Pionex Crypto Trading Bot User Guide — Chapter 3.2 — Sideways Bots

The Martingale Bot

3.2 The Martingale Bot

The Martingale is a strategy using a laddering series of buys, multiplying the investment amount with each subsequent purchase, then selling off all at once at a pre-set gain amount.

Martingale strategy was invented to be used in speculative games such as the “High card takes it all”.

Each round the player doubles their bet, the idea being that eventually a win will recoup all losses plus some.

Since we are not talking about multiple players at a table engaged in a game of pure chance when we are talking about crypto trading bots, we are technically playing with only one opponent: The price direction of the market!

Martingale is not a Grid Bot, but falls into the Dollar Cost Averaging bot principle, because it’s expectation is to buy assets at different price levels over time, but in this case it is spreading your risk strategically over a price dip.

Your chances of the price going upward will statistically increase with the number of consecutive buys you make.

The thing is — Martingale applied to poker or slot machine gaming is far more risky than applying the strategy to swing trading, IF you know what you are doing and learn to operate the bot. In a game of chance, you might have no luck at all. You might not be able to bluff your opponents. They might simply have better random luck!

Factor in a table full of players instead of just a 1 on 1 game, and the odds become astronomically different.

In a live trading market trading a single asset with an automated trading bot, once you get the hang of it — a martingale bot is nothing at all like gambling in a poker game. While this trading strategy can be said to have borrowed the Martingale concept from gambling, in practice with trading the odds are much better than any random chance game ever could be.

This bot will use more funds to buy for each subsequent price dip, multiplying the total of each purchase until your full position is attained. Each order after the initial opening purchase is referred to as a Safety Order.

Unlike a Grid Got, you will often see your full balance invested and be in the red more often, with greater levels unrealized losses until the price recovers. Generally speaking, for that reason — Martingale is considered to be a riskier bot. But that also means this can be a far more profitable bot.

When selecting the Martingale, you will be presented with two options, Standard Mode, and Trailing Mode.

Standard mode consists of multiple buys, each buy increasing until the full investment is invested, followed by a single sell order, then the bot restarts on it’s own after the sell is executed.

Trailing mode consists of multiple buys, then it gets a little more complicated when selling. Once price reaches your sell threshold, it must follow the trailing percent before the sell is executed.

Standard Mode + AI Strategy.

The AI Strategy will auto-generate all your configuration for you, you only need to select your Risk Preference, and enter the amount you wish to invest.

These automated settings take a snapshot of the recent price movement and generate a configuration profile based on actual market data.

A Balanced risk profile will create 8 Safety Orders, while a Conservative risk profile will create 15 Safety Orders, spreading your investment over a wider price spread.

Please be aware: AI Strategy only configures settings based on the market movement averages at the time you start the bot.

The AI Strategy option does not dynamically update while the bot is in operation. In order to keep your bot operation optimized, it is recommended to stop and restart the bot when market conditions change to allow Pionex to re-generate new AI Settings based on the price trends happening at that moment.

With AI Strategy, there is nothing to teach here, the bot will perform according to a risk profile pre-selected by Pionex.

Customized Configuration

Customized settings allow you do to some pretty cool but risky things to maximize your profit. You can squeeze the spread and lower the amount of buys, and see some pretty wild profits, but conversely, you can also end up in the red just as fast. Use caution when testing Customized configurations.

It is recommended to use the “Copy Parameters to Manual Settings” option that takes the AI Settings, copies them into the Customize panel, and then you can begin modifying using some of the values from the AI settings as a starting/reference point. You can use the AI Settings as a base, then modify them when you see opportunities

Important Terms to know for Martingale:

Price Scale: when price drops by the defined %, the bot will buy a number of coins.

Volume Scale: The volume scale is a multiplier. After the initial purchase, the next buy and each buy after that will increase the total investment value by this multiplier, until the last buy invests your full balance. Example: 1.5 = After your first purchase, each purchase will increase your total investment by 1.5x, until the last purchase invests your full balance.

Safety Orders: after the initial purchase, your bot will make more buys — this value defines how many buys.

Investment: the total amount of capital invested into your bot.

Stop Loss Percentage: the total amount of loss you are willing to take before the bot closes, sells, and stops.

Let’s say you have captured 5% profit after several rounds of trading and the market turns around, how much of that 5% gain are you willing to loose before stopping the bot?

If you enter 2%, then if price dips, your bot will sell and close when you hit your stop loss value, and you will have 3% total gains.

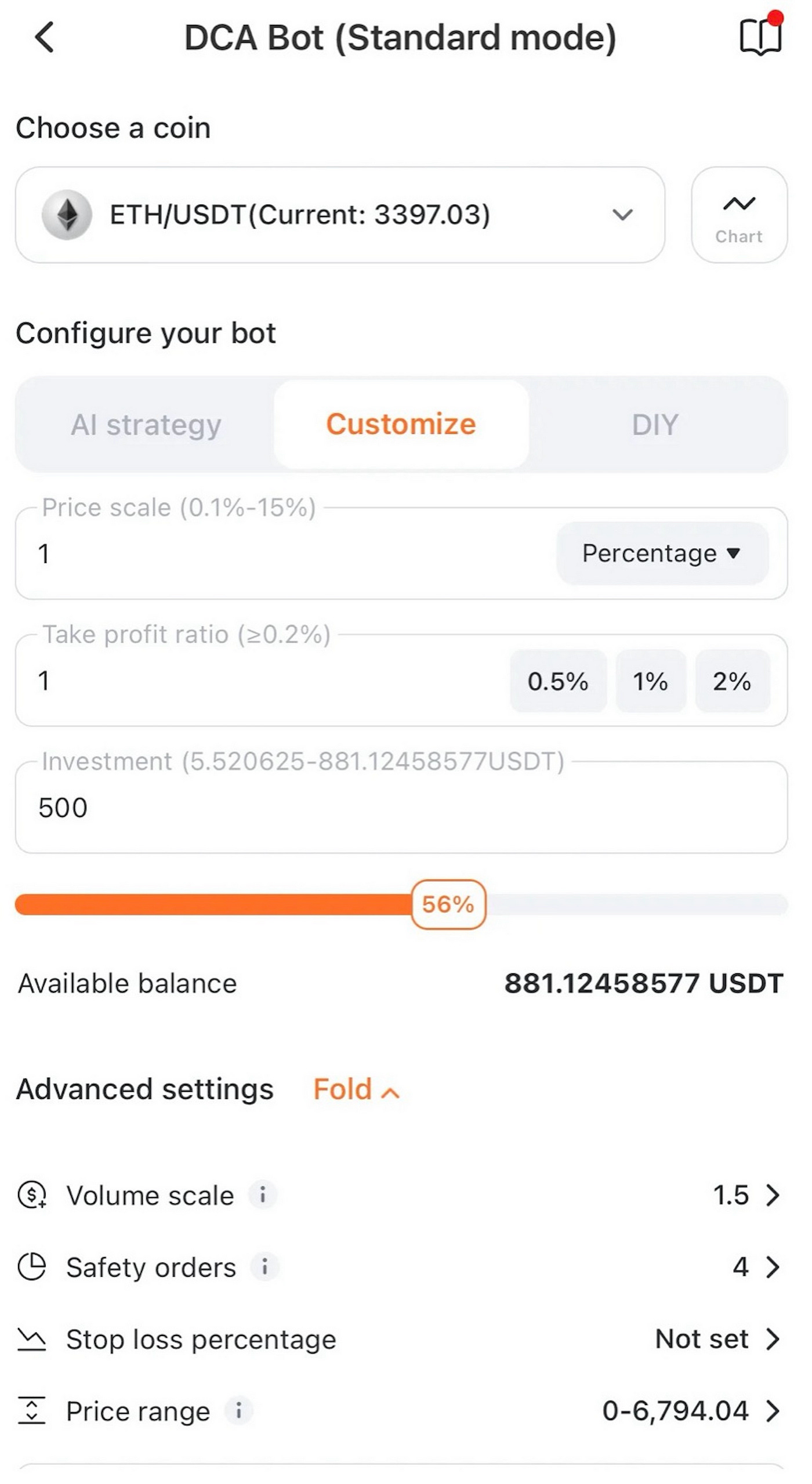

In the example image, a Price Scale of 1% and a Volume Scale of 1.5x mean that every time the price drops by 1%, the bot will make another purchase, and each subsequent purchase after the first purchase will increase your investment by 1.5x.

Safety Orders defines how many total purchases, so in the bot configuration above your bot will make 5 total purchases.

The initial purchase + 4 Safety Orders, increasing your investment 1.5x until the final purchase invests your full balance.

Let’s say you invest $500 total, this is how the bot will manage that $500: the first order will only be investing portion of your full investment. The exact proportion is shown in the configuration panel. Based on that value, I have extrapolated this math for example sake :

For a total investment of $500, the first purchase round comes out to around $38 of your total investment.

The next order will be 1.5x that. which is $57.

You now have $95 invested.

The next order will be 1.5 x $57. which is $85.5.

You now have $180.5 invested.

The next order will be 1.5x $85.5. which is $128.25.

You now have $308.75 invested.

The last order will be 1.5x 128.25, which is $192.37.

192.37 + 308.75 = 501.12.

The last purchase will round itself off to the nearest value possible under your full investment.

$501.12 will become $499.xx

Your full position has now been fulfilled, and the bot is waiting for price to swing back up by 1% above it’s last purchase to execute the big sell and generate around $5 profit.

1% of $500 is $5

As the asset price bounces up and down, a properly configured martingale captures on this over and over, and it adds up quickly because more of your investment is being invested than with a standard grid bot.

A Martingale can capture 1% gains every few days, sometimes every day, depending on how you have the bot configured, and the average market movement.

You have more control over your profit generation with the Customized Configuration.

If you reduce the total amount of Safety Orders, this will have the effect of investing more of your total investment into each purchase, leading to larger investment value fluctuations and higher profit potential.

Increasing the Price Scale can also increase the total profit per sell, leading to higher profit potential.

For example: If you configure a bot for 2% Price Scale, and 5% Take Profit, while minimizing my Safety Orders to 4, (which is a VERY risky bot profile), you can capitalize on a volatile market, and especially if there is a strong upward momentum for the coin you are trading against.

This is only something you should attempt after you have been testing and using the Martingale for a while, when you gain confidence in how to operate it.

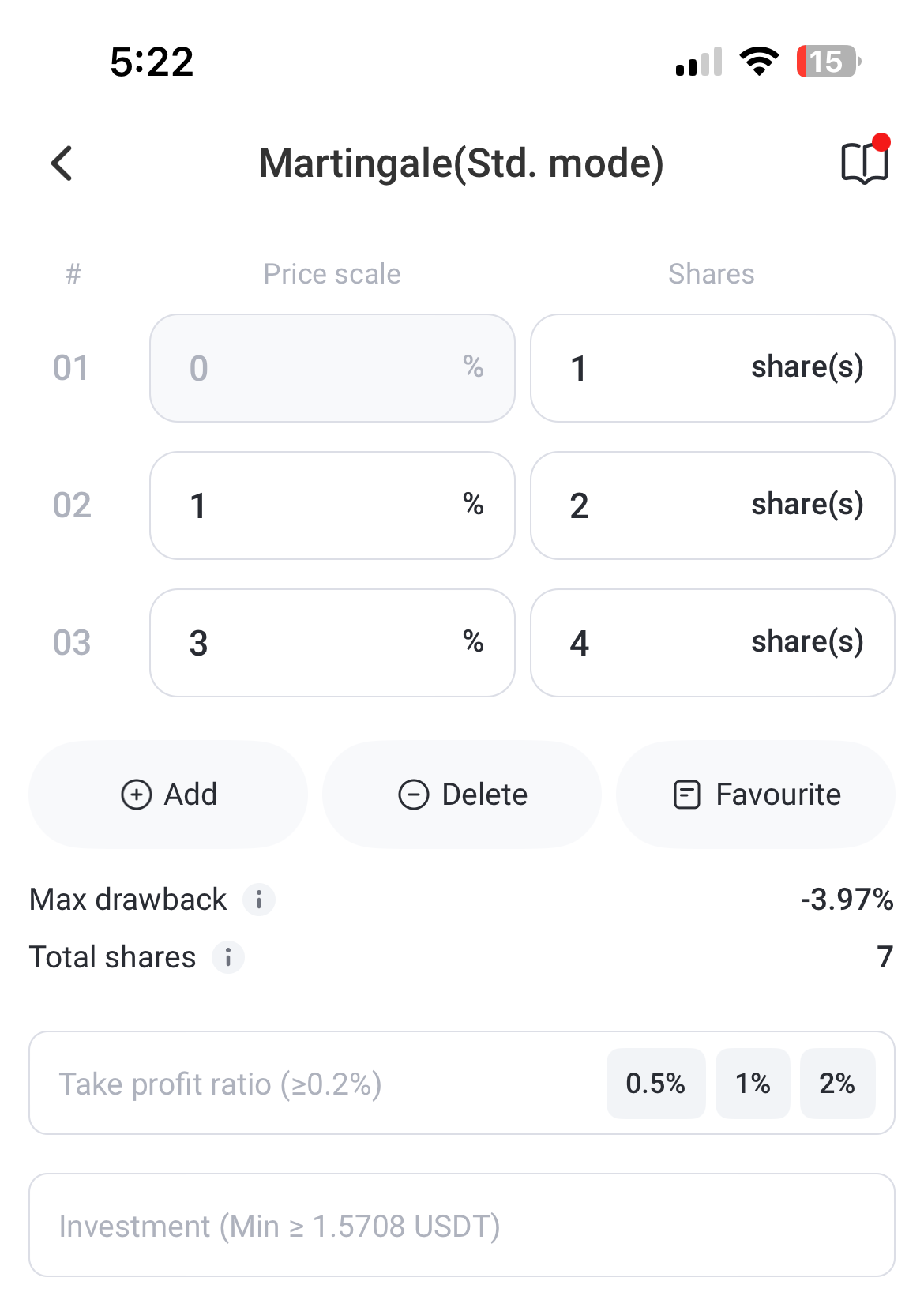

DIY Configuration

This is the possibly most advanced trading bot configuration profile you can create with Pionex.

Things you can do with DIY Martingale Configuration:

Change the Price Scale with each purchase, creating a varied price scale of your own design.

You can Change the Volume Scale of each investment that occurs with each Safety Order. This is done by modifying the share value.

These settings give a trader quite a bit of control over the Martingale bot, and can create wildly different results. Test and proceed with caution.

Trailing Mode

Essentially, the Trailing Mode is a tool that combines two trading strategies — the Martingale Bot and the Smart Trade Bot, to help you modify the settings so it doesn’t miss out on big price pumps.

When you use a regular Martingale Bot, you have to guess how much the price might drop and set your buy points ahead of time. But what if the price falls way more than you expected? Or what if it shoots up suddenly and you miss out on bigger profits?

That’s where the Trailing Mode shines!

Important Terms for Martingale in Trailing Mode

Max Rebounce: the percentage the price must rise (or rebound) from it’s lowest point before the bot executes a buy order during a price drop. It’s part of the Trailing Buy mechanism, which waits for a confirmation that the price is starting to recover before buying, helping you avoid catching a falling knife (buying too early as the price keeps dropping).

Trailing Percent: how much the price must move before the bot executes a buy or a sell. The name “Trailing Mode” might sound like it only applies to selling, but it actually enhances the entire Martingale strategy by adding trailing behavior to both the buying and selling phases.

Here’s an explanation for the novice trader:

In the Standard Mode, the Martingale bot buys at fixed price drops (like every 1%) and sells at a fixed profit target (like 1% above your average cost).

Trailing Mode makes it smarter by letting the bot “trail” the price — watching it move and waiting for the right moment — before both buying and selling.

It’s not limited to a trailing sell; it covers Trailing Buy and Trailing Sell.

Trailing Buy: When the price drops to a level where the bot would normally buy more (based on your Price Scale Rate, like 1%), the bot doesn’t buy immediately.

It follows (or “trails”) the price as it keeps falling, waiting for it to hit a low point and then rebound by a set amount (like the Max Rebounce, e.g., 0.5%).

Only then does it buy, ensuring it catches the price closer to the bottom

The Martingale bot makes multiple buys — and each buy trails the price drop to find a good entry point.

Trailing Sell: When the price rises enough to hit your profit target (the Take Profit Ratio, e.g., 1% above your average cost), the bot doesn’t sell right away.

It trails the price as it climbs higher, waiting for it to peak and then dip by a set amount (like the Trailing Percent, e.g., 0.5%).

Then it sells everything at once, locking in a potentially bigger profit than if it sold at the exact profit target.

This is the one sell per trading round — it trails the upward trend to optimize your exit.

The term “Trailing Mode” might make you think it’s only about trailing the sell because “trailing” is a common term in trading for things like trailing stop-loss orders (which focus on selling). But in Pionex’s Martingale Bot, Trailing Mode is a full package: it applies trailing logic to both the multiple buys and the single sell.

An Example to Tie It All Together:

Configuration: Price Scale 1%, Max Rebounce 0.5%, Take Profit 1%, Trailing Percent 0.5%, on a LTC/USDT trading pair.

Let’s say LTC drops from $100 to $99, bot trails to a low of $98.50, and buys when it rebounds to $98.99 (0.5% up).

Price drops again to $97.50, bot trails to $97, buys at $97.49 (0.5% rebound).

Now, price rises and hits $99 (1% profit on average cost), bot trails to $100, sells at $99.50 (0.5% dip).

Trailing Buy: For the two buys at $98.99 and $97.49.

Trailing Sell: For the one sell at $99.50.

The Standard Martingale Bot operates by one simple rule: every time the price drops by xx%, buy more, and when it goes up by xx% from your average cost, sell everything for a profit. This works fine when the price moves in small steps. But if the price crashes hard or skyrockets — you might get trapped waiting for a tiny profit while missing out on a bigger opportunity.

Trailing Mode tries to compensate for this when the price rises to your “sell zone,” the bot doesn’t sell immediately. It waits for the price to climb higher. This way, you lock in more profit from an upward trend.

More Examples:

Let’s say you’re trading BTC/USDT.

You set your bot to:

1% Price Scale.

1% Take Profit.

0.5% Trailing Percent.

In a normal Martingale Bot, if BTC drops steadily, it buys at each step and sells when it recovers 1% — great for small wiggles. But if BTC crashes 10% then surges 20% (like after a big news event), the regular bot might buy low, get stuck, and only take a tiny 1% profit, missing the big wave.

With Trailing Mode: As BTC drops, the bot waits for the lowest point and buys after a 0.5% rebound — snagging you a cheaper price.

As BTC surges, it waits for the highest point and sells after a 0.5% dip — grabbing more of that upward trend.

The result?

You can make more money when prices swing wildly and lose less when things go wrong compared to the regular Martingale Bot.

There’s no “AI Strategy” for Martingale in Trailing Mode — this bot is for traders who want to tweak things themselves. It might take some trial and error to find settings that work for you.

Why It’s Both Useful (and Tricky)

The Trailing Mode is awesome for crypto because it handles big price jumps better than the regular bot. It’s like having a safety net for wild markets.

But it’s also harder to set up — you need to guess the right trailing ratio (like 0.5% or 1%) based on how much the price usually bounces.

Too big, and you might miss trades; too small, and you might not get the best gains. Practice + watching the market can help you get better at this.

Advantages of a Martingale

Spreading Risk Over a Dip: That is what Martingales do best. Price can zig down quite a bit before it zags back up.

This solves the day-trader problem of entering full position all at once, then having to wait out instant drawdowns until price rebounds to sell target.

Easy to Understand: Requires basic math and simple probability odds to grasp and operate — in general it is easier to “see an actionable path and take it”.

Higher Profit Short Term Potential: You will have a goal of reaching full position with this bot, with some practice and learning — you can yield higher profits in a shorter period.

Disadvantages of a Martingale

Miss Out on Spontaneous Upward Price Spikes: Martingales can miss out on fast bull runs that lack volatility if not configured to capture those higher gains.

This happens because the staggered purchasing strategy only initiates the first buy or two repeatedly if the volatility doesn’t ever drop the price far enough to invest a greater percentage of your investment. The first few buys are always a much smaller fraction of your full balance than the last few buys.

To overcome this weakness, the Trailing Mode exists.

Riskier Than a Grid Bot: Martingale Bot will tend to create higher profit yield than a Grid Trading bot, because it aims to invest a full position, and thus it is has more potential to get stuck in the red, for larger periods of time, but also inversely has more potential to rocket into the green for larger more frequent gains.

The key difference between a Martingale Bot and normal Dollar Cost Averaging is that Martingale bot features a laddering incrementally increasing buy-in and then sells off the asset in one sale; while normal DCA can be thought of more like a simple automated recurring buy, purchasing more of an asset periodically at whatever prices you define, or whatever the going market price happens to be.

A useful tip for those just getting started with Martingale Bots:

Martingales are riskier bots, so it is best to only use them with trusted cryptocurrencies that have an established history.

Bitcoin, Ethereum, Litecoin are the best to run these bots with. If you run the Martingale on those main three cryptocurrencies, you have reduced your risk already.

Bitcoin, Ethereum, and Litecoin, have strong histories.

Bitcoin shows strong upward trajectory continuing over a decade. Ethereum is also strong, but lately not gaining as much, but well established and often directly follows Bitcoin price movements. Litecoin price may not be going anywhere really, but it is useful because it has been somewhat predictable, bouncing between $50–125 for….. years.

If you end up in the red (in loss territory) with your Martingale bots on any of the three cryptos above, this can be seen as an impermanent loss.

You only lose money if you close the bot and sell at a loss.

If you leave the bot open and wait, price eventually recovers and you have lost nothing but time.

If you use the Martingale on an unknown altcoin and it tanks never recovers, you are at permanent loss. No gain, only pain.

Chapter 3.2 Key Points:

Martingale bots are based on an old gambling strategy

Moon Bots are Grid Bots with Wide Price Ranges and buy/sell order pairs that yield much larger profit per grid than normal.

Growth Bots are intended to accumulate more of a specified cryptocurrency. To create a growth bot, you can select the pre-configured Bitcoin Growth bot, or you can set up a customized Grid Bot with a Crypto/Crypto trading pair.

The second crypto asset in any trading pair is the target asset for accumulation. So a BTC/ETH pair would accumulate more ETH, and ETH/XRP pair would accumulate more XRP.

Continue to the Next in this series:

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris