Navigating The Unexpected Turns

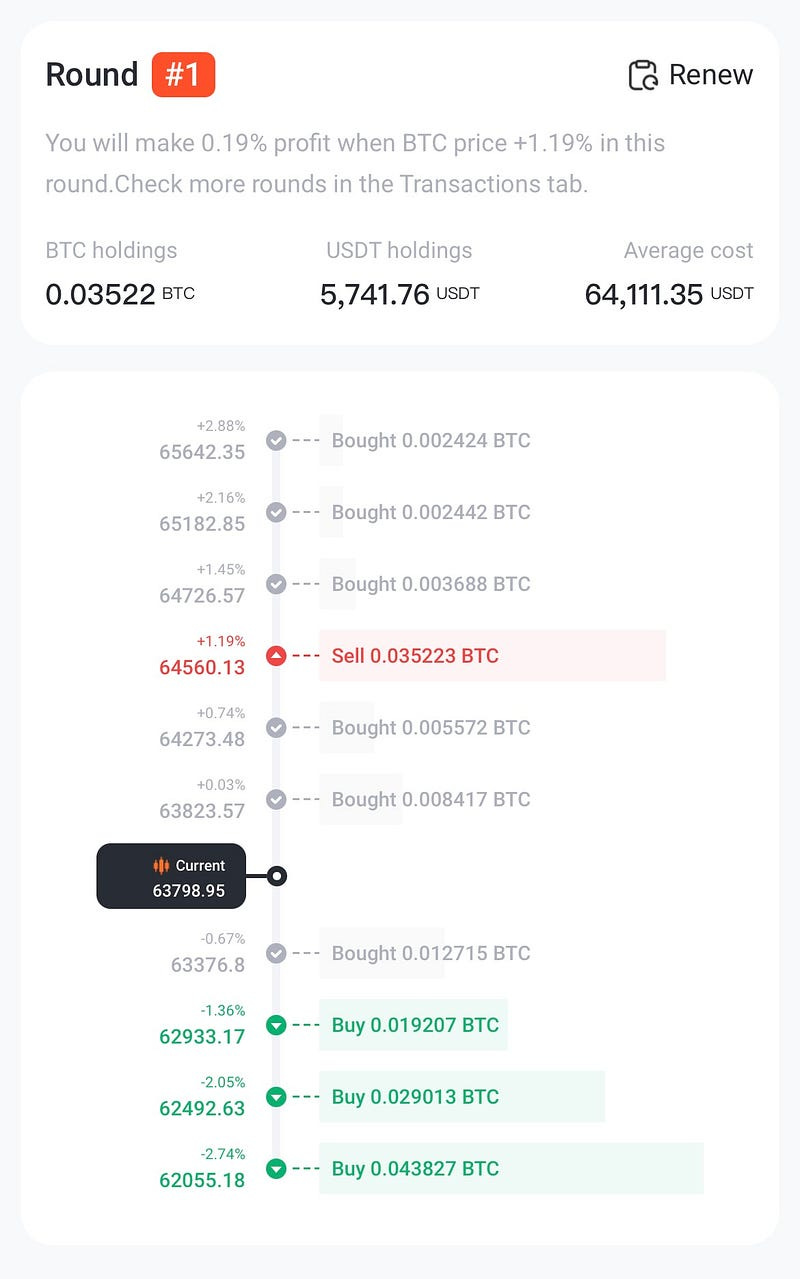

Two months ago, 3 of my bots got dropped off at the peak, and so I closed two of them and waited for BTC’s price to recoup, it did last week, so I restarted the bot.

It is still in action, as I set my spread wide this time.

1% / 1%, and 9 buys, meaning it will take an up to 9% dip and stay active. I base this on recent tendencies for the price to move about 5k up or down. 5k being 10% of 50k, approx.

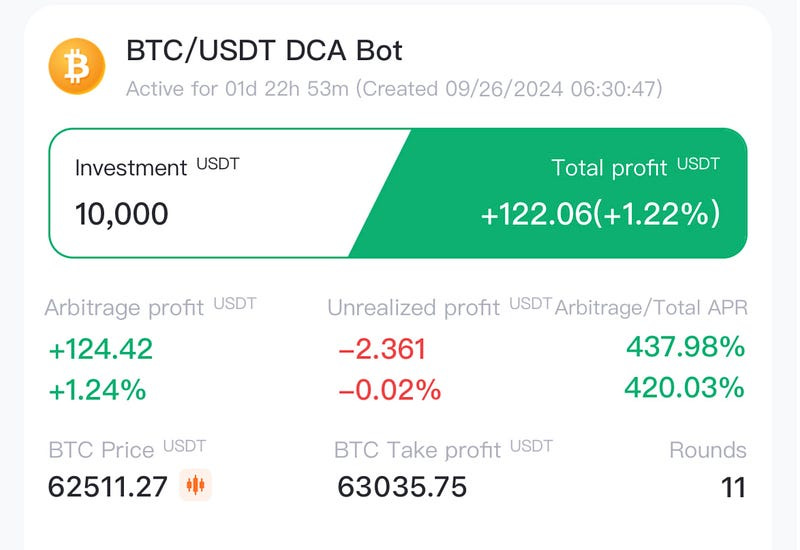

I captured about $120 in a few days, and my bot has been reset to the current range.

My ETH is still staked, earning interest, but price has not recovered back to $2900, so I have not restarted my ETH bot.

I am keeping my Martingale spreads wide, and I have one modification to my strategy that I will make a LAW rolling forward.

LAW: When we get close to an All-Time-High price of BTC, I will immediately widen ALL of my spreads on all of my bots and keep them there until after whatever dip happens.

No exceptions.

We can be almost certain, any time the price reaches an all-time-high, we will statistically be in for a series of dips until BTC reaches its new price floor.

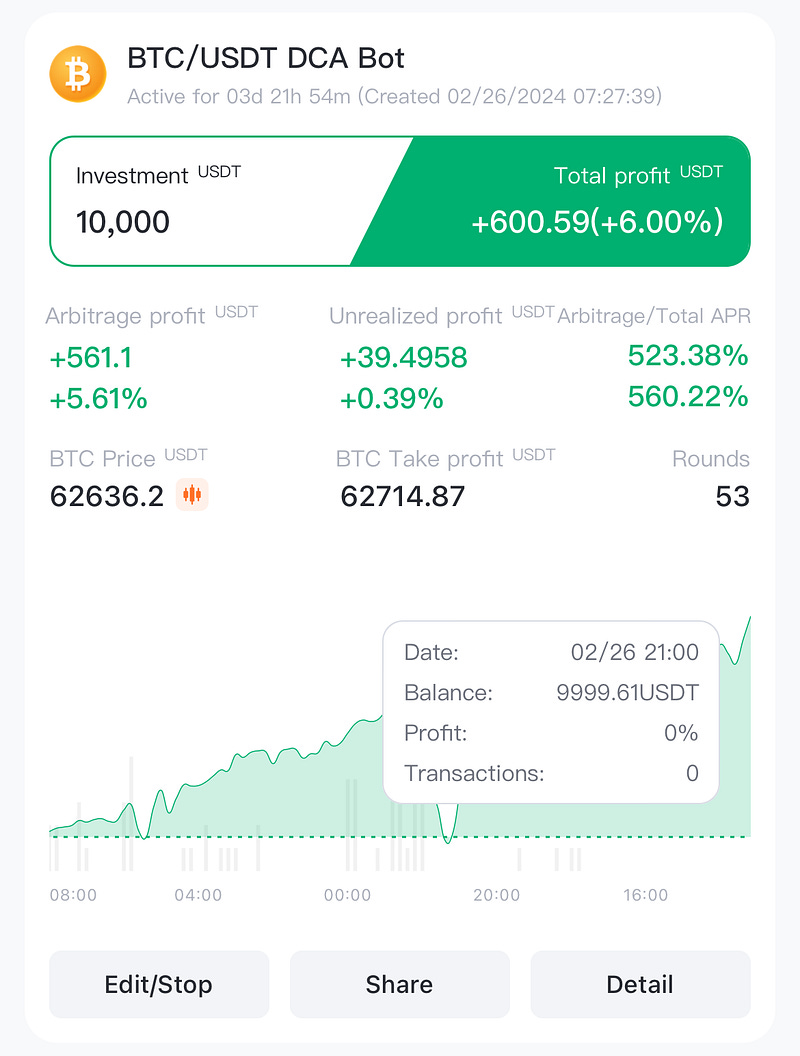

This means that, as tempting as it may be to squeeze my spread and go nuts like I did back in February:

The method I have used to greatly increase my profit during more sideways markets cannot persist as we approach the peak of a bull run.

Squeezing is really only suitable for flat or sideways markets or mildly bullish conditions.

Any time we approach new All-Time-Highs, my squeezing will cease, immediately. If I do not widen my spread, my bots will simply get dropped off at the top of the mountain, headed into extended drawdown city.

As a result, I have been looking for other strategies of trading that might better suit bearish conditions, while investigating new signals.

Now, keep in mind - I am running these Martingale bots on BTC and ETH, for a reason.

Drawdown tends to be temporary. Impermanent. In other words, not a real loss unless BTC or ETH never recovers.

Any other coin, who knows?

And this brings me to my verdict on some of the tools I am testing right now.

Trading Signals with over 90% Accuracy; it’s True.

I have been following Fox Signals for a little over 2 weeks after purchasing a lifetime license on App Sumo, and so far, the signals have proven to be at least 80% accurate on their worst days — staying in the 90% range most often.

Because these signals have been so specific, and specifically aiming at random coins that I really have NO IDEA about, it is best that I spend some time learning about futures before really testing it.

These specialized tools are not meant for the risk-averse.

I have read far too many comments from students in futures forums and social media groups who talk about “blowing accounts,” and this is just part of the learning process for this type of trading.

OUCH.

That is some Ultra Mega Risk Balls!

I have not once “blown” an account with Martingales.

Technically, I haven’t had any permanent losses. I’ve closed at a small loss, and usually have been able to recoup within a few weeks. The biggest loss was the recent 10% dip, which left me $1k-1500 down for a few weeks until the BTC price recovered.

Unless Bitcoin crashes to zero, it’s pretty much impossible to “blow” my account with a Martingale bot.

In futures — blowing your account means one thing — liquidation or losses eating the total balance.

Martingales cannot be liquidated, there is no leverage there to trigger such actions. And I can’t imagine being so bad with it that my account hits zero.

For these reasons, I am jumping right back into my martingales, booting them up asap, with a modified strategy for the All Time High periods, and rolling forward with that.

I will create more cashflow with other ventures, and try to learn more about futures in the meantime. I will probably play in a paper trading sandbox. It might very well be worth my time to use part of my assets in the futures world, I just don’t want to be using any more than 5–10% of my bot funds if I do, and I want to really have a grasp of what I am doing.

Thank you for reading!

Until next time….

Onward and Upward, Everybody!

-Chris

#botlife

This channel provides content about cryptocurrency and cryptocurrency related topics with a focus on providing tutorial…www.youtube.com

#tradingbots #signals #regroup #ifitsnotbroken #dontfixit #keepgoing #martingale