Purpose Bots — Crypto Bots to Cover Random Things You Want

Want a new toy? Set up a bot to cover it!

I’ve done this a few times now.

Heads up…..this might be the least intelligent use of crypto that I can show you.

It all depends on how you look at it.

From a wealth building perspective….. EEEEK!

From the perspective of a person whose primary goal is automating personal income and becoming good at running bots, it works, and can help motivate you.

If all you want a simple wealth building strategy, I write about that here:

This story is for people who want new things, and are ok putting their cash into bots for the purpose.

This story is for those who want to practice running bots until they master them, who like the idea of adding a little extra motivation into the mix to keep them in the game, and give that good old intermittent-reward feeling.

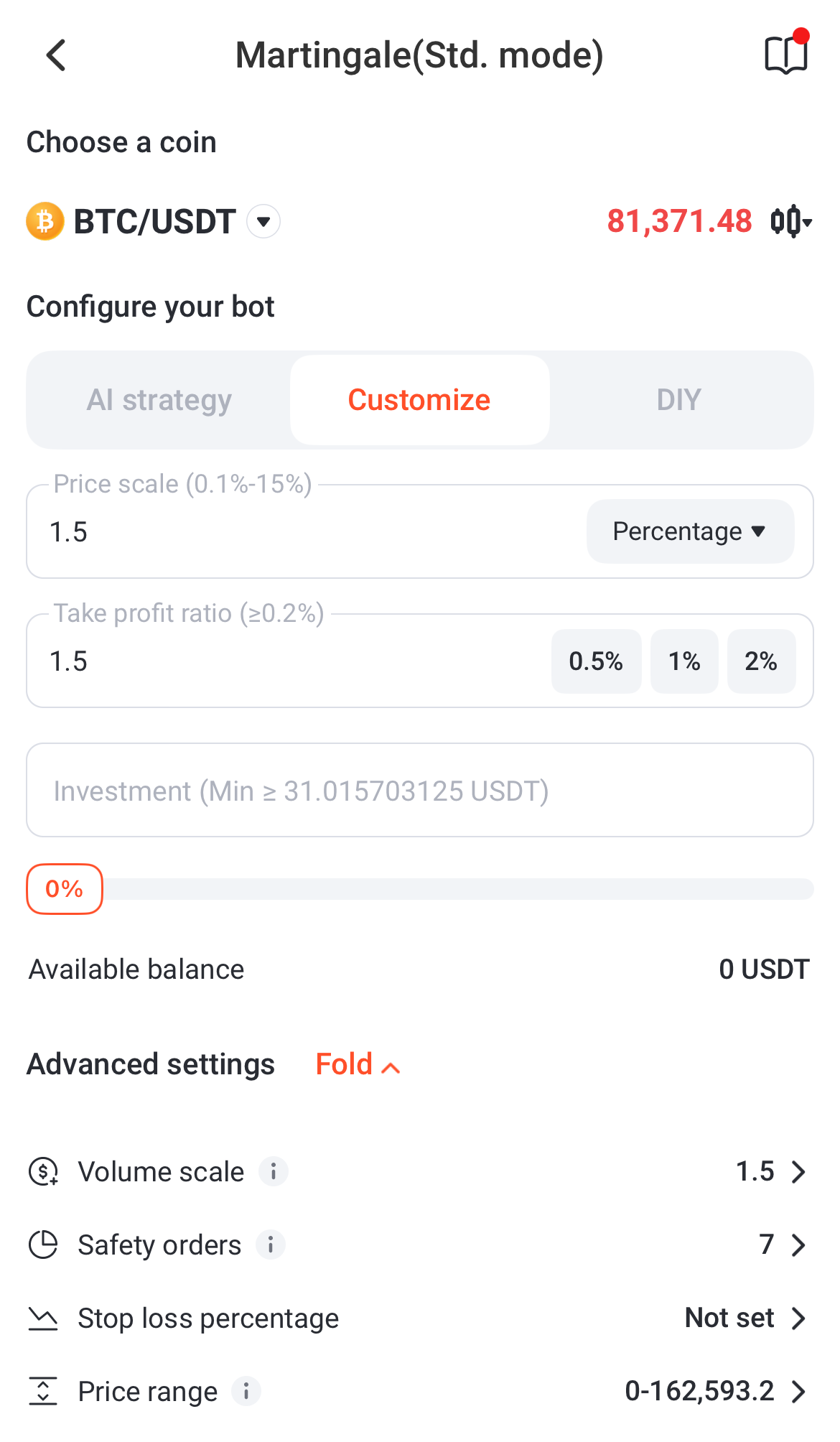

Back in 2022, I first discovered the Martingale strategy of crypto bot trading. This style has become like my first and most well-worn baseball glove, comfort wise.

Martingale evokes a certain sentiment from some people due to it’s use in gambling, but Martingale applied to crypto trading bots… is nothing like Martingale as a poker strategy.

This bot was yielding around $75 or so per month, with $1000 invested — on a 1% Price Scale / 1% Take Profit and 7 buy configuration. I was delighted and surprised to see this.

Up until that point, I had been using grid bots, which yielded around 20% per year, tops (but were yielding more like 8–12% for me). The martingale strategy I was testing was earning more in a single month, than a grid bot was earning in an entire year.

As I would learn over the course of my first year testing them, this configuration was set up to capture decent volatility.

7 buys (which is 8 total buys, for reasons I explain in my Beginners Guide to Crypto Trading Bots) — at 1.5% = this bot will stay in-range for a 12% price dip, which helps keep me in the green.

I immediately figured out that I could shrink my percentages or make fewer buys, and earn more return, faster, even when the market was less volatile — but I had to be extra careful. Just as easily as I can earn faster, I can end up in the red faster too, so I had to time this right.

So I changed my settings to squeeze the percentages and buys.

0.5% Price Scale

1% Take Profit

3 Buys

There was a guitar that caught my eye, and it seemed like a perfect goal to add to my list of goals to motivate me to keep engaged and active trading. I stuck $500 into a martingale bot, and within about 1.5 months I had $800 and I pulled it out and bought that guitar.

It was a Jackson Soloist in white:

>>Jackson Soloist SLXM DX Listing on Amazon<<

That was a risky maneuver, as my bot was in the red -$100 or so at one point, and almost stopped the bot at a loss.

Luckily, ETH and BTC were in a general upward trend by the end of 2022 going into 2023, and the bot was able to capitalize on that.

However, the bots I use have ended up in the red for months at a time with this risky maneuver, so be careful there.

Never leave these bots with squeezed configurations running for too long. Just long enough to capitalize on a strong upward market trend, then close them.

As long as you are trading on BTC and ETH, against USDT, you can be reasonably sure the bot will recover and you don’t have to close at a loss, but you DO have your funds tied up, waiting that out.

I mention this because — I don’t want people thinking you can just use this method without risk. The risk is indeed the squeezed settings I am using that can snap up more profit in a short period.

If you run the martingale on a random obscure coin that peaks and never recovers — you probably just lost money.

BTC and ETH, historically, recover, and keep climbing.

BTC obviously the winner in that race.

In my personal opinion, never use Martingale on any altcoin you are not very familiar with and reasonable comfortable with your choice.

Creating bots with a specific purpose can help motivate you to keep in the game, to keep learning, to keep testing until you find the strategies that work for you!

Start with small balances, test the waters, and you might be surprised at how easy it is to get that <new thing you want>.

Disclaimer : This is not financial advice and I am not a financial advisor. This is just what I am doing with my own money. I am NOT an expert. I am some dude on the internet who sees a path sometimes, and takes it.

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris