3.1 The Grid Trading Bot

The Grid Bot is the most common standard trading bot. All platforms that have trading bots will have a grid bot or some variation of it. Understanding the basic Grid Bot, also known as the Spot Grid, is the foundation of all automated swing trading.

These are generally the safest bots to test the waters with when you are getting started. Using the default settings, they represent the least risk and safest bot strategy for inexperienced traders. They are also excellent bots for minimizing risk and trying to grow larger investments while hedging against extended drawdowns and volatility.

The Grid Bot creates a grid-like pattern by placing buy and sell orders strategically at different intervals above and below the current market price, within the price range you define. Each corresponding buy-sell order pair is called a grid.

The bot takes your total investment, divides it by the number of grids that you define and invests an equal portion of your total investment into each buy-sell order pair. The bot automatically makes trades when the market fluctuates, each trade involves a portion of your investment, but never the full investment in a single order.

Fewer grids = more invested into each grid, fewer buys and sells.

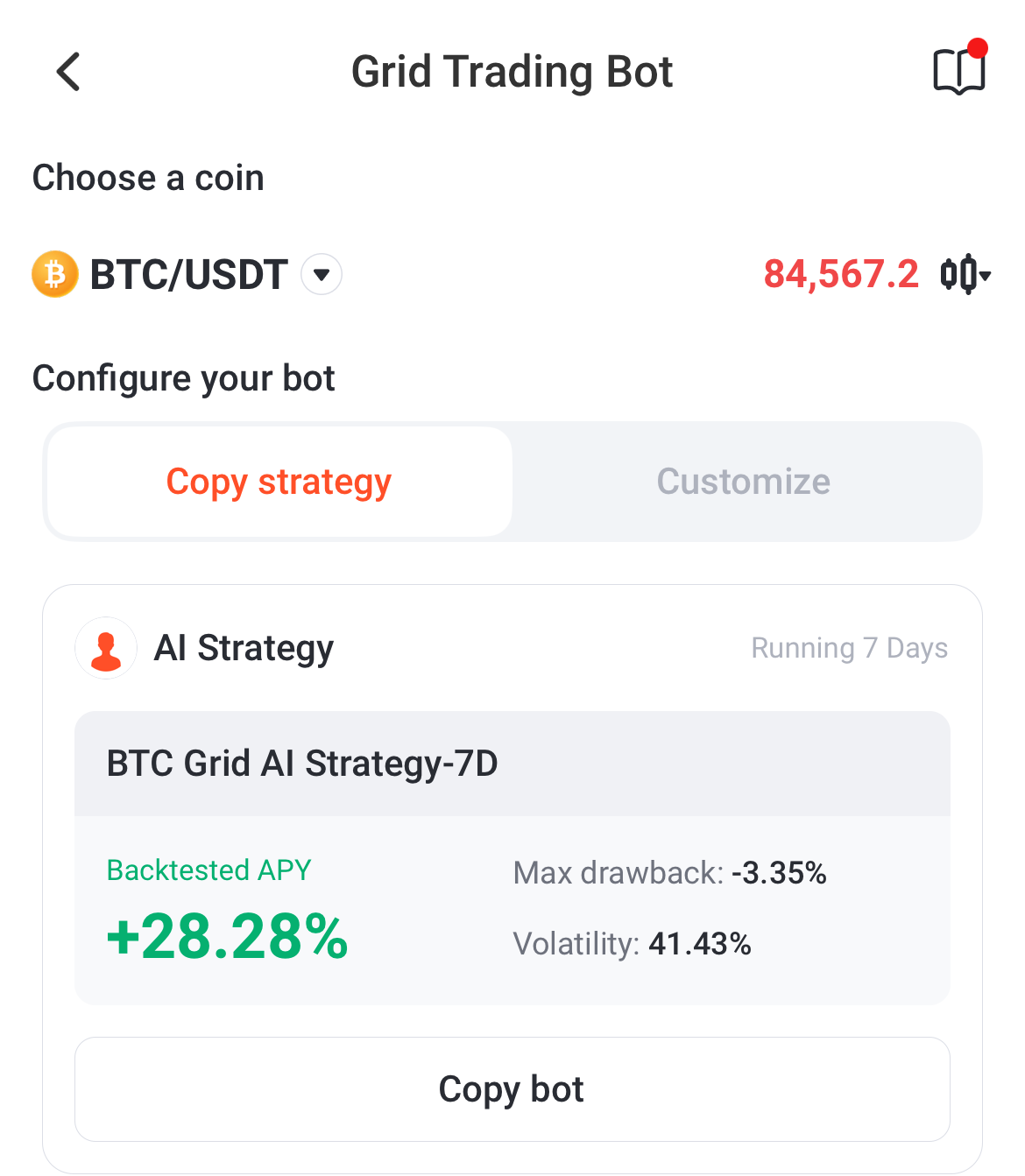

To start a Grid Bot, select the Grid Trading Bot option on the Create a Bot screen. You will be presented with two options: Copy Strategy or Customize.

Copy Strategy

Pionex has tried to simplify things by allowing us to copy the most profitable configurations from user-backtested strategies. A user can scroll down and see what kind of profits are being yielded by different pre-set strategies, and select the one they want to test. Some will be better for short term gains, others for longer durations, noted by 7d, or 30d intervals (7 day, or 30 day backtesting profiles).

Backtesting uses simulated trades with the current market conditions over a protracted period of time to generate an estimated Annual Percentage Yield. These values are estimates, and not expected to be indicators of guaranteed profit yield.

Scroll through the list and see what is available:

If you find a strategy you wish to copy, click “Copy Bot”.

After you click Copy Bot, You will be asked next to enter your investment amount. Enter the amount you wish to invest into the bot, then click Create Bot.

If you wish to view the details of the Grid Trading Bots operation before you start, click Parameters and it will reveal more information. In the example below, we can see the Price Range is $74810 — $100,798, with 49 Grids.

You cannot modify anything here. You can only define your investment amount.

If you wish to use the backtesting settings as a starting point, you can always select “Copy parameters to Manual settings”, and this will load of all those values into the Customize panel and you can modify your settings as desired.

Customized Configuration

To customize your Grid Bot, you first need to determine the Price Range and the Quantity of Grids you wish to deploy.

Clicking on “AI 2.0 Backtest” will pre-populate the Price Range and Quantity of Grids fields with values generated by recent backtesting. Note: Don’t do this if you loaded the settings from Copy Strategy into your Customize panel, it will overwrite those values.

For example, let’s see what happens when creating a bot with a Price Range of about $26,000 ($72k-$98k) and 61 total grids.

The Grid Bot opens by placing both buy and sell orders at regular intervals above and below the current market price.

Each Buy Order, has a corresponding Sell Order, and you can see them in a list by clicking “Detail” when your bot is operating.

If the current price of Bitcoin is $84,000, the bot might place buy orders at $73,100, $73,900, $74,700, and so on, and sell orders at $95,700, $94,900, $94,100, and so forth. All of these orders are opened at the same time, with a portion of your total investment tied into each Grid.

As the price fluctuates, the bot will automatically execute trades whenever the market reaches the predefined grid levels. When the price reaches a buy order, the bot will execute a buy, and when it reaches a sell order, it will execute a sell trade.

Since the bot has both buy and sell orders in place, it profits from the price movements within the defined range. If the price moves up, the bot sells at higher levels, and if it moves down, it buys at lower levels. The goal is to accumulate profits from these fluctuations.

You should regularly monitor the market and adjust the grid parameters as needed to adapt to changing market conditions. This may involve closing your bot, restarting it and adjusting the Prince Range or the Quantity of Grids.

Another Hypothetical Example

Let’s consider a simplified hypothetical scenario where we’re trading Ethereum (ETH) with an investment of $10,000. We will set up a grid with a range of $300 (ETH Price $3,200 to $3,500) and to keep it simple, we will only ask for 4 grids. The bot automatically generates our grids, as follows:

Buy Orders: $3,200, $3,250, $3,300, and $3,200

corresponding to:

Sell Orders: $3,250, $3,300, $3,400, and $3,500

Suppose ETH price fluctuates between $3,200 and $3,500 over a 10 day period, executing all trades at each grid level:

$2,500 invested at $3,250, sold at $3,300, profit = 1.5% = $50

$2,500 invested at $3,350, sold at $3,400, profit = 1.5% = $50

$2,500 invested at $3,300, sold at $3,400, profit = 3% = $75$2,500 invested at $3,200, sold at $3,500, profit = 8.6% = $215

Total profit from a $10,000 balance:

Total = $390 profit, 3.9%

Lower and Upper Limit: You will define the bot’s spread by setting the lowest price and highest price you want the bot to act within.

Profit per grid: Defining your total number of grids determines your profit ratio and transaction frequency.

Smaller grids (<1%) result in more transactions with smaller profits, while larger grids (>1%) yield fewer transactions with larger profits.

Investment: Your total investment is the capital you allocate to the bot.

In the example, based on a BTC value of roughly $84,000 — let’s say I define the lower limit at $10,000 (BTC’s USD value), and the upper limit at $120,000.

My bot will now make a few buy orders that will be FAR below the market price of $84,300, and those buy orders will not execute unless Bitcoin price falls to that range. It will also open sell orders that correspond to each of those buy orders, which will not execute until the market hits those levels.

If you create too wide of a spread, your bot ends up placing orders that will sit idle and not execute.

This is also the best long term configuration considering that Bitcoin has faced up to 80% corrections in the past. If your spread is too thin, your bot can go out of range faster and trading stops until price comes back into range, or you stop/reconfigure the bot.

Advantages of a Grid Bot

Profit No Matter the Market: Grid trading makes the most of market by enabling users to profit from price swings in any direction without having to forecast the moves of the market.

Risk Management: By distributing risk over many trades and reducing vulnerability to abrupt market swings, grid trading is the bumper bowling version of automated swing trading. By opening buy and sell orders at regular intervals and only investing a portion of your full balance for each trade, it minimizes risk effectively and represents a safer bot option for those wanting to test their first trading bots.

Disadvantages of a Grid Bot

Lower Returns: The typical gains seen on grid bots are anywhere from a few percent to about 30%. This is not a hard absolute rule, but in general when you look at the calculated backtested values presented in the apps, the grid bots are fairly conservative in their profit predictions.

Can Be Complicated To Mentally Conceptualize: The profitability of a grid bot is greatly effected by very small changes. Because the number of grids and the size of the spread create a very wide variability in performance, it might require quite a bit of work to sit down and figure out where you need to improve.

The Pionex Grid Bot does not grant the user any control over their grid spacing, or distribution of the funds. All of that happens automatically. Some users may graduate to other platforms with more control over grid configuration.

Chapter 3.1 Key Points:

Grid bots are the safest bots to test the waters with for newbies.

Grid Bots form the basic trading principle behind automated swing trading. They buy low, sell high, and divide your total investment into buy/sell order pairs which are called Grids.

Copy Strategy allows you to use the backtested strategies available on Pionex, creating 1-click default configurations where you only need to define your investment amount and start the bot.

Customized Configuration will allow you to modify bot settings according to your own discernment and knowledge of trends, or simply to allow you to try to be more profitable by taking more risk than the default settings would be aiming for.

Continue to the Next Story in this series:

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris