A few years ago, I started using a very simple micro-investing app / debit card for my primary checking account, and I wanted to share my results with you.

The results I show here were gained by rounding up the difference of every purchase to the nearest dollar and putting that into an ETF account, for 3 years.

It’s become a permanent part of my tool set and I consider it one of the more passive income sources that I have.

It’s Investing on Autopilot.

Their motto : starting with Acorns, Mighty Oaks Grow.

They grow slowly, but they do indeed grow.

The primary idea behind the app is that it will round up your purchases on every item purchased with your Acorns debit card, and take that remaining spare change and put it into a stock portfolio.

If you use your debit card a lot like me, it adds up quickly.

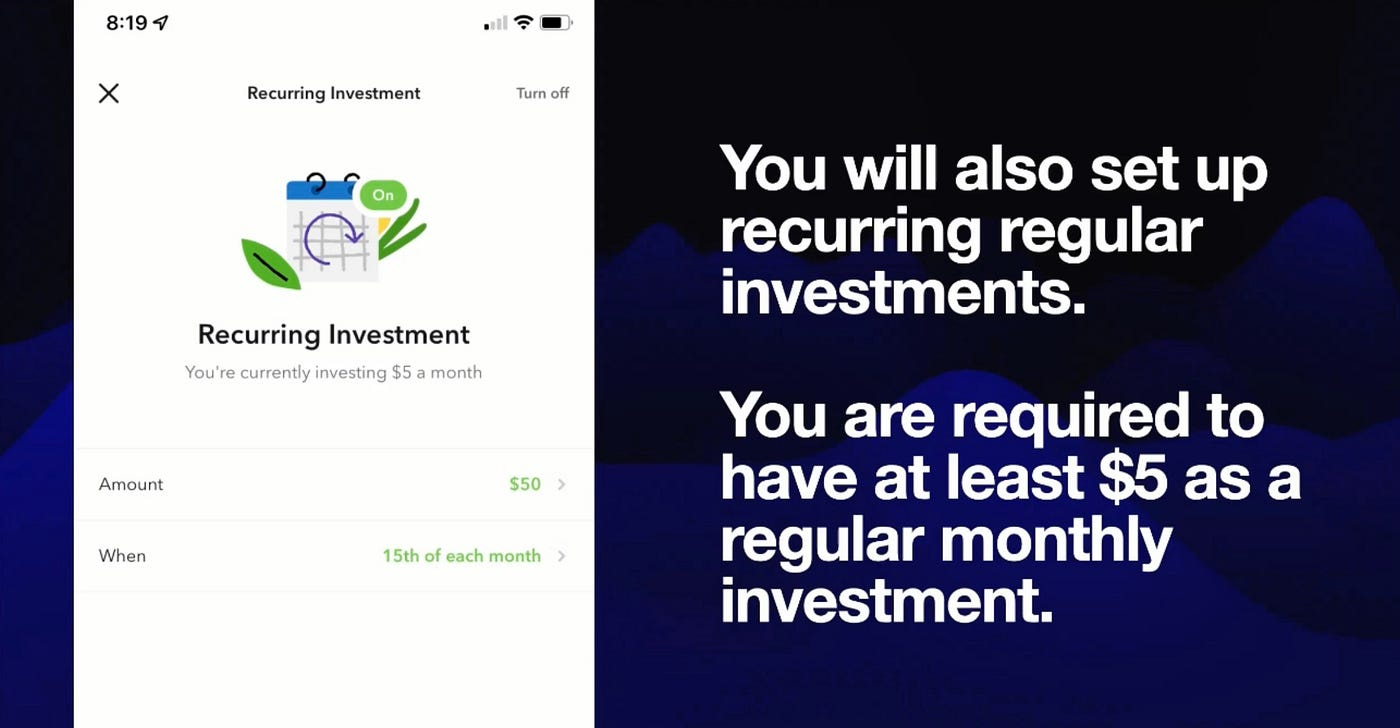

That’s what I did for the first two years, only depositing $5 per month.

After you sign up, you need to connect an external bank account to get started.

Acorns also has the option of establishing a bank account through them and getting an Acorns debit card.

That is what I use.

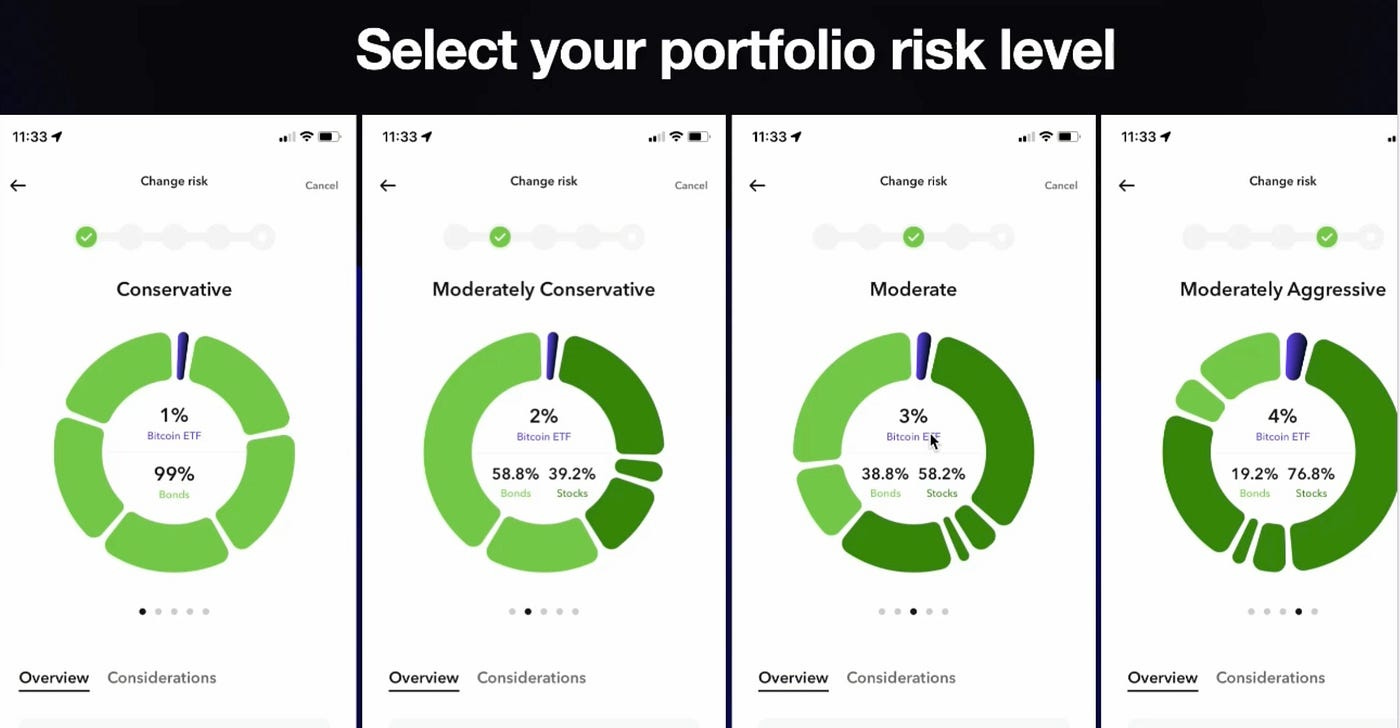

Then you’re going to select your portfolio risk level.

Since I wasn’t starting out really with anything and I was just rolling off my debit card, I wanted to go moderately aggressive, and then I eventually upgraded to aggressive.

But it’s important to know you need to select one and stick with it later on.

If you want to change it, you’ll have to divest the entire balance and then it rolls it over.

This can end up triggering a taxable event if you want to change your risk level, just for a heads up.

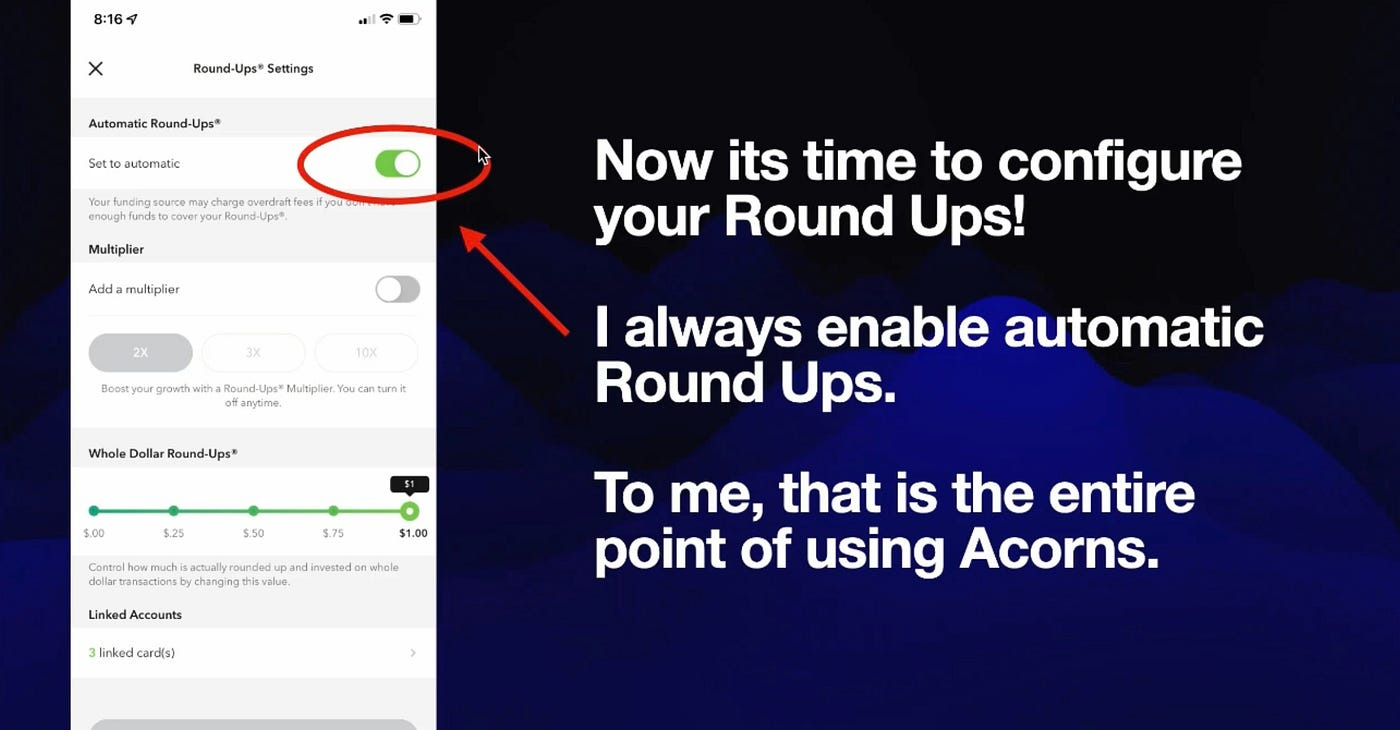

Now you need to configure your roundups.

I set them to automatic. To me, there’s not really a point in using Acorns unless you’re going to use it automatically.

Don’t give yourself the choice, just automatically do it.

Then you can set how much you want your roundups to be.

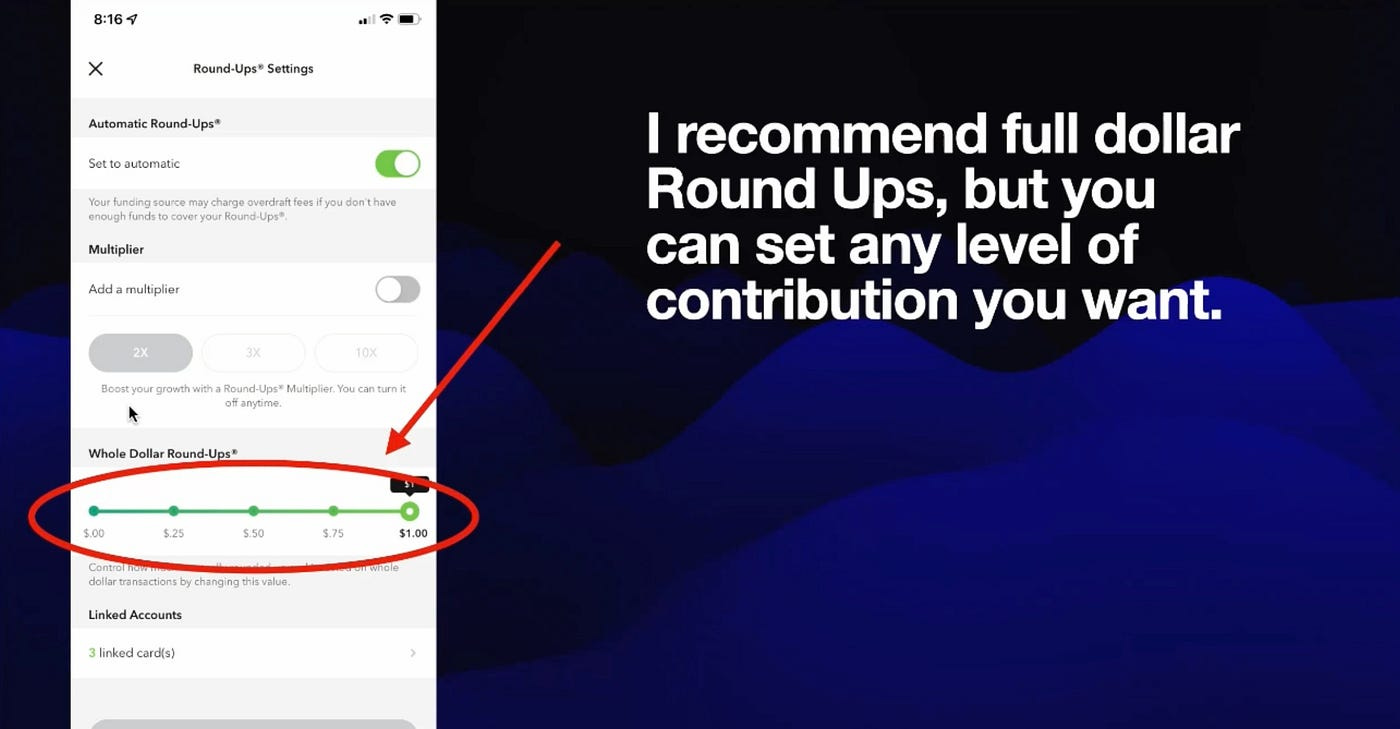

I just do the full dollar round up. What that really means is : say you get a coffee for $1.55, it’ll round to the nearest dollar which is 2.00, and Acorns will invest 0.45 into your stock portfolio.

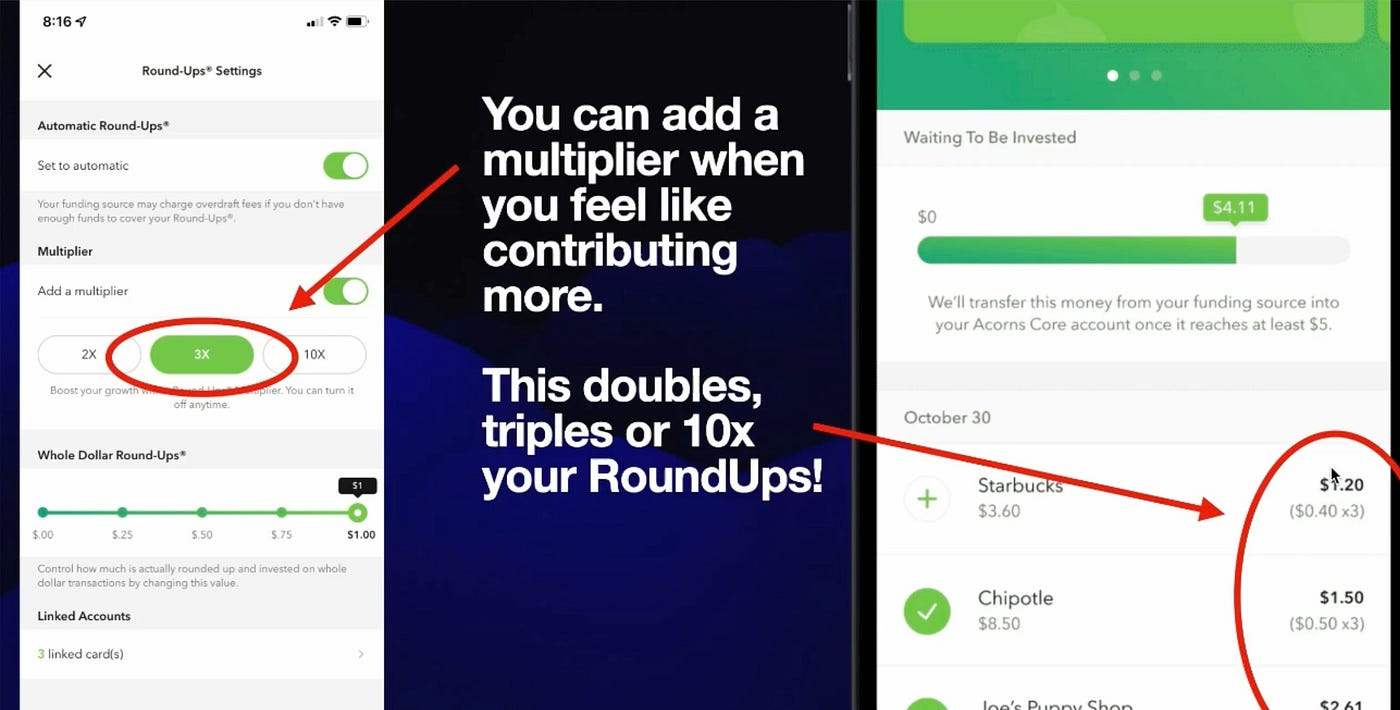

You can add a multiplier when you feel like contributing more.

A multiplier will 2x, 3x or 10x your roundups.

So here’s a day where I did a three x multiplier. You can see what that means when I spent $3.60 at Starbucks. It takes that $0.40, multiplies it by three, and it invests $1.20.

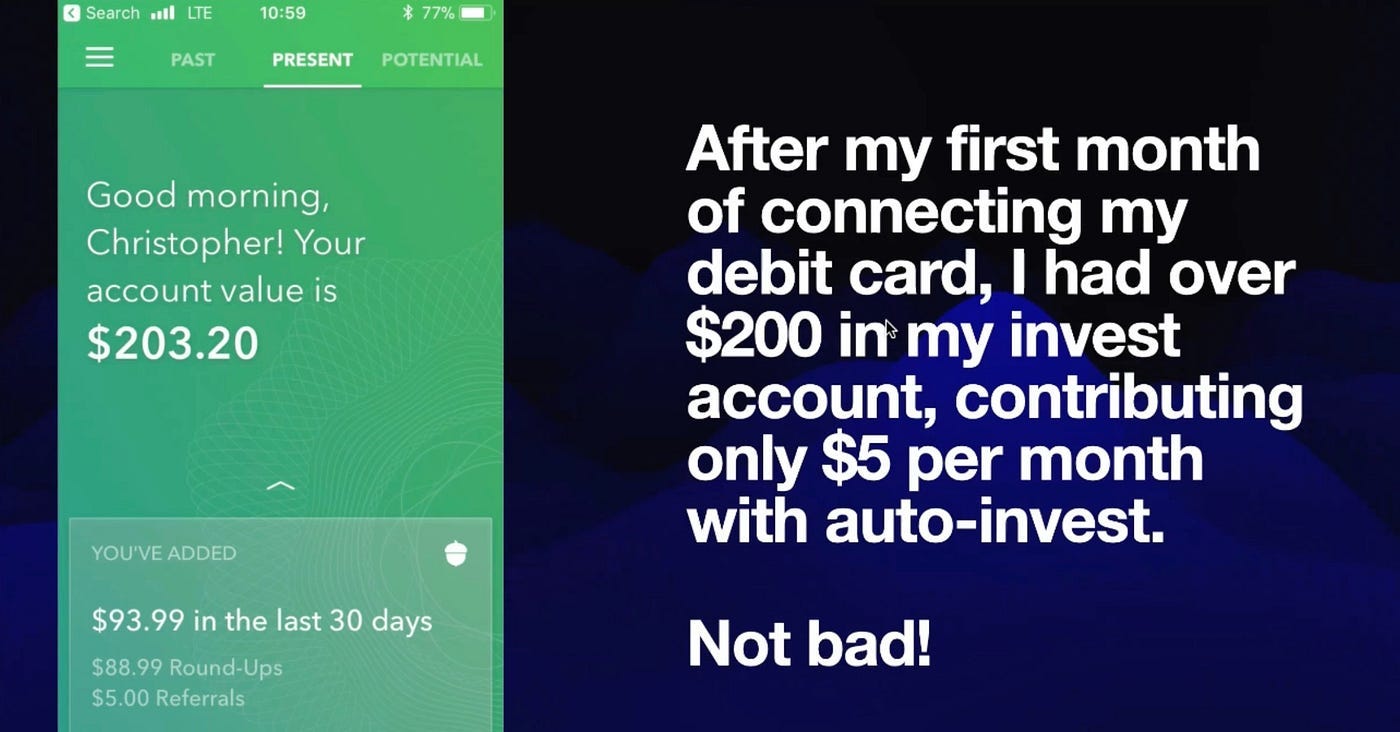

After my first month of connecting my debit card, I had about $200 in my invest account, contributing only $5 the first month. (I use my debit card ALOT, it is both personal and business)

When I saw that, I was like, okay, I think I can stick with this and we’ll see my full results later from about three years of using Acorns.

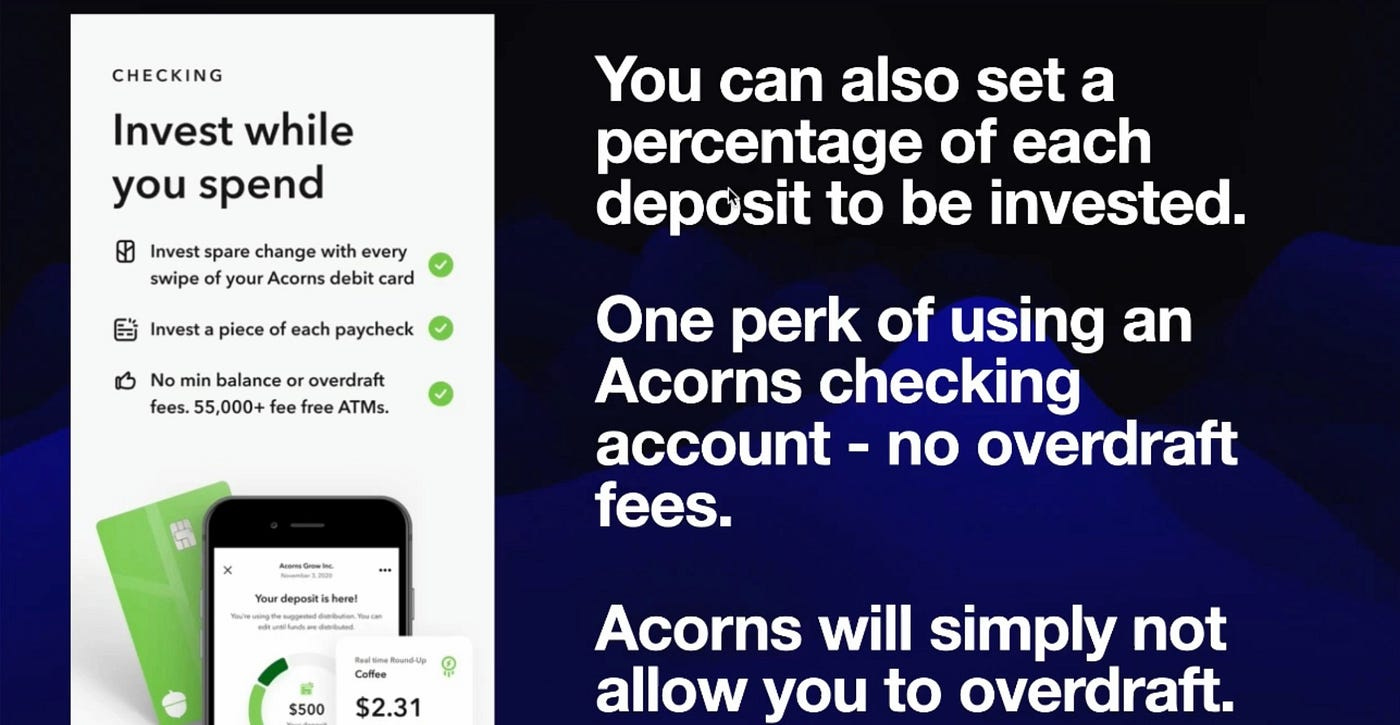

You can also set it up so that a percentage of your deposits will be invested.

During year 3 of my adventure, Acorns enabled a new feature.

Auto investing a portion of your deposits.

It says “invest a piece of your paycheck”, but if you are like me and you sell on websites, also on Ebay, Etsy, Amazon, and Reverb, ANY deposit from anywhere can be set up for auto-investing a certain percentage.

Pretty freakin cool, huh?

I set my auto investments to 5%. It adds up faster than you think.

I have my direct deposits and various deposits from platforms set up to automatically invest 5% of each deposit.

And all that’s happening while my roundups are happening with every debit card swipe or every debit card purchase online.

No Overdrafts

And another perk = no overdraft fees.

And I say perk….. and they kind of bill it like that.

But what it really means is that the purchase will be rejected.

So be careful if you have existing bills on auto pay or anything.

You might not be charged by Acorns for an overdraft fee, but you want to make sure you have the balances to cover whatever bills are going out, that’s for sure.

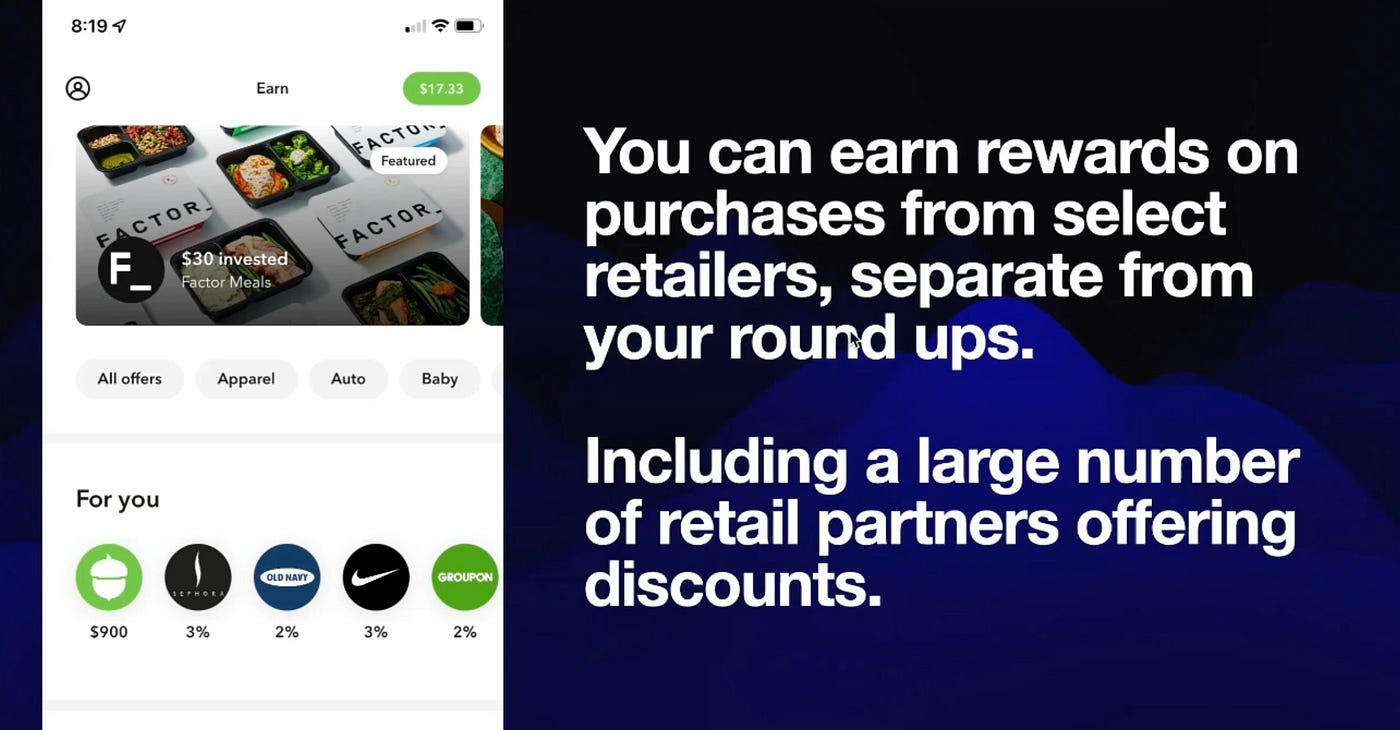

You can also earn rewards from purchases on select retailers separate from your roundups!

And this has to do with your Acorns Debit card.

So if you don’t have the Acorns debit card, you cannot earn rewards at various retailers.

The rewards are invested into your investment account, but heads up — it takes awhile. Those rewards are not instant.

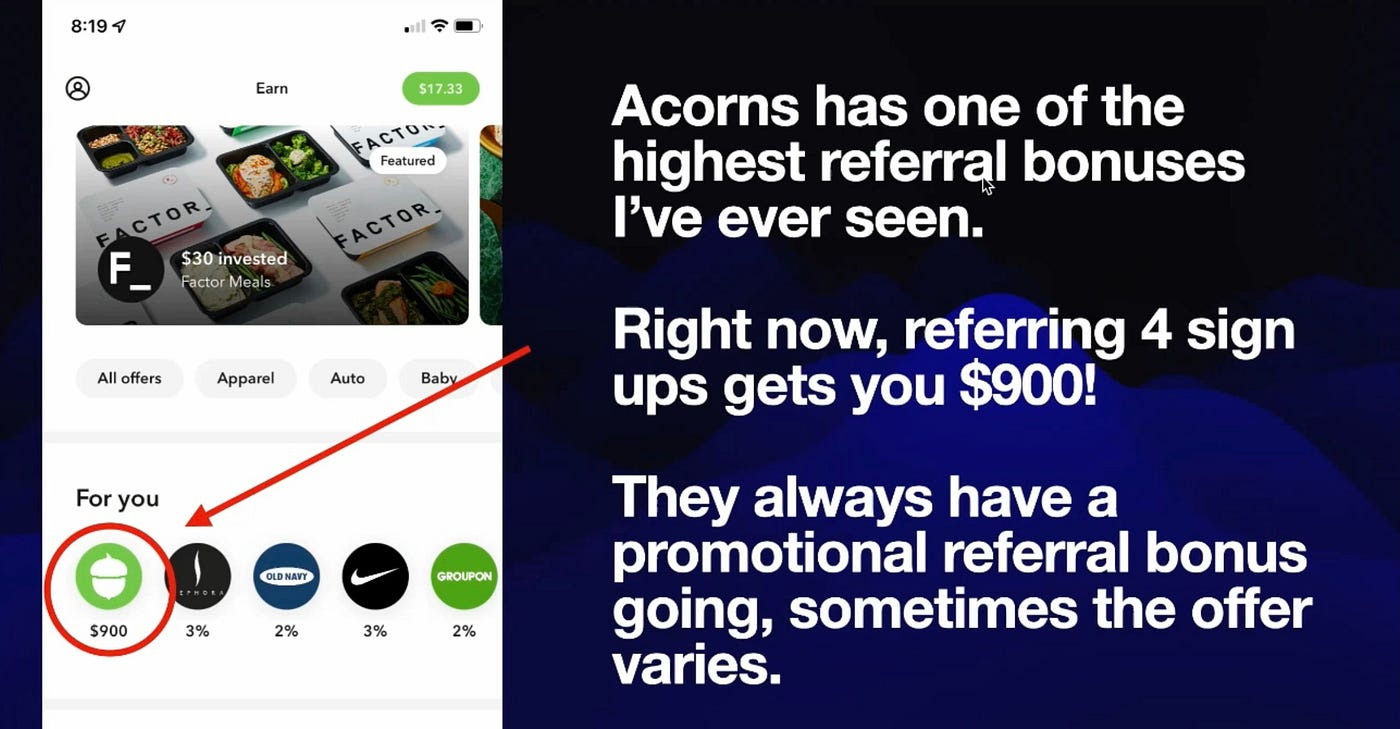

Referral Bonus Insanity

One reward that you can earn — look right here where I’m highlighting this big $900. This is the referral bonus.

And I’ve received one referral bonus in the past, and it was $500.

If I refer four people, meaning four sign ups come from my link, and I get the reward deposited into my account.

Acorns has one of the highest referral bonuses I’ve ever seen.

It’s unreal that they’re giving away $900+ for sign ups!

They always have some promotional going. It’s not always $900.

So far, I’ve only earned one referral.

Results

So what are my results?

After 3 years of using acorns and sticking with it and not ever really withdrawing my balance, I ended up with a little over $16,000.

And that’s probably spending somewhere like $1000–2000 a month on my debit card for the roundups.

And then — for the last year I switched to $50 per month recurring contribution. First two years I was $5 per month. Third year I selected $50.

I highly recommend this app. Definitely worth your time.

Click here to check out Acorns!

Thank you in advance for using my links!

If you sign up for Acorns, you may be one of the four people that helps me get a $900 referral bonus!

Onward and upward.

Here is the video version of this blog, if you prefer to watch video.

Thank you for reading!

This story contains affiliate links, thank you for using them!

Until next time….

Onward and Upward Everybody!

-Chris