Today, I want to share a glimpse into my routine.

I’ll be squeezing profits with my DogeBot to generate the money to pay a bill!

(This story was written on Jan 3rd, but was scheduled to publish today to coincide with the publishing of my corresponding YouTube video, which is available at the bottom of this story).

I decided to invest $10,000 in my DogeBot, again.

I set it up to operate under a thin spread to maximize profits during upward price movements.

My goal?

To accumulate enough to cover my car and home insurance bill, which was due in 3 days.

Doing this is definitely a risky maneuver every time I do it, but I’ve done this so many times now. I am comfy with it.

“Fortune favors the bold!”

Note: this bot isn’t some crazy Python script or anything. It’s available on a mobile app anyone can download from their mobile app store. I am trading on Pionex. If you are outside of the USA, you would need to download your version. The video version of this story is available at the end.

Crypto Trading Robot | Free Crypto Trading Bot | Pionex US

Pionex US is the best crypto trading bot currently available, 24/7 trading automatically in the cloud. Easy to use…

Waking Up to Money

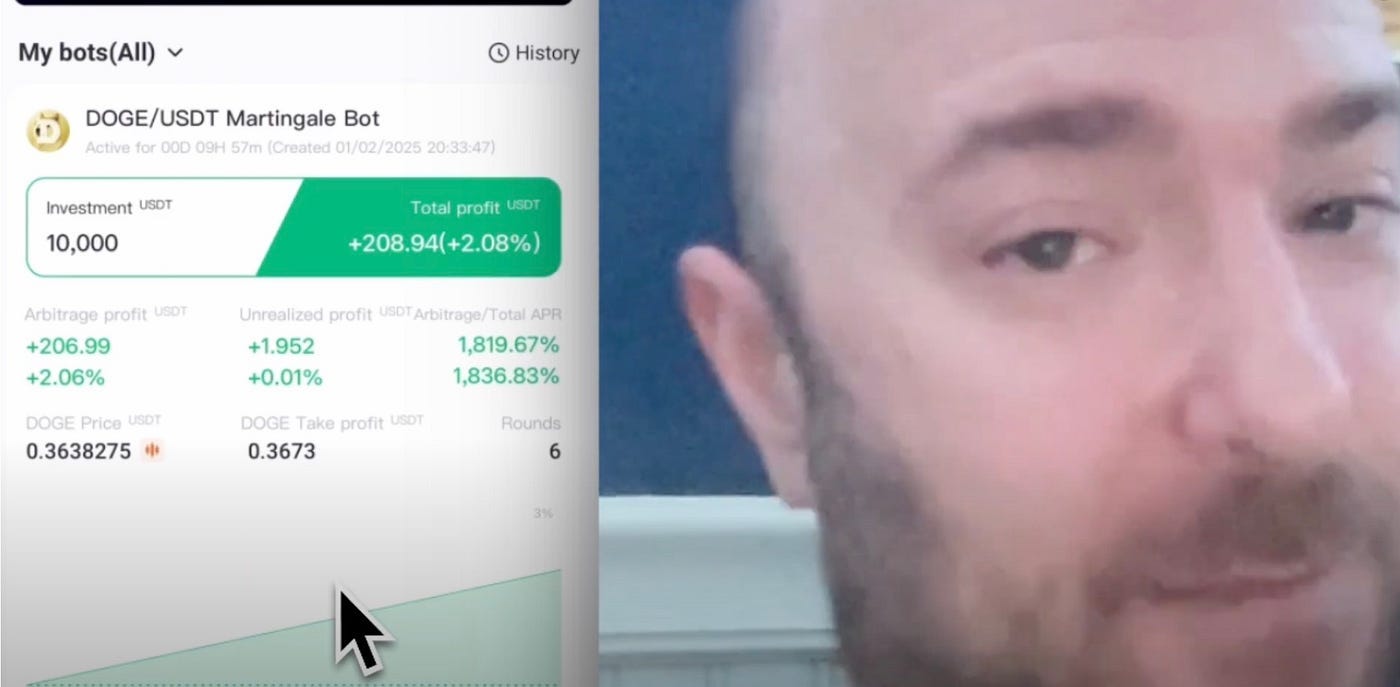

Starting the bot around 11 pm, I woke up to find my DogeBot had already captured around $200 in profit. I monitored price movement closely and waited to see in which direction the market might break.

Within a couple hours the market decided to tick up, the bot had captured around $250, so I closed my bot, captured that profit, and restarted the bot.

I widened my spread and adjusted my Safety Orders slightly.

By the end of my trading session, I had successfully captured the funds I needed.

I closed out my bot, feeling accomplished.

It was a mix of strategy, patience, and a bit of luck/timing.

Setting Up My DogeBot for Maximum Profit

My Approach: Squeezing The Spread

Every time I say that in my head, I hear Paulie Shore saying “Weezin’ the Ja-uice!!!!”

Sorry, that was …. an extra detail you probably never needed. Anyway….

When I set up my DogeBot, my primary focus was on squeezing spreads.

What does that mean?

Essentially, I wanted to make the most out of tight price movement, and snag more profit than normal, in a shorter timeframe.

I deposited $10,000 into the bot, aiming to capitalize on the strong upward movement I was seeing. I operated under a thin spread, which means I was trading with minimal percentage differences, and fewer Safety Orders.

This strategy is risky but it’s a strategy that can yield significant rewards, even without using Leverage.

I monitored my bots closely when I do this, never letting more than 30 minutes or an hour go by without checking the bots on my mobile.

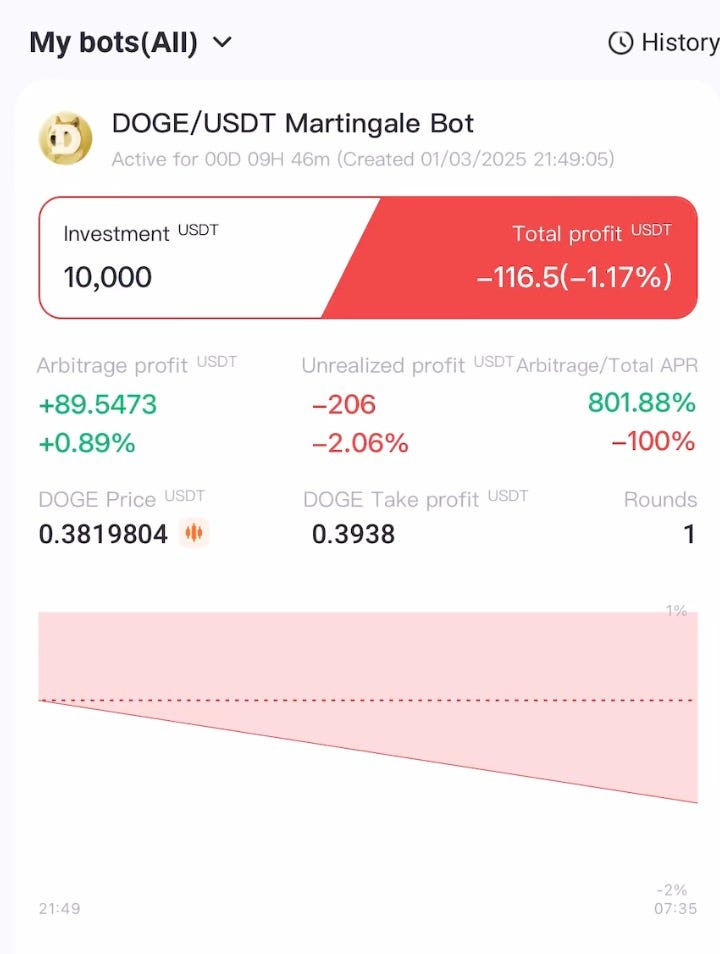

Sometimes my bots are in the red for a few hours, but if the market is still moving strongly upward, I wait it out.

Sometimes patience pays off.

Watching the market helps you make informed decisions.

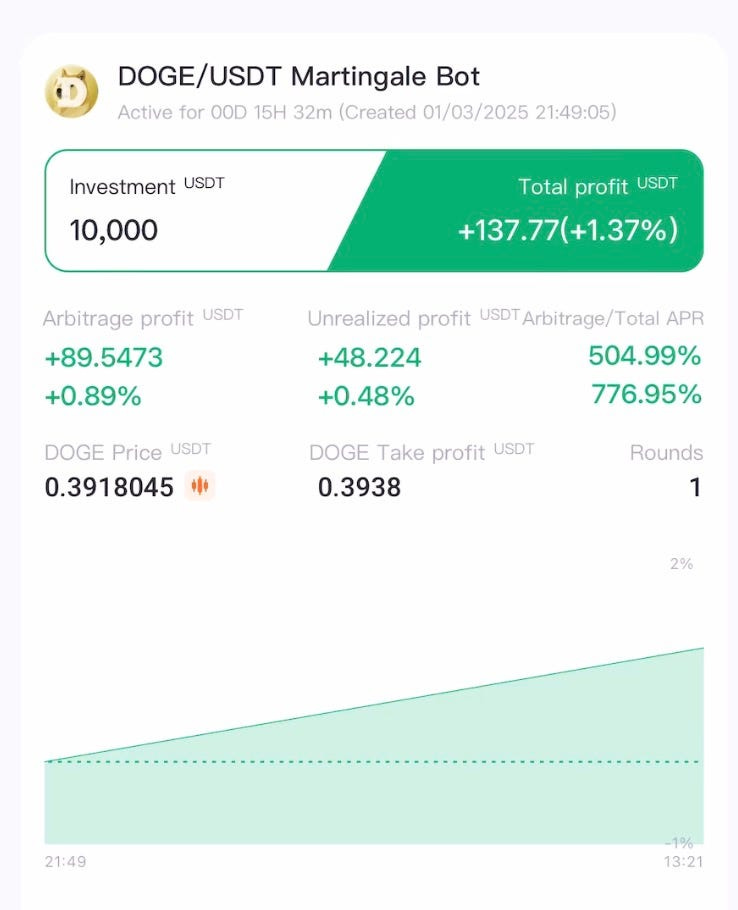

The bot recovered quickly and I captured another $130 shortly after that.

Details on my Martingale strategy

Now, let’s talk about Safety Orders. Safety orders are Pionex’s term for Martingale’s staggered buy-in, which help in mitigating losses.

Safety Orders tell the bot to make additional purchases when the price dips, helping you average out your entry price.

This is particularly useful in a volatile market, such as crypto.

First Safety Order: I set this up to trigger if the price drops by a certain percentage. This way, I can buy more of the asset at a lower price.

Second Safety Order: This kicks in if the price drops even further. It allows me to further reduce my average cost, increasing the chances of profitability when the price eventually rebounds.

Throughout my trading day, I adjusted these settings every time I closed out and captured profit, and I adjusted them based on observing market behavior.

I find that being responsive to fluctuations is key to my success with these bots.

So…. it’s not all completely automated yet.

If a bot can automatically make these choices for me one day, that would rock. But for now….a little diligence is required.

I regard Martingale method in crypto bot land as the “Bumper Bowling” version of high-risk, high-reward bot trading, as long as you are trading on TRUSTED BLOCKCHAINS.

DOGE is DEFINITELY a higher risk than BTC, ETH, or LTC.

I don’t normally trade on anything other than those chains.

Heads up!

Tips for Beginners Looking to Implement a Similar Model

If you’re new to trading and want to try a similar model, here are some tips:

Start Small: Don’t invest more than you can afford to lose. Begin with a modest amount. Never invest big at first. Into any bot. This is true even after you have been trading with bots for years. Any new bot that I am unfamiliar with, I start small. Always.

Educate Yourself: Read up on trading strategies and market behaviors. Knowledge is power!

Stay Informed: Keep an eye on market news and trends. It helps in making timely decisions.

Follow Automated Income Lifestyle: I’m learning and share what I uncover along the way.

Remember, trading is not just about making money; it’s about managing risks effectively.

Navigating Market Volatility and Risk Management

Reacting to Fluctuating Market Trends

Prices can soar one moment and plummet the next. I’ve learned to react quickly to these fluctuations when running tight spreads. It is a calculated risk, but one that I feel comfortable taking when I observe the market and three things are true:

Strong Upward Movement in the last 2 hours

Strong Support for Price Level Stability for at least the last 7–14 days Prior to the Strong Upward Movement

The Liquidity Heatmap lights remains cool at the current range, and the nearest hot spot is 5–10% away from current price level

Liquidation Heatmap, BTC Liquidation Heatmap, Crypto Liquidation Heatmap-coinank

Liquidation Heatmap are popular among users because they can be utilized in a myriad of ways -- from magnetic zones to…

When to Close a Martingale Bot for Profit

Knowing when to close a martingale bot is crucial. After several hours of trading, I had captured around $250.

What does that mean?

It means I stop the bot, sell the BTC, capture the profit in USDT, and restart the bot, realizing my profit immediately, instead of keeping my gains in an UNREALIZED state. This also allows me to adjust the bot parameters using AI to assist me, optimizing my settings for the current moving averages.

This strategy two huge positive benefits:

I REALIZE my gains faster

It keeps my bot in active trading range

Stopping and starting again and changing the settings not only captures profit in a more readily available tangible way, it also helps your martingale bot remain healthy (active and trading), constantly putting the bot into more optimal alignment with the current price level and price movement.

Goal attained within 48 hours.

Victory!

I have successfully covered my bills.

Profits gained incrementally, closing out my bots at each major profit capture, in order to realize the profit faster.

Had I not done this, my bot might be in the red today even after making several sells, and I would have to dig into my reserves to pay my bills.

It’s a lesson I’ve learned through experience.

I “get in, get out”, then widen my spread again when I want to go back to paying less attention to my bots.

Plans for Future Trading Experiments

Looking ahead, I’m excited about my ongoing exploration of crypto bots. I plan to continue sharing insights through my “Crypto Trading Bots 101” series.

The current bull market presents strong opportunities for us all.

In the coming year, I hope to experiment with new strategies and refine my existing methods. It’s easy to get comfy with something and hit the repeat button and forget that greater profits might be just around the corner when testing new things.

I encourage everyone to stay informed and adaptable.

As I wrap up this rewarding trading day, I’m filled with optimism. I look forward to sharing more experiences and insights with you all. Happy trading!

As promised, here is this story in video form:

Continue to the Next Story in this series:

(To Be Continued)

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

A.I. Lifestyle

#botlife #tradingbots #dogebot #lovethatdoge #getit #bong #trading #btc #crypto