How I Handled The Dip — Crypto Trading Bot Update — August 8th

I am feeling pretty good about a price recovery today.

I am feeling pretty good about a price recovery today.

I’ve had numerous people reach out to ask how I am handling the recent big price dip and what my response was.

My last Crypto Bot Update pretty much covered it, but — I will elaborate a bit more.

There It Comes— Crypto Trading Bot Update August 5th, 2024

The fall I was anticipating just happened, and may not be over.

The Martingale bots that I closed (two of my primary income-generating bots)— I didn’t close out and sell for USDT, which would have meant a loss of around $2500 between both bots combined if I did that.

Ouch, that would be 12.5% of my total balance invested in them!

I stopped the bots and held the crypto. Then I moved the crypto off-exchange.

No reason to have my money sitting on a centralized exchange inactive, and Pionex US doesn’t have staking for interest. (Which helps them avoid the US regulatory hammers)

Pionex; A Club For Bots Only. #Botlife

I have been concerned lately due to a lawsuit on KuCoin exchange by the United States.

The BTC and ETH are being held in external wallets, earning interest while I wait.

Not much, but I have a strict rule — if I am going to put any money on a centralized exchange at all, it has to be earning SOMETHING.

Otherwise cold storage is a better option.

When price ticks back up I will create limit orders and convert to USDT at 2% increase over value, take that profit, and restart my bots!

Fingers crossed. I can’t actually predict the future, but that is what I am hoping to see.

BTC is already back at $59k again this morning, and it’s barking up the $60k tree fast.

Admittedly — the Martingale bots I am using are a bit weak when it comes to sharp movement trends…. unless I can get a signal before hand and respond in time.

Until recently, I used a bit of easy “whale-watching” as my signal and it has helped me a lot in the last year or so, but right now I’m having trouble replacing the app that was giving me excellent notifications about that. It all of a sudden stopped giving me multiple notifications.

And so far, most apps I have tried to enable notifications on, only give me a single notification instead of blasting my phone.

Crypto Whale Watching; Trading Signals — Futures Price Notifications

A curious phenomena I’ve noticed….

Haha. This is the only time I have ever been happy to see my phone get blown up with notifications. It actually gave me a decent actionable signal.

I will find it again….. eventually.

Maybe on Telegram or something.

Signals are shaping up to be unavoidably important for a solid martingale strategy.

Rolling Reserve Becomes The Active Bot Instead

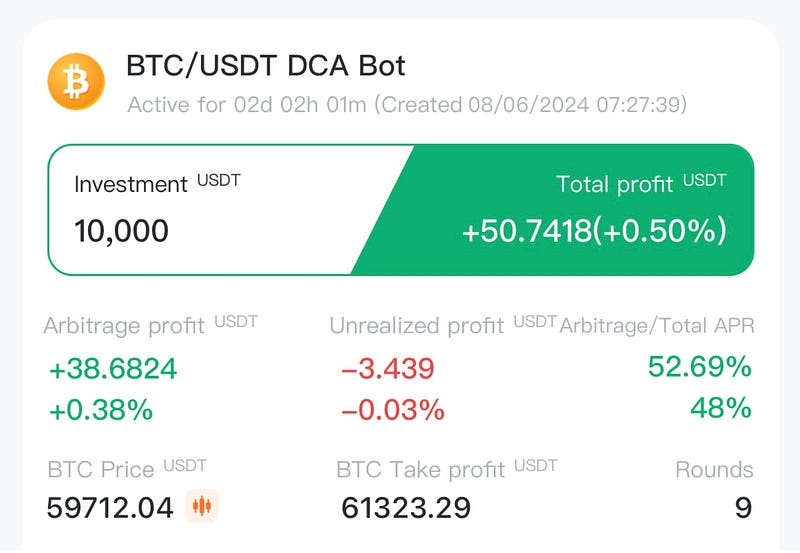

In the meantime, I have another $10,000 that I was going to keep for rainy day fund, but instead of paying bills directly with it, I decided to start another bot in the current range, with a wide spread just in case there is another level to this dip.

It’s doing it’s normal thing.

It is not profiting as much as it could be because I am not going to risk squeezing the spread right now, but this bot will likely get a few bills paid for me until price recovers.

I am also spending time expanding my knowledge and trying new things.

There are more bots than just martingales, but it’s funny — when something works, you tend to pull the lever again and again, even when conditions change and maybe another set of levers will work better right now.

Until I find bots that can profit better than Martingale for short term income-generating goals, I will stick to them for that purpose, and my strategy might be shaping up to be something like having $100k into bots, and alternating active bots. When some are in range, others go out of range.

This might look like having 3 10k bots for each coin (Bitcoin, Ethereum, and Litecoin), with different configuration profiles.

One would have ultra-wide spread — what is referred to as a Moon bot, only it would be created with Martingales instead of Grid bots.

The second bot would be a Martingale with medium spread. This would be to better capitalize on realistic average price movement, while also trying to stay in range a bit better.

And the third would be what I refer to as …..my Profit-Udder bot.

Those are the bots I squeeze to get more profit from.

Yeah, I just made that name up, but it fits well.

The Profit Udders will go out of range more often than the others, and will require taking losses to keep active sometimes, but the other bots will provide instant support in those events.

The 10th bot would be something like a Crypto Growth bot, which arbitrages between ETH/BTC to continually increase my BTC.

Beginner’s Guide to Crypto Trading Bots — Part 8— Growth Bots

Strategically Increase Your Crypto Holdings

My strategy may change if my learning yields better bots for income-generation.

Time will tell.

Until then, I’ll keep rocking the Martingale.

Now, back to summer.

Happy trails, you guys.

If you would like to check out my trading bot updates starting from the beginning, here is the first story in the series:

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

Automated Income Lifesyle w/ C.W. Morton

I'm just a regular guy who automates everything I possibly can. ⭐ SUPPORT THIS CHANNEL…www.youtube.com

#botlife #tradingbots #tradingbotsasincome #primaryincome #digitalhustle