Beginner’s Guide to Crypto Trading Bots — Part 9 — The Infinity Grid

To Infinity and Beyond!

To Infinity and Beyond!

The Infinity Grid

Profile

Best for : Bull Market

Profit Expectation : Moderate to High, Short Term

Risk : Low/Moderate. (Best to start when market is perceived to be low, and expected to rise in steep movements.)

What Is Infinity Grid?

An Infinity Grid is simply a Grid Bot without an upper limit.

With Infinity Grid, you can take advantage of bullish market conditions and prevent missing out on opportunities.

It can prove challenging for investors to take full advantage of a trend and avoid losing out on prospective gains by selling all of their positions too soon when using standard Grid Bots.

It is impossible to foresee future market moves with absolute certainty.

An Infinity Grid solves the problem of losing out on trades because price breakouts surpass the top bound of your grid.

When the market regularly hits higher highs and lower lows, as it does during strong bull market cycles, the Infinity Grid trading bot performs especially well.

Infinity Grid vs. Grid Bot

The way that Grid Bot and Infinity Grid handle price ranges is different.

While Spot Grid trading limits deals to a predetermined price range, Infinity Grid eliminates the upper bound and permits earnings to increase in tandem with market developments.

So why would anyone ever chose a standard Grid Bot?

If the market is not trending upward, you will simply have orders that sit, unable to be fulfilled with your Infinity Grid, but not really stalling your bot, just reducing it’s profit potential.

A standard Grid may prove more profitable in a flatter market, but you can really test both and see positive results.

AI Settings

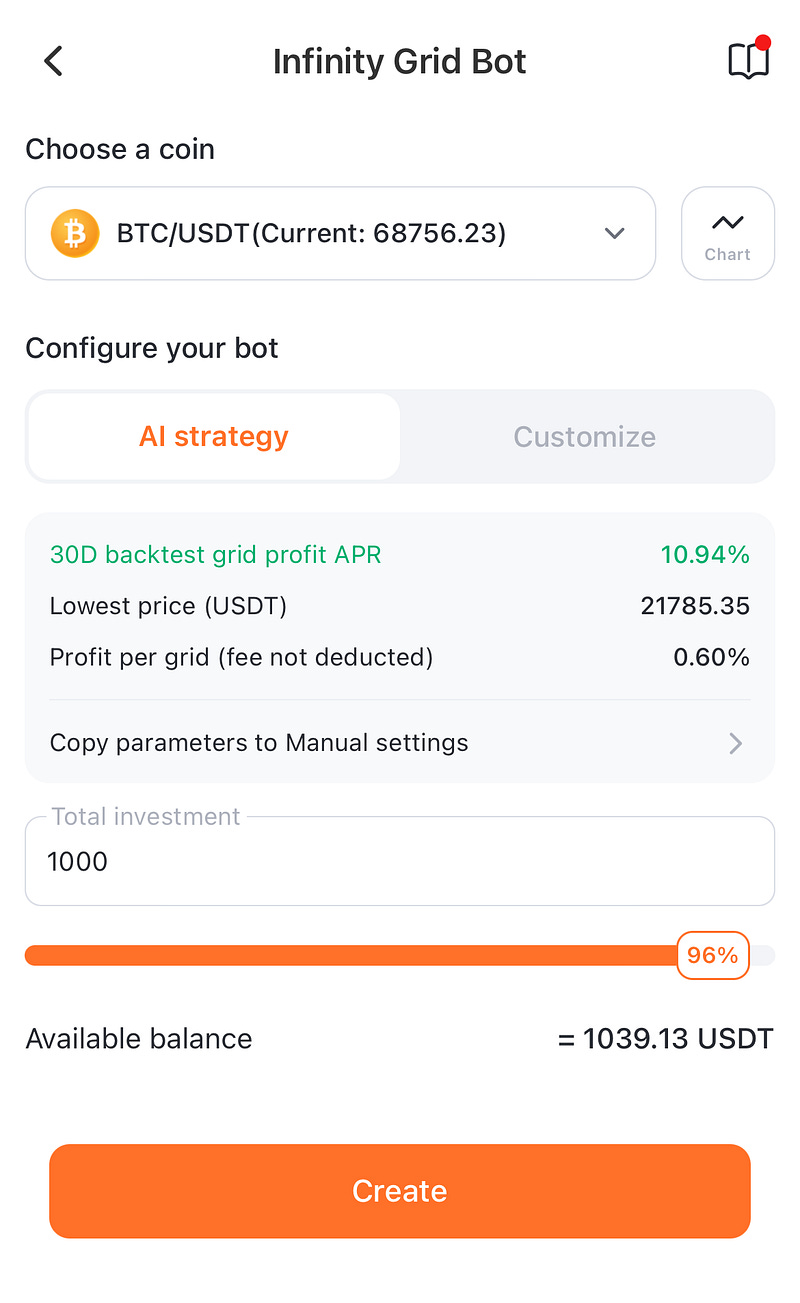

AI Settings suggests parameters based on historical market data analysis. You only need to input your total investment.

Customized Configuration

You can set your lower limit and desired profit per grid, and a stop loss, and that’s pretty much it.

The bot stops trading when it hits the lower limit and resumes once the price exceeds it.

The profit per grid, or grid size, determines your profit size and transaction frequency.

Smaller grids (<1%) result in more transactions with smaller profits, while larger grids (>1%) yield fewer transactions with larger profits.

Your total investment is the capital you allocate to the bot.

Summary : The Infinity Grid Bot shines in upward-trending markets.

The Infinity Grid Bot is popular among optimistic investors attempting to ride a bull market.

Overall, if you believe a crypto asset’s bullish trend and growth is immanent, the Infinity Grid bot is built for that.

The Infinity Grid bot’s Advanced Settings allow you to select Stop-Loss and Take-Profit prices. The Stop-Loss price is the lowest at which the bot will automatically sell the base currency to offset possible losses.

However, when the price of the underlying asset reaches the predetermined level, the bot will close the position at the Take-Profit price, protecting your earnings.

The Grid Bot will execute it’s grids, and continually create more grids as price increases, keeping your bot alive during a strong bullish trend.

As with any bot strategy you haven’t tested, it is recommended to start with smaller balances, parallel test different configurations, and become accustomed to the bots operation before you invest major amounts of your money.

Parallel testing your bot settings will help you determine what is more profitable for you.

Because Infinity Grids are investing a fraction of your total principal into each grid, losses are reduced, while allowing you to still capture strong upward trends.

Continue to Part 10 of this series :

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

Automated Income Lifesyle w/ Chris Morton YouTube

#botlife #bots #tradingbot #cryptobot #cryptocurrency #bitcoin #altcoin #infinity