Understanding Grid Bots.

Grid Trading Bot

Profile

Best for : Any Market Condition

Profit Expectation : Low/Moderate/Long Term

Risk : Low/Moderate (APR 3%-30 average%)

The Grid Bot creates a grid-like pattern by placing buy and sell orders strategically at different intervals above and below the current market price. The bot automatically makes trades when the market fluctuates, taking advantage of price differences to benefit while reducing potential losses.

Each trade involves a portion of your position, but never the full position in a single order.

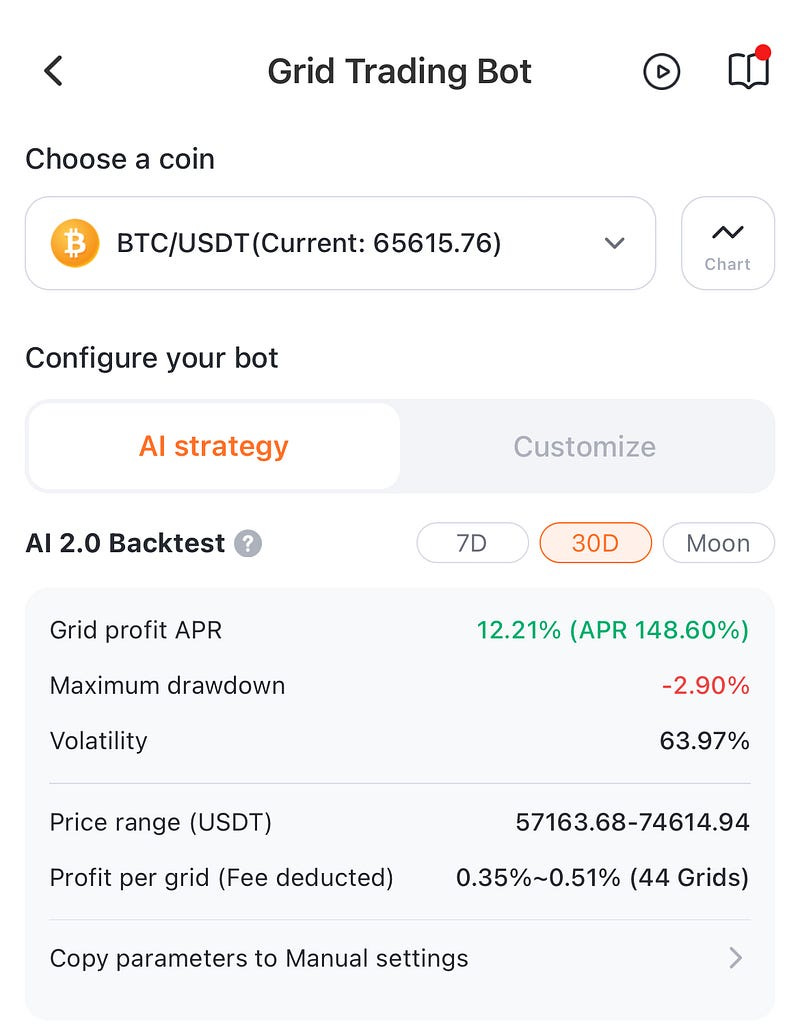

Set Grid Parameters: Determine the range within which you want to trade and the number of grid levels you wish to deploy. For example, let’s consider trading within about a $20,000 range with 44 grids.

The bot opens by placing both buy and sell orders at regular intervals above and below the current market price.

For instance, if the current price is 59,000, it might place buy orders at $59,300, $59,700, $60,100, and so on, and sell orders at $60,100, $60,400, $60,800, and so forth.

As the price fluctuates, the Grid Trading Bot will automatically execute trades whenever the market reaches the predefined grid levels.

When the price reaches a buy order, the bot will execute a buy trade, and when it reaches a sell order, it will execute a sell trade.

Since the bot has both buy and sell orders in place, it profits from the price movements within the defined range.

If the price moves up, the bot sells at higher levels, and if it moves down, it buys at lower levels. The goal is to accumulate profits from these fluctuations.

Regularly monitor the market and adjust the grid parameters as needed to adapt to changing market conditions. This may involve adjusting the grid range, grid spacing, or the number of grid levels.

Another Hypothetical Example:

Let’s consider a hypothetical scenario where we’re trading Ethereum (ETH) with an investment of $10,000. We’ll set up a grid with a range of $200 (from $9,900 to $10,100) and deploy 10 grid levels with a spacing of $20.

Buy Orders: $9900, $9880, $9860, …, $9700

corresponding to :

Sell Orders: $10100, $10120, $10140, … $10300

Suppose the price fluctuates between $9800 and $10200 over a 180 day period, executing trades at each grid level:

Buy at $9900, sell at $10100, profit +2%

Buy at $9880, sell at $10120, profit +2.4%

Buy at $9860, sell at $10140, profit +2.8%

Buy at $9700, sell at $10300, profit +6%

Total = 13.2% profit

Total profit from on a $10,000 balance = $1,320 approx.

Manual Configuration

If you wish to adjust the bot to dynamically adjust in different market conditions, you need to select Customize.

You will define the spread — defining the lowest price and highest price you want the bot to act within, and set the number of grids you want executed, controlling the amount invested in each grid, and the profit potential of each.

In the example above, based on todays BTC value (roughly $65,000) — let’s say I define the lower limit at $10,000 (BTC usd value), and the upper limit at $70,000.

My bot will now make a few orders that will be FAR below the market price, and those orders will not execute unless Bitcoin falls back to that range.

If you create too wide of a spread, you end up placing orders that will never be filled, and are thus kind of pointless.

If your spread is too thin, your bot can go out of range faster and trading stops until you stop/reconfigure the bot.

Advantages of Grid Bots

Profit No Matter the Market: Grid trading makes the most of market by enabling users to profit from price swings in any direction without having to forecast the moves of the market.

Risk management: By distributing risk over many trades and reducing vulnerability to abrupt market swings, grid trading entails putting buy and sell orders at regular intervals and only investing a portion of your full balance for each trade.

Disadvantages of Grid Bots

Lower Returns. The typical gains seen on grid bots are anywhere from a few percent to about 30%. Grid bots are generally made to be safer and mitigate risks.

Complicated To Mentally Conceptualize

The profitability of a grid bot is greatly effected by very small changes. Because the number of grids and the size of the spread create a very wide variability in performance, some people will do well, others might never do well, and it might require a lot of math to sit down and figure out where you need to improve. The more grids = the more complicated it is to “see a path and take it.”

Adaptive Strategy

To adapt to the state of the market on the fly, users can change grid configuration by stopping the bot, reconfiguring, and restarting.

I do this all the time with DCA Martingale bots — and I call it “widening” or “thinning” the spread.

A lot of the same principles would be involved in adjusting your grid bot settings.

Continue to Part 4 of this series :

Beginner’s Guide to Crypto Trading Bots — Part 4 —DCA Bots

Do Yourself a Solid with Dollar Cost Averaging!

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

Automated Income Lifesyle w/ Chris Morton

I'm just a regular guy who automates my income. A few years ago I automated my primary business to the point where I…www.youtube.com

#botguide #tradingbot #beginner #userguide #strategy #getstarted #btc #crypto