Spot is not the way, not the way at all…..

At this point I kind of feel like Tim-the-Tool-Man Taylor, in that I am showing all of you what not to do, more than what to do, in regards to Fox Signals.

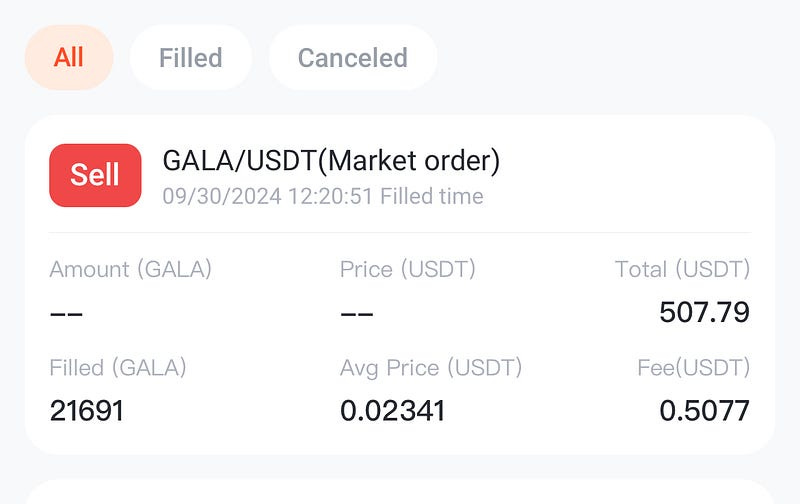

I entered on a Long signal for Gala yesterday in the wee hours of the morning at $500, using only spot trading (no leverage), and it worked like a charm.

The position was closed out around noon, with a little over 2% gain.

So that’s good, right?

Well, sort of.

It’s always nice to make a gain!

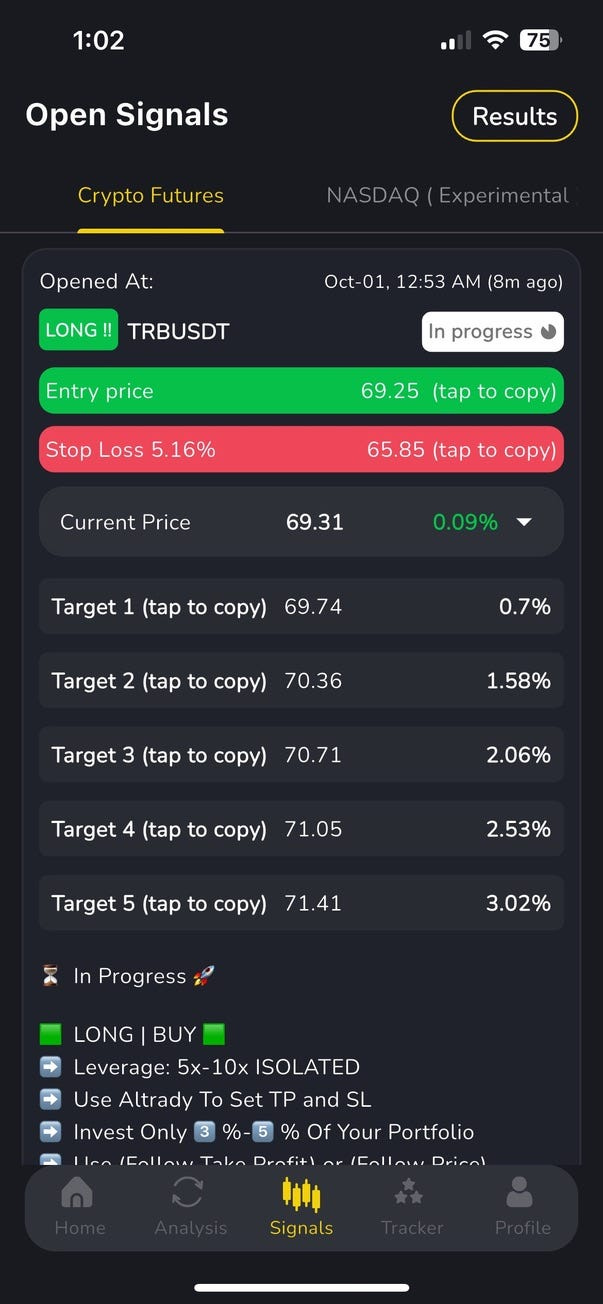

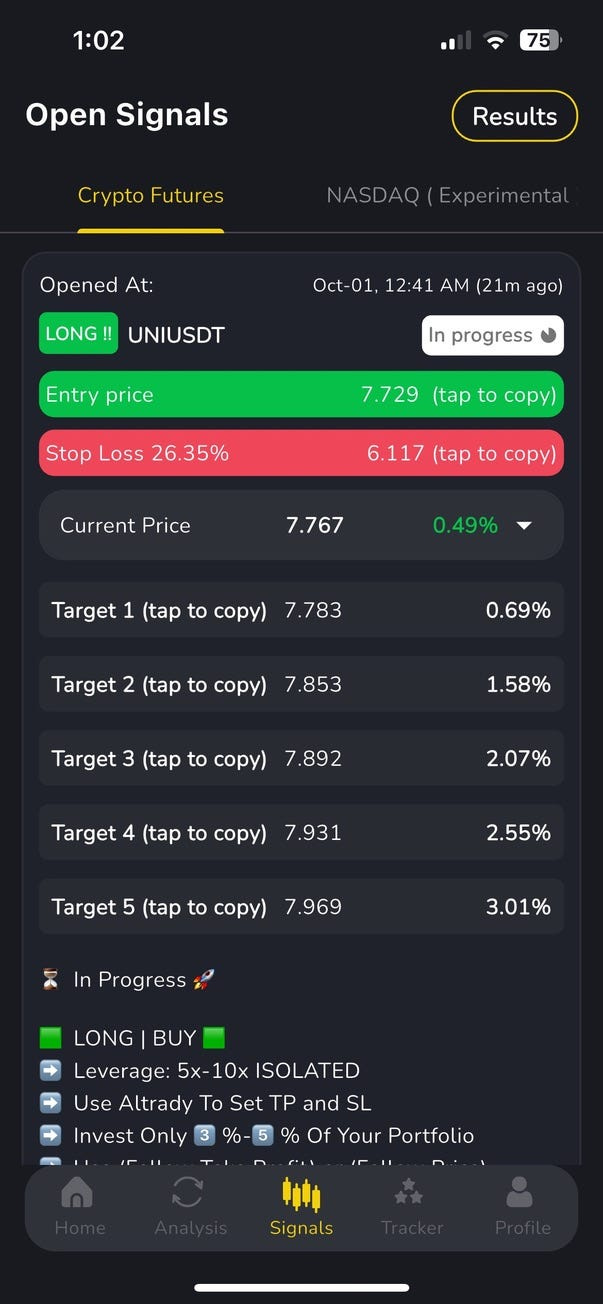

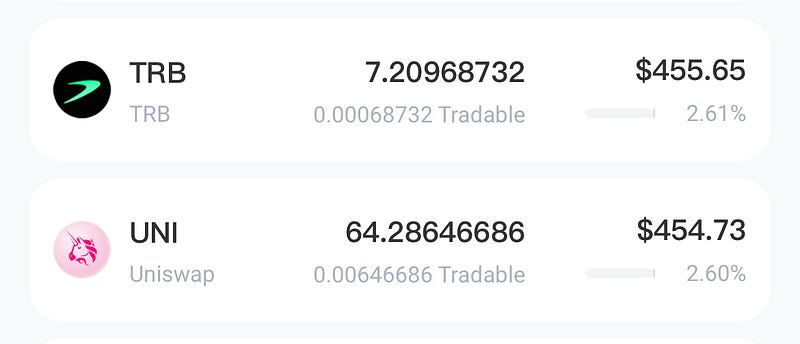

This morning, I entered two more positions on the notification of a Fox Signal.

TRB, and UNI. Both Long (the only signal you can really use with Spot Trading).

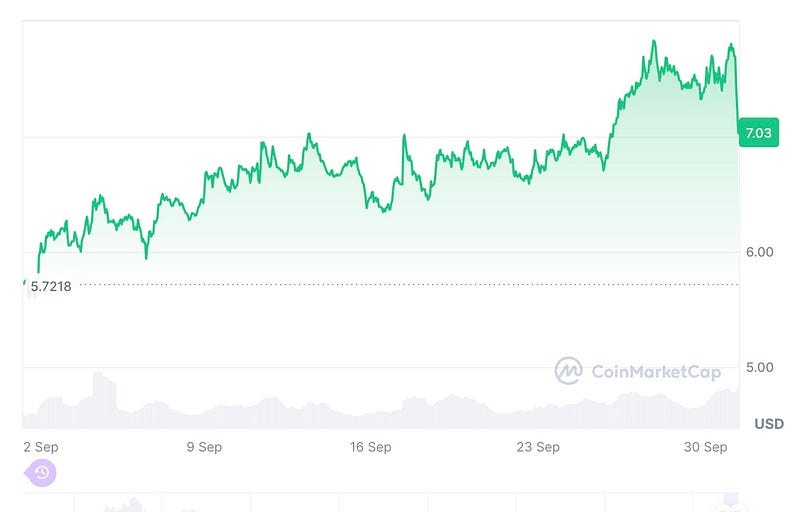

And, as you can see, the dip we just had today — wrecked the plans of the signal.

A signal cannot predict a sudden event causing a disturbance.

I am $45 down on each, approx., and waiting to rise some before perhaps closing out, I haven’t decided yet.

Not sure why the dip happened this morning, could be some market mover I haven’t heard about since I haven’t booted up the TV, youtube, CoinMarketCap, or anything else yet.

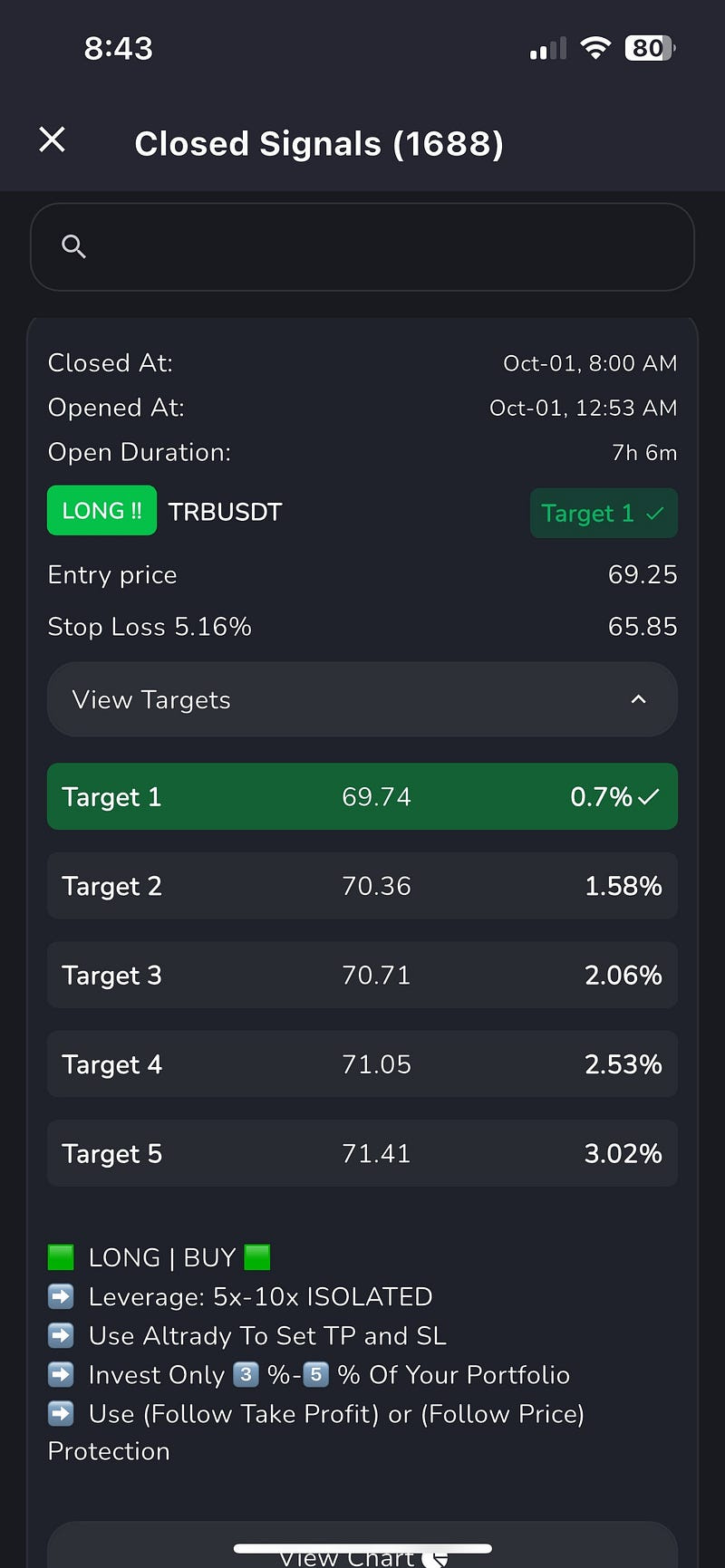

Fox Signals closed out of TRB, with a 5% stop loss, after only securing one profit level in the trailing take profit set up.

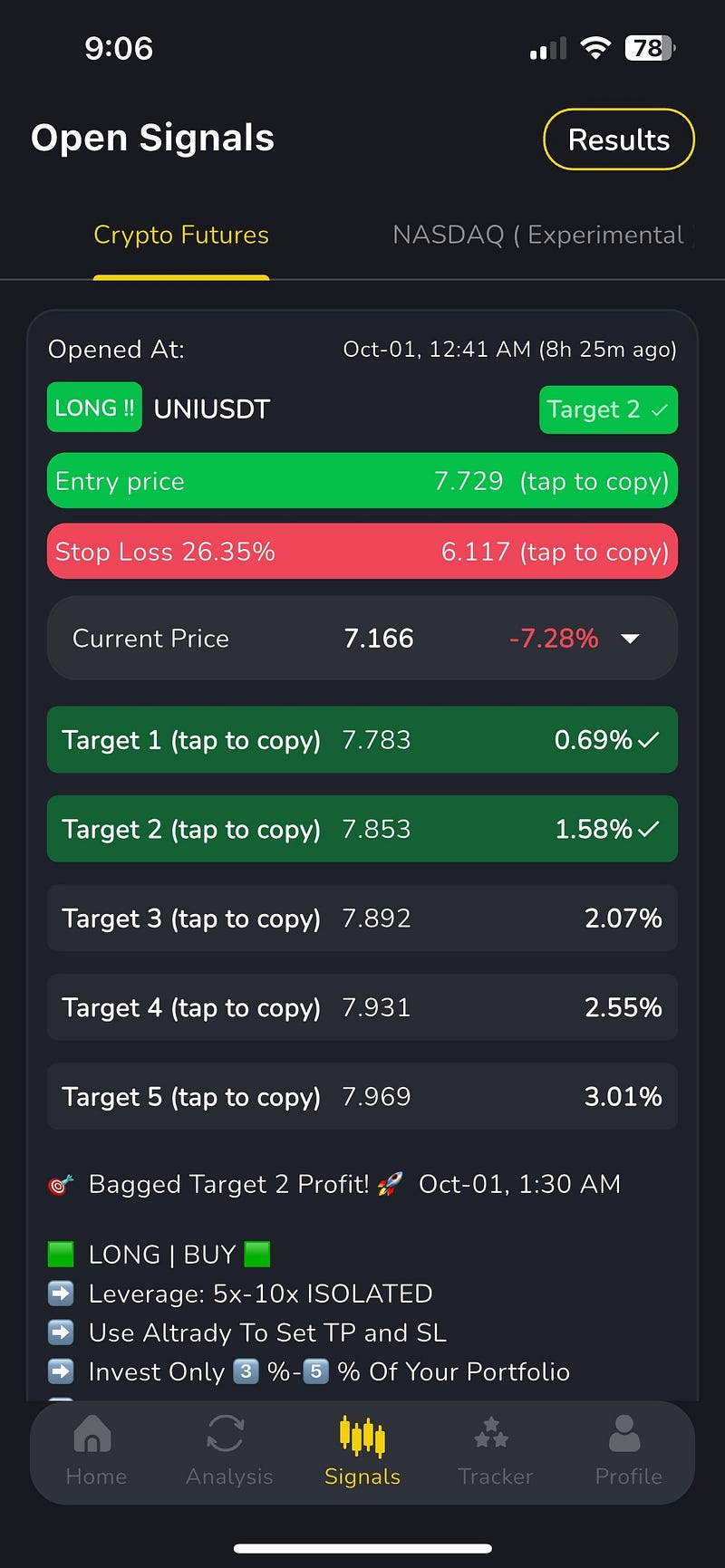

The UNI signal is still open, with two levels of profit captured by the trailing take.

It has a significantly larger stop-loss for some reason.

Spot Trading on Fox Signals = Nope

Yes, it can work, but that lacks the stop loss / trailing take which is likely the entire key to staying profitable on very specific signals like these.

Fox Signals is clearly set up for Trailing Take Profit, and Futures.

Spot is about the same risk I assumed it would be.

Which is why I don’t like sticking my full positions in all-at-once, and then riding a superior draw down for who knows how long if my call was not correct.

The martingale bots that I prefer, are made to spread that risk quite nicely with a trailing buy-in.

A signal can be great, but it can’t be so great that it can somehow predict ALL sudden movements

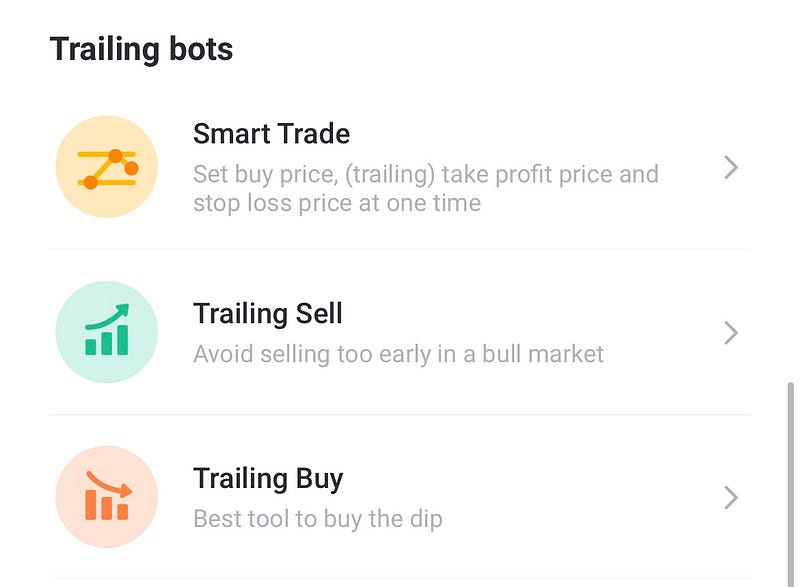

With no ability to sell at multiple levels on a simple spot limit order, I am looking to test the Pionex Trailing Sell bot.

This is similar to Trailing Take Profit, without the leverage.

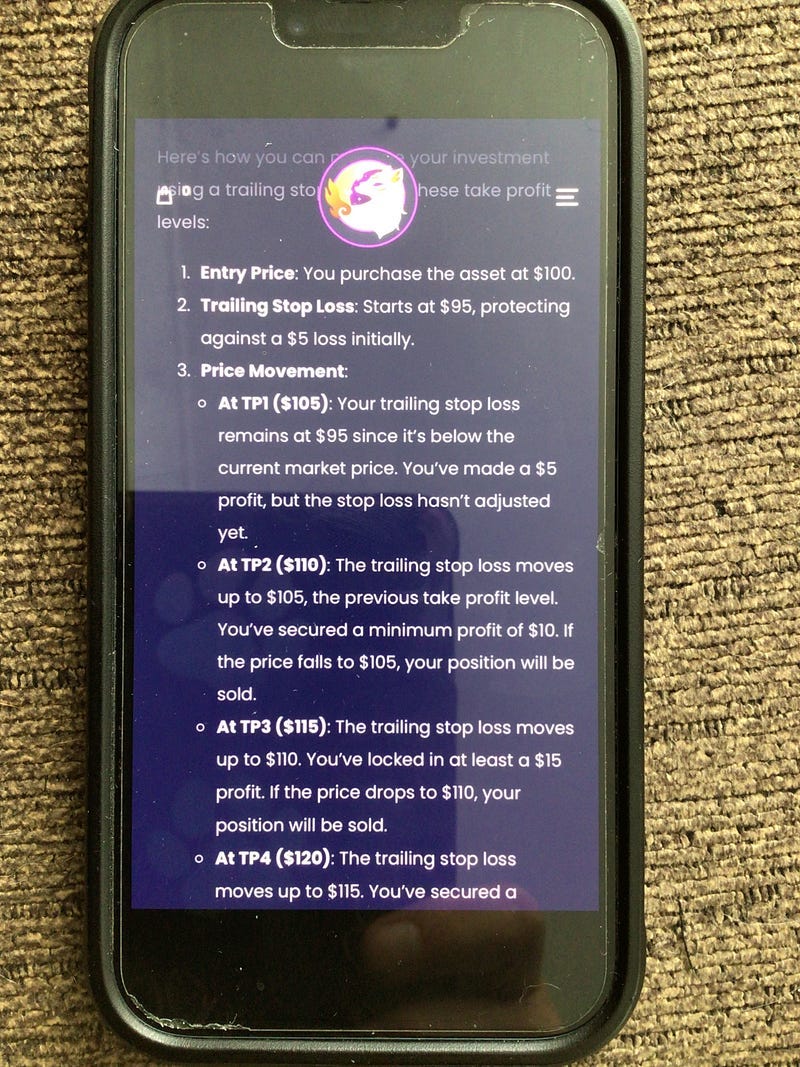

I am still unclear how Fox Signals have configured their profit takes — is it the reverse of a Martingale’s buy in?

Which is to say, does the profit take multiply the amount sold incrementally?

Or does it just take equal chunks on each level when capturing the profit?

I don’t have an answer yet, and it may be something totally dependent on individual strategy, and thus outside the bounds anything Fox Signals team will comment on. I imagine this would create a large variability in the ability to accurately capitalize on their signals.

Pionex Trailing Sell Configuration

I’ll have to learn more because I don’t like wading into muddy waters.

I’ve been reading about Futures trading for weeks, and admittedly I am nervous to test for multiple reasons.

The first being - I just don’t know enough about it, and thus I lack the confidence to test the waters when I don’t know if there might be piranhas.

I have lucked out a couple of times on futures with totally random memecoins, but that was a fluke. I was just rolling dice more or less.

I have some more learning to do, maybe a course or two.

Mainly because I want to make sure I completely grasp what Fox Signals recommended set up is doing.

To be clear, Fox Signals only offers signals.

The screenshot above is from a convo in Telegram and though Fox Signals themselves are set up around a basic strategy, they shy completely away from giving any set up advice, tutorials, or any kind of education around how to implement futures/trailing takes, etc. They point you to users of the their signals who are experienced traders on Altrady, etc.

They seem to want to avoid the red tape that comes with being financial advisors or any kind of behavior that might cross into territory that brings them under fire by regulator entities.

There are plenty of traders and customers in the telegram discussions who offer help and just as many asking questions and getting answers from peers who spare the time and energy to respond.

This is very positive, but I am clearly remedial here, as the answers I have received only lead me to more questions!

Altering My Plans

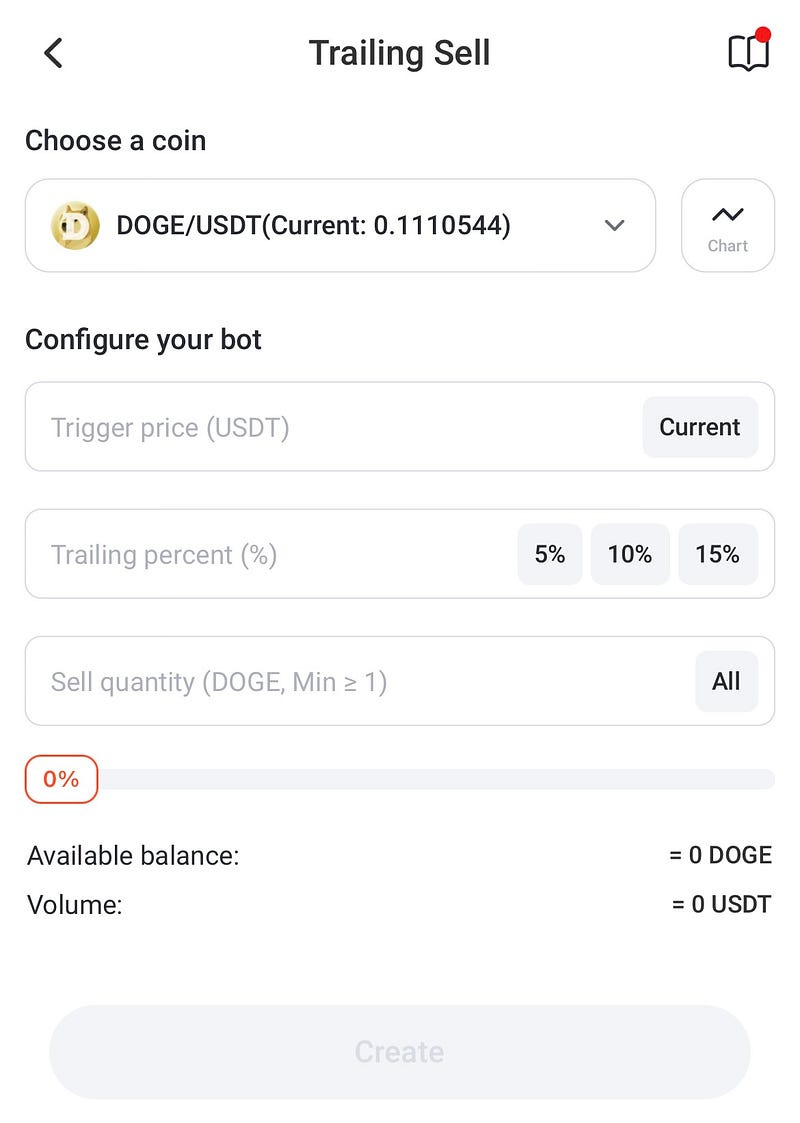

After closing my current positions later today or tomorrow, I will experiment with Trailing Sell on Pionex first. The main weakness that I can foresee would be that I can still end up at a loss that is not offset by initial profit takes, especially if I simply ignore the bot — as there is no stop loss option for it.

There are no “advanced” settings where I can configure a stop-loss.

Any mega movement can quickly become mega drawdown, the same as any strategy where I stick my full position into the pot all at once.

Thing is, the dip we just had isn’t particularly huge.

It’s just a dip, same as any other that happens every few weeks.

I could also probably get away with leaving positions open, and opening at break even or a little profit.

Would I still be profitable right now if price had crossed the first or second profit take before the price dipped?

It’s time to do some math, then test and find out!

I will only test the Trailing Sell Bot when I can sit near my computer, keeping an eye on an my position, so as to slam stop when I need to. There really is no other way.

This will totally be a day trading experiment, using a limited uni-directional trading bot.

This is definitely NOT a set it and forget it endeavor!

I have’t used trailing sell before, so might as well test it and see what happens.

Later, Alligators.

Continue to the Next Story in This Series:

Testing Signals; Fox Signals — Final Verdict — Glad I’m in, but I’m also out.

It’s a keeper, but I can’t use it. What the heck is this guy talking about?

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

#botlife

This channel provides content about cryptocurrency and cryptocurrency related topics with a focus on providing tutorial…www.youtube.com

#cryptotrading #signals #signalabuse #spottrading #timtaylor #mistakesweremade