Beginner’s Guide to Crypto Trading Bots — Part 6— Rebalancing Bot

The art of shuffling your coconuts to stabilize your coconuts, or even to get more coconuts!

The art of shuffling your coconuts to stabilize your coconuts, or even to get more coconuts!

“If you could go back in time and give yourself advice from over a decade of trading crypto, what would it be?”

He paused.……“Rebalance, Rebalance, Rebalance!”

Rebalancing Bot

Profile

Best for : All markets

Profit Expectation : High, Long Term

Risk : Low (dependent on the chosen crypto itself, and time of bot creation relative to market conditions)

Rebalancing is the practice of re-adjusting the allocation of assets within a cryptocurrency portfolio to maintain a degree of risk exposure, or just for simple diversification purposes.

It entails regularly selling and purchasing or disposing of cryptocurrencies within the portfolio in order to preserve the desired ratio of assets to other assets.

This technique can be used with two coins, or multiple coins and different ratios.

So, why would I want to do this?

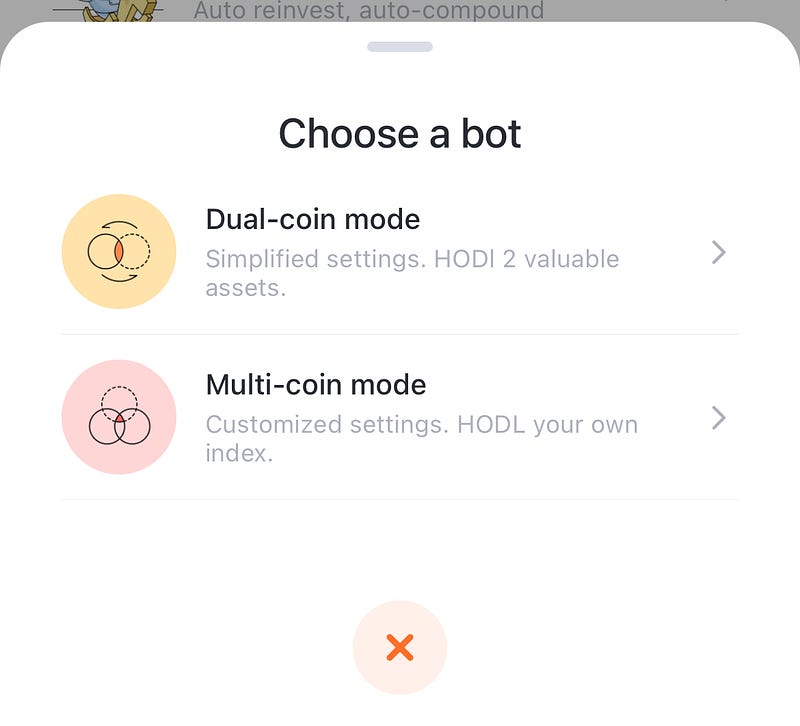

When you select the Rebalancing bot in Pionex, you will be presented with two options.

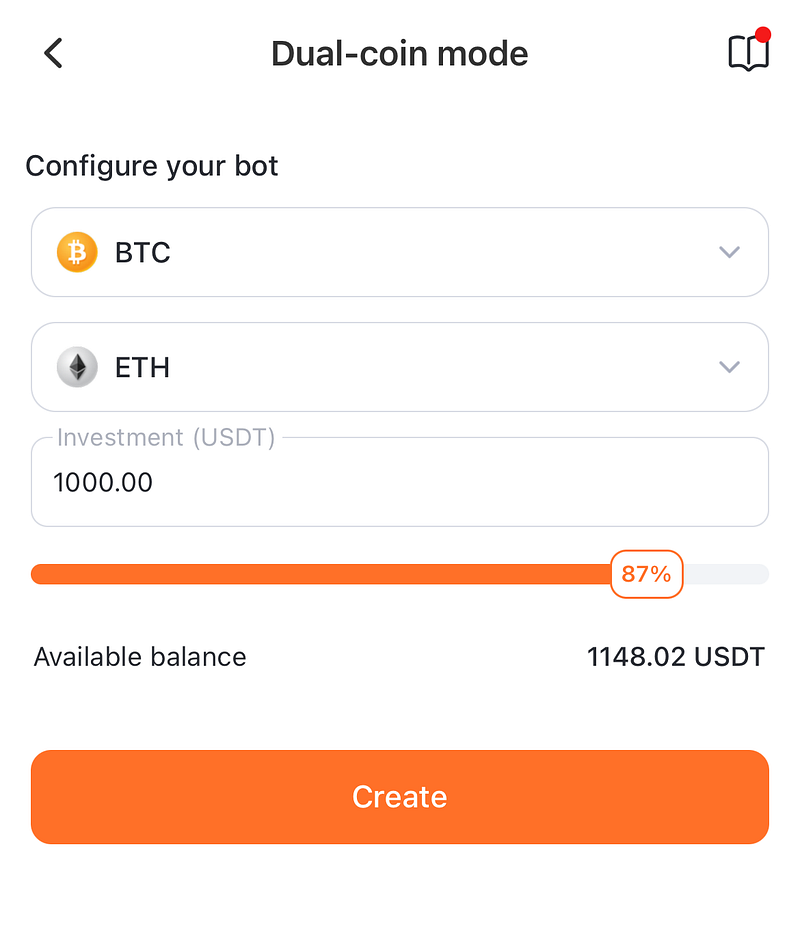

Dual-Coin Mode

If you build a rebalancing and select dual-coin mode with BTC and ETH, the bot will distribute your holdings at a 1:1 ratio.

The bot will purchase equal amounts of Bitcoin and Ethereum based on the current market price.

By default, the bot will check in every five minutes, adjusting it’s position to reflect changes in the two coins’ exchange rates and maintaining a 1:1 position ratio at all times.

If you invest $1000, then it will put $500 into BTC and $500 into ETH.

Gain Balancing

When your BTC value has increased to $600 USDT and your ETH value has remained relatively stable at $500 USDT, the rebalancing bot will sell $50 USDT of BTC and purchase $50 USDT of ETH in order to maintain the position ratio at 1:1. You currently have $550 USDT in BTC and $550 USDT in ETH.

When it comes to strategy, the rebalancing bot has an edge over hoarding coins since it can take advantage of changes in token exchange rates to engage in rebalance arbitrage.

If you are outside of the United States, the bot also supports “Spot” and “Leveraged” on coins selection.

Note : the leveraged tokens are high-risk derivatives, please be careful while selecting those currencies.

Loss Balancing

If one currency in the portfolio experiences a decline in value while the other maintains a relatively stable value, the same remains true — the bot will take action to keep things level.

Let’s say your Bitcoin (BTC) falls to $400 USDT value and Ethereum (ETH) stays at $500 USDT.

In this instance, the initial 1:1 ratio between Bitcoin and Ethereum is no longer upheld, as Bitcoin now makes up a smaller share of the portfolio than Ethereum.

The bot will sell some ETH and use the proceeds to buy BTC in order to bring the portfolio back to the intended 1:1 ratio.

Multi-Coin Mode

Up to ten coins can be allocated in the “Multi-coin mode,” which if you are not in the United States, also allows for the selection of “Spot” and “Leveraged” coins.

The position and proportion of each coin can be easily adjusted in the Customize Tab.

If you are unsure about the coins to select for the rebalancing bot, you can begin by clicking the “Select an index” button.

This is essentially copy trading based on other traders rebalanced portfolios.

These indexes, which comprise high-value and potentially profitable cryptocurrency assets (such as top coins in different domains, platform coins, mainstream coins, and so forth), are all endorsed by prominent figures in the field.

Three index sorting techniques are available: “Latest published,” “Most profitable (180D),” and “trending.”

The index can be selected based on your personal tastes.

Options :

Trigger Price: The operation of the rebalancing bot occurs when any given coin hits it’s trigger price. You can set each value independently. This is how the user controls how much gain or loss is needed to trigger a rebalance.

Rebalance: This is the option to toggle the bot on/off while keeping your positions active, without having to stop the bot. This allows you to hold and ride when you want to stop re-balancing temporarily. (Such as in the event of a massive price increase in one currency that is not a market movement moving the other coins up along with it)

Rebalance Mode

This option will determine if you are rebalancing according to time intervals, or specific price fluctuations.

Periodic

Periodic rebalancing will check your ratio according to the time interval you select.

Threshold

Threshold Rebalancing will rebalances when a coins price hits the threshold you select.

Can I loose money with a Rebalancing Bot?

Absolutely.

As with any investment or any bot, there is always risk.

Price swings in cryptocurrency marketplaces are sometimes erratic and unpredictable.

The rebalancing bot may purchase or sell assets at a loss if the prices of the assets in your portfolio fluctuate significantly over a brief period of time.

Most likely ways to Loose Money rebalancing:

Inaccurate Market Predictions: The rebalancing method is predicated on the idea that the market will behave a specific way, such as trending or returning to the mean. The rebalancing bot may execute trades that degrade the performance of the portfolio if these forecasts prove to be inaccurate.

Leveraged Positions: Leveraged positions, which increase both gains and losses, may be permitted by certain rebalancing bots. Losses could be significant if the market goes against your leveraged position.

Most likely ways to Make Money rebalancing:

Accurate Market Predictions: Need I say more?

Leveraged Positions: Leveraged positions. With great risk comes great reward. No guts, no glory.

I have recently opened two rebalancing bots with some ETH, BTC, and LTC. And another with just BTC/ETH. I intend to test these for a year before I publish stories about them, and even that may not be long term enough to really see the true effects of rebalancing. T

hese are the primary cryptos I am using bots with.

While there is no such thing as an absolute guarantee (even BTC might crash one day), choosing coins with a high trust factor is the best way to come as close as you can get.

Continue to Part 7 of this series :

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

Automated Income Lifesyle w/ Chris Morton YouTube

#botlife #tradingbots #crypto #trader #bitcoin #coin #tradingforaliving #bottrader