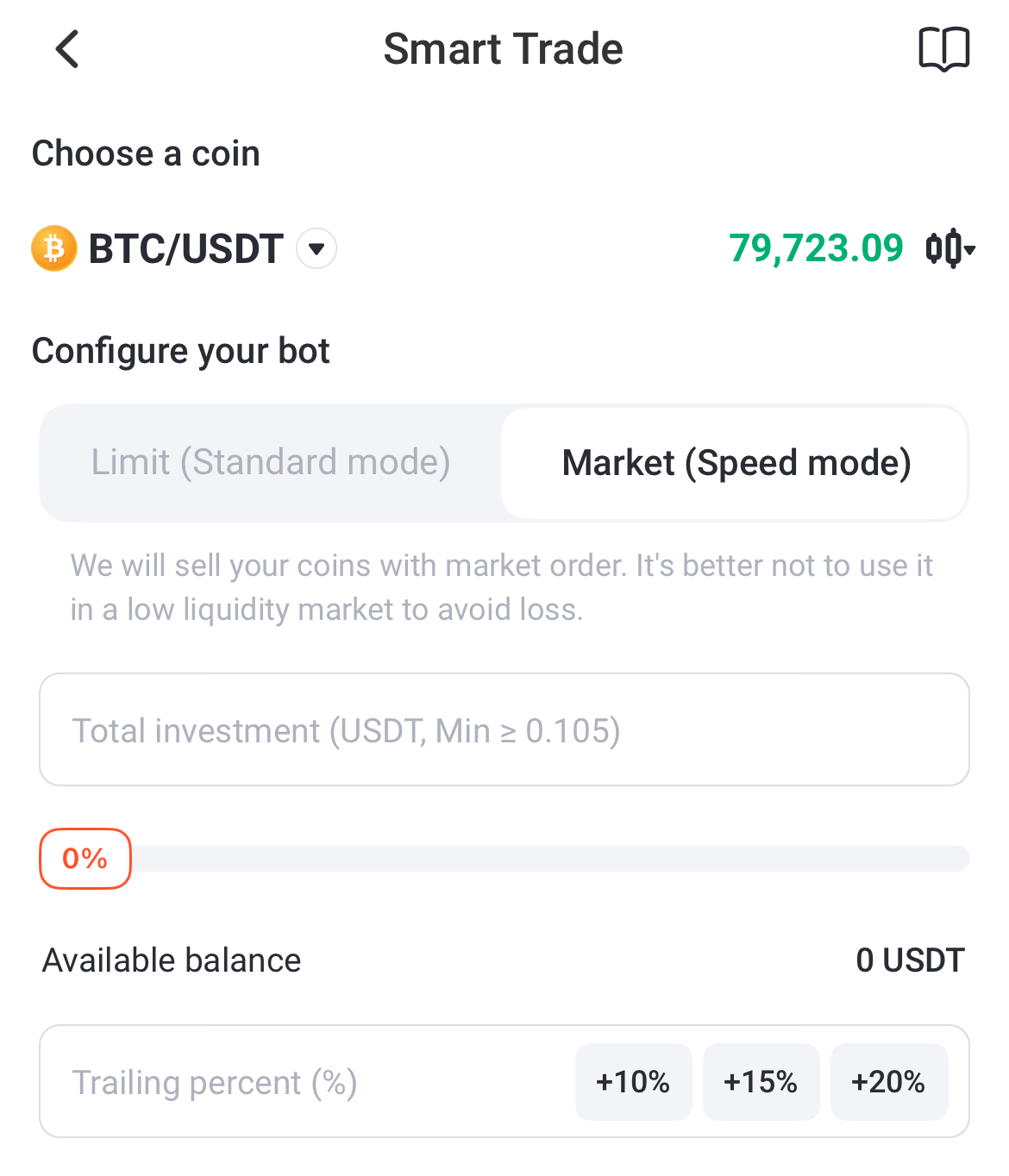

Market (Speed mode)

Two settings: your investment amount, and a trailing percent.

This mode will execute your buy immediately on opening, and then sell using your defined trailing percent.

Simple, Fast.

Let’s dive deeper into the Smart Trade Bot and how it works with some specific, beginner-friendly examples.

The Smart Trade Bot is all about automating a single trade cycle — buying at one price, selling for a profit (or cutting a loss) — with the option to tweak it for different market conditions. It’s simpler than the Martingale Bot and great for catching short-term price moves without needing to babysit your trades. I’ll break it down further and walk you through a few scenarios.

Detailed Explanation of What It Does

The Smart Trade Bot is like setting up a one-shot trading plan with four parts:

Buy-In: You decide when the bot buys your crypto. You can:

Use Limit Mode to set a specific price (e.g., “Buy when it hits $100”) — it waits until the market matches your price.

Use Market Mode to buy instantly at the current price (e.g., “Buy now at $102”) — faster but includes a small fee.

Take Profit: You tell the bot when to sell for a profit:

Fixed Take Profit: Sells at a set price you choose (e.g., $110 for a $10 profit).

Trailing Take Profit: Follows the price up and sells after a small dip (e.g., 1% below the peak), aiming for more if the price keeps climbing.

Stop Loss: You set a floor to sell if the price drops too much (e.g., $95), so you don’t lose more than you’re okay with.

Once you activate it, the bot runs 24/7 until it either sells for profit or hits the stop loss, then stops until you set up a new trade.

Why It’s Great for Beginners

Simple Goal: It’s about one buy and one sell — no complex averaging like the Martingale Bot or the Grid Bot.

You pick the prices, so it fits your comfort level. It handles fast-moving crypto markets (like Bitcoin or altcoins) without you needing to react in real-time.

Specific Trading Examples

Here are three examples showing how the Smart Trade Bot works with different coins and strategies. I’ll use realistic numbers based on typical crypto volatility as of March 23, 2025 (imagining current market vibes).

Example 1:

Catching a BTC Dip (Limit Mode, Fixed Take Profit)

Coin: BTC/USDT

Buy Price: $60,000 (Limit Mode — you think it’s a good dip to buy).

Investment: $300 (buys 0.005 BTC at $60,000).

Take Profit: $62,000 (fixed, aiming for a 3.33% gain).

Stop Loss: $58,000 (limits loss to 3.33%, or $10).

What Happens:

Bitcoin drops from $61,000 to $60,000; the bot buys $300 worth.

BTC rises to $62,000; the bot sells your 0.005 BTC for $310, netting you a $10 profit (minus tiny fees, like 0.05%).

If BTC falls to $58,000 instead, it sells for $290, cutting your loss at $10.

Example 2:

Riding an Altcoin Surge (Market Mode, Trailing Take Profit)

Coin: DOGE/USDT

Buy: Market Mode (current price is $0.20, buys instantly).

Investment: $100 (buys 500 DOGE at $0.20).

Take Profit: Trailing, 1% trail (sells after a 1% dip from the peak).

Stop Loss: $0.18 (10% drop, limits loss to $10).

What Happens:

Bot buys 500 DOGE at $0.20 right away.

DOGE surges to $0.25, keeps climbing to $0.28, then dips 1% to $0.2772. The bot sells all 500 DOGE for $138.60, earning you $38.60 profit.

If DOGE drops to $0.18 first, it sells for $90, capping your loss at $10.

Trailing Take Profit shines with volatile altcoins like DOGE, letting you ride a hype wave for bigger gains instead of selling too early.

The Smart Trade Bot is like a sniper — it takes one well-aimed shot at a trade, buying low and selling high (or cutting losses) based on your rules. Whether you’re snagging a BTC dip, riding a DOGE pump, it’s a straightforward way to profit in a “plan an attack and execute” kind of way.

Set it, forget it, and let it work for you!

Why It’s Useful

Catches Immediate Trends: It’s great for coins that bounce up and down or trend upward (like leveraged tokens or volatile cryptos), helping you profit without guessing the exact top.

Reduces Risk: The Stop Loss keeps you from losing too much if the market crashes suddenly.

Hands-Off: You set it once, and it trades for you — no need to stare at charts all day or sit staring at your phone.

Important Terms to know for the Smart Trade Bot:

Limit Mode: Buys or sells at a price you choose, but it might take time or miss the trade if the price moves too fast.

Market Mode: Acts instantly at the current price, perfect for quick moves but slightly more expensive due to fees. It buys at the market rate, and sells using the trailing percent that you define.

Trailing Percent: The trailing feature (for profit-taking) lets it ride price surges longer, unlike the Martingale Bot’s Trailing Mode, which also trails buys.

How Smart Trade Differs from Martingale Bot Trailing Mode

The Smart Trade Bot is simpler and more standalone — it’s one buy, one sell, with optional trailing for profit. The Martingale Bot Trailing Mode executes multiple buys as the price drops and one sell, using trailing for both buying and selling, aiming to average down costs in a falling market.

Smart Trade is better for quick trades or riding a single trend, while Martingale is for longer, dip-buying strategies.

The Smart Trade Bot is like a smart fishing net — it waits for the right moment to scoop up profits during price rises and cuts losses if things go south. It’s perfect for beginners who want to dip into trading without overcomplicating things.

Chapter 3.3 Key Points:

A Smart Trade Bot is a simple buy/sell automated trade, 1 Buy, 1 Sell, with the option of a Trailing Sell. Compared to a Grid Bot, it can be thought of as executing 1 Grid.

Limit (Standard mode) automates a simple Limit Order buy and sell.

Trailing Sell allows the bot to capture more profit and avoid selling to early in an upward price swing

Market Mode executes your buy at market rate, and waits to sell at your defined trailing percent.

Continue to the Next in this series:

Until next time….

Onward and Upward Everybody!

-Chris

#cryptobots #crypto #smarttrade #exchange #bitcoin #marketmaker