Beginner’s Guide to Cryptocurrency Earning Strategies

A breakdown of the most important concepts to get you started on the road to financial freedom.

A breakdown of the most important concepts to get you started on the road to financial freedom.

Cryptocurrency’s immense potential for great returns has attracted millions worldwide.

Anyone with an Internet connection now has the opportunity to invest in this highly volatile and yet potentially rewarding market.

But before you dive in head-first, it’s essential to understand some of the intricacies involved — the strategies, the risks, and the rewards.

Just as a seasoned sailor doesn’t set sail without a compass, a successful crypto trader should not venture into the crypto sea without a solid strategy.

Today, we will delve deeper into the world of trading strategies, unearthing key principles so you can choose what aligns best with you.

But beware; this journey is not all smooth sailing.

You might encounter some daunting conditions along the way, some turbulent markets, and even some losses.

But that’s the nature of the beast — and in the end, if you stick with it, you’ll be equipped with a strategy that can weather any storm.

I should mention before I go on, that I am not offering official financial advice, and I am not a financial advisor. I am just a regular guy who reads, takes action, and has found a solid path thanks to making friends and learning from them, implementing and testing at home, and now I want to put what I have learned into blog form to help beginners and intermediates like myself on their journey.

Developing Your Wealth Plan

To command a ship, you must first understand its working parts — the way the sails catch the wind, how the rudder steers the course.

Similarly, in cryptocurrency trading, understanding the basics is your first step towards developing a solid strategy.

Setting Goals and Limits: Before you start trading, set your financial and professional goals. What you do you want from your first year of trading? To double your holdings? To leverage your crypto assets to buy physical assets?

I found that I was not as successful with my trading until I set a goal, and plotted a path and went for it. For me, that was wanting to see an extra $2000 per month in my pocket.

Specify the Limits on your investments and the profits you expect. This template will not only avoid the risks of overtrading but will also keep your losses in check while you are developing your strategy.

Market Conditions: A thorough and updated understanding of market conditions is indispensable. Is the market bullish, bearish, or going sideways? Your strategy should be flexible enough to adapt to any market conditions. Practice a strategy efficient for each different market condition. I outline market conditions in my Martingale Theory blog post. Click here to read it.

Risk Management: This isn’t spoken about enough. No trader can afford to ignore risk management. Decide what percentage of your portfolio you are willing to risk on each trade. When I first started testing crypto trading bots, I would only use $100 or so, then I worked my way up to feeling comfy with $1000, and eventually started running $10,000 bots when I felt more comfy with my strategy. But this is only because I am also HODL’ing balances and staking as well. I do not have all my crypto running in bots on centralized exchanges!

Understand your risk-reward ratio: This essentially refers to how much risk you’re willing to take for the potential reward. Understanding this ratio will help you assess the worthiness of a trade. For me, an efficient trade should ideally have a risk-reward ratio of at least 1:3.

We have set sail from the shore, and there’s no turning back now.

Understanding the Market

Now that you have your basic plan starting, it’s time to dip your toes into understanding market behavior.

Fundamental Analysis: Don’t just look at the price of the cryptocurrency. Look deeper. Does the crypto have any groundbreaking technology, a potential for future growth, competent team members? Is there market news that could affect the price? All these factors impact the price — and they should impact your strategy.

Technical Analysis: This is where the numbers come in. Trends, pattern formations, mathematical indicators — these are sciences that can predict future market behavior based on past data. Indicators such as Moving Averages and Relative Strength Index are the many tools at your disposal.

Market Analysis: Subscribing to market news alerts, reading cryptocurrency-related facts, and joining relevant online-groups are great ways to stay updated. A well-informed trader is a successful trader.

You should be able to use these three to adjust your strategy on the fly.

I outline a more dynamic strategy by responding to market conditions in my Martingale Theory Medium story. Click here to read it.

Select a Trading Style

Every trader has a unique style, usually some combination of common trading styles.

Breaking this down, I find these 4 styles to be the best place to start for beginners.

Based on your personal preferences, your financial goals, and the time you can dedicate, you can fine tune your trading style to match your lifestyle.

Day Trading: This involves performing multiple trades within the day to capitalize on short-term price fluctuations. Day trading can be lucrative if done right. But this requires that you stay glued to your computer or your app, for the most part.

Swing Trading: Swing traders don’t need to monitor the market continuously. They ride the “swing” occurrences in the market, capturing gains from price changes over a couple of days. Typically this amounts to setting limit orders, and walking away.

Hybrid Day/Swing Trading: I use my favorite trading bots to do this for me, but I still monitor and intervene a bit. It requires quite a bit of random attention and input, like day trading, but it also automated to be less work, like Swing Trading. I don’t have to stay glued to my computer, but if I do not follow my strategy outlined in my $6,000/mo Cypto Trading Strategy, I am not as profitable.

Position Trading: This is a much long-term strategy that involves holding a position in a cryptocurrency for weeks, months, and even years. This is long term holding. In crypto tuns, to the moon baby! Position traders look at long-term trends and larger price movements. A really cool bot to test here is the Bitcoin Moon bot on Pionex, check it out!

Your trading style will significantly affect your methods of analysis, the time spent on trading, and the risks you assume.

There are more styles I can add here, like Derivatives and Futures, but I will save those for the future.

Not the least of which being because I have not ventured that far myself.

Decide wisely!

I operate within both a Hybrid mode of trading, as well as Position Trading, and because so far both have proven to be a great way to generate capital.

Neither of those methods require all of my time, and I can adjust my bot settings to a more “Set it and Forget it” mode when I need to do other things.

The bulk of my holdings, however, I prefer to keep in private wallets, or earning a staking return or some kind of interest.

The bulk of “my bag” so to speak, I like to keep it slightly diversified, and most of it in more stable but less profitable holding places.

I mainly bold ETH, BTC, LTC. And a few select others.

A Healthy Flow of Crypto, Diversified

I run bots to increase my capital holdings.

Then I take profits from my bots, and I immediately move those profits into a combination of Staking Protocols, Decentralized Exchanges, and Cold Storage.

I then earn in staking protocols like Loopring, while I user Decentralized Exchanges like DCR DEX, where I Position Trade and set limit orders for longer term gains.

Then, finally, crypto ends up in Cold Storage.

BTC cold storage

No, I’m not talking about putting your computer into a freezer.

I am talking about holding it on a device that is NOT connected to the internet, at all.

Hot Storage = any connected wallet that can possibly be compromised in a hack.

Cold Storage = a fancy USB drive, more or less. Inaccessible to the web.

I use a Trezor model T.

You can click here to look at the listing on Amazon. They are definitely worth it. This is one of the most secure ways to store your crypto.

This method does earn interest. Coin stored here cannot be trading actively. But, it does one thing well.

Hold a balance securely, and watch the dollar value ascend over time, without worry of exposure to hackers, scammers, etc.

And, thanks to modern times being so unpredictable, might be a good idea to get a faraday bag or box, to store your Trezor in, just in case … anything weird happens.

Give yourself that extra bit of security.

Decentralized Exchanges.

These are peer to peer networks that facilitate crypto exchange without a middle man. You never move your crypto into a wallet that you do not own. You typically connect your own wallet, and function with it, connected to the exchange.

These exchanges come with their own risks, but in general, they is far safer and less exposed to being hacked, hijacked, or shutdown by a government.

My favorite is DCR DEX, which has no trading fees.

Free trades, all day, everyday.

I do most of my Position Trading on DEX’s to avoid fees, and the risk of over-using centralized exchanges as much as possible. The more crypto you have on a centralized exchange platforms, the more exposed you are.

DEX’s are to crypto exchanges, what a VPN is to internet use. There is no identity binding, there is no custodian, they are essentially peer-to-peer money transfer engines.

The catch for DCRDEX, you have to have a stable connection, and remain connected.

If you disconnect, your orders will not be able to execute.

Exactly like any other Peer to Peer / Client to Client connections running in a live action environment.

Centralized Exchanges

I keep the bulk of my crypto away from centralized exchanges, and only keep bots running on them to increase capital faster.

This is because of a very real danger that all of us face with centralized exchanges (Pionex is an example of a centralized exchange).

I was active on Cryptopia in 2018 when they were hacked, and overnight everyone lost access, and they have been in liquidation ever since.

I lost 3k worth of enjin coin, which would be worth like 20k today.

Ouch!

Though I am running 3 bots on Pionex, and have about 30k in the system, I cringe.

I am maxed out, and looking for other exchanges that have Martingale style bots.

My original goal with bots is to have each bot running on a different platform, so that if any of them go down, I don’t loose all my cryptobot cashflow overnight.

KuCoin Exchange went bye bye in 2023, and now only Pionex remains for USA users.

KuCoin and Pionex have the best and most robust bot trading available, IMHO.

Ill be sure to make a blog post and videos about it when I find another platforms that I use regularly and profit with.

If you know of or use another platform that you love, feel free to comment and let me know! I’d love to check it out, and any recommendations are always welcome!

Staking Protocols

Some of my crypto is staked in liquidity pools earning interest from being loaned to other crypto users.

These are a great way to earn passively on a holding balance. They tend to do better than most savings accounts, interest wise.

But, you always need to stay ahead of the game on these.

Sometimes staking pools loose liquidity fast, and you don’t want to be stuck in a pool that comes and goes.

I try to select pools that have been around a while, and have a company behind them with a vision.

Like Loopring V2.

Trading Bots

Trading bots areby far my favorite way to earn with crypto.

They are kind of like a slot machine, only the way I am playing it, I haven’t seen much bad luck.

It seems a lot less like gambling, and more like predicting statistical probabilities.

I am using a trading bot that applies an old slot machine strategy to the market, with fantastic results.

This method seems to do WAY better in a market where up and down direction is almost a coin toss second to second, compared to a purely random chance machine.

Click here to check out my other blog if you want to learn about this strategy!

Set it and Forget It

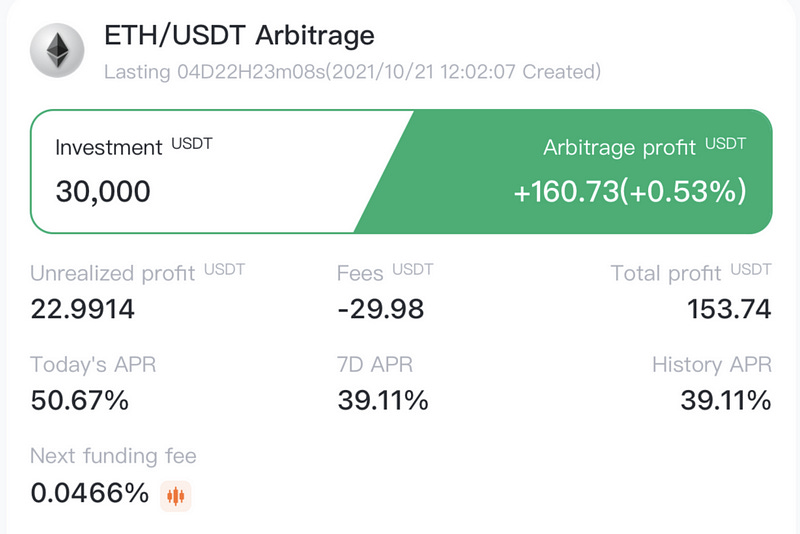

What I refer to as “Set it and Forget it” bots — are bots that do not require my attention at all.

These are bots that earn while I sleep, or while I vacation, and I am not worried about loosing the bag.

“Set it and Forget It” bots like this ETH Arbitrage bot usually do not profit as well, but are safer to run, and end earning anywhere from a few perfent per year, to around 20–30%, depending on market conditions.

You can still go into the red, but after you have them running a while, they are more stable than the risker bots I really profit greatly from.

The more advanced bots that are more profitable, require more attuned market awareness and attention.

Examples of Set it and Forget it bots include Grid Bots, Infinity Grid Bots, Moon Bots, Arbitrage Bots, and Rebalancing Bots.

Semi-Automated Bots

These are bots that you can set up and get running, but will still require that you pay attention to them and dynamically adjust configurations if you want them to remain profitable in different market conditions.

I love Martingale bots, but that’s just me.

Examples of Semi-Automated might be Martingale bots, Futures bots, bots that can go out of whack if you aren’t paying attention.

My favorite platform to run bots, so far, is Pionex Exchange.

Rebalance, Rebalance, Rebalance

Rebalancing a portfolio refers to the process of realigning the quantities of assets within the portfolio to maintain its desired asset allocation and risk/return.

Over time, due to market fluctuations, the value of different cryptos in a portfolio can change, causing the portfolio’s allocation to deviate from its original target allocation.

Here’s how the process typically works:

Establishing a target asset allocation: Before investing, investors decide on the mix of assets they want to hold in their portfolio based on their investment goals, risk tolerance, and time horizon. This allocation could include holding balances, bot trading, staking, all which have been covered in this blog.

Monitoring the portfolio: Regularly tracking the performance of the portfolio is essential. As the value of assets fluctuates, the actual allocation of the portfolio may drift away from the target allocation.

Determining when to rebalance: Rebalancing can be done periodically (e.g., annually or quarterly) or triggered by specific thresholds (e.g., if an asset’s allocation deviates by more than a certain percentage from its target). The decision to rebalance depends on the your overall strategy and market conditions.

Execution: Once the decision to rebalance is made, the investor sells over-weighted assets and buys under-weighted assets to bring the portfolio back to its target allocation balance. This involves selling a portion of the assets that have performed well and buying assets that may have underperformed but are expected to recover or provide better future returns.

Tax implications: Rebalancing may have tax consequences, particularly in taxable accounts. Selling appreciated assets may trigger capital gains taxes. Investors should consider tax-efficient strategies when rebalancing their portfolios, such as utilizing tax-loss harvesting.

Reevaluating the target allocation: Over time, investors’ financial goals, risk tolerance, and market conditions may change. Therefore, it’s essential to periodically reassess and adjust the target allocation as needed.

Rebalancing ensures that the portfolio remains aligned with the your objectives and risk preferences, helping to control risk and potentially enhance returns over the long term.

There are even rebalancing bots that can help you do this, but because they mostly exist on centralized exchanges, I am doing this task manually for myself, at this time. When a rebalancing bot comes to a decentralized exchange, ill be all over it.

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris