Beginner’s Guide to Crypto Trading Bots—Part 10 — ”Set it and Forget It” vs “Semi Automated”

What’s the difference?

What’s the difference?

When I first started using crypto trading bots, I assumed that all trading bots were fully automated and totally capable of hands-free constant profit.

Just start them up, then sit back and watch it compound, right?

Whoopee!!!!

Right?

The truth is — that is NOT the reality!

If you want your bots to earn enough to excite you, and also remain in action without stalling out or taking big losses, it is likely you will need to be dynamically configuring your bots on the fly, stopping them and restarting them with fresh settings based on the current market trends, or choosing different bots based on your ability/desire to engage them.

Note : When I go on vacation, I run very different bot settings than I do when I have all day to play Mr. Day Trader.

My primary earning bots are Martingales.

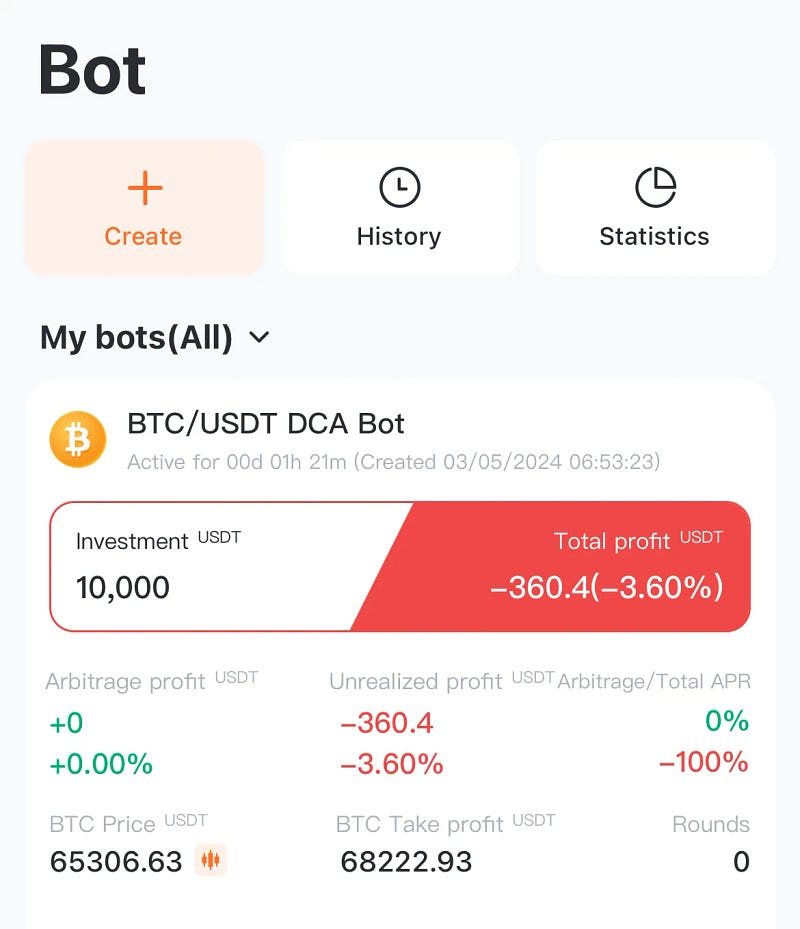

When my Martingale bots end up in the red — and the price of the crypto doesn’t recover within 2–3 days, it takes a fair amount of market analysis confidence and a bit of dumb luck to know when to hit stop and restart at a loss and recoup in the current range, and when to wait it out banking on the market to rise soon.

Heads up:

The Martingale bots I use are in the red quite often.

This is expected.

Especially when squeezing my bot spread to maximize profits by creating more volatility on demand.

What I mean by that statement is, even when a market is relatively flat, zoom in a bit, and you’ll find it’s still got some heartbeat to it, to capture a smaller price flux requires lower buy/sell percentages and fewer buys — this applies on the Martingale Bots, specifically. (Grids Bots are a bit different)

This definitely creates more risk for me, as bots can jump out of range when squeezing, quite easiliy.

But - thanks to sticking to a strategy, I don’t have to worry being negative for very long.

Once you get a good feel for how each of the common trading bots work, how to configure them, how to respond to them, and just as importantly — what coins to run them with, you will eventually find a favorite bot, or a set of favorite bots and they will start to feel like a set of complimentary tools, comfortably worn in like your favorite shoes.

You will start to get a better idea of what settings to run, and why, and which bots to use, and when.

Then you can have a reality where you are profitable most of the time, and you can walk away without worrying about loosing your investment to unexpected price crashes or bot arbitrage losses.

What is the best bot to use right now?

The Best Tool for the Job!

Set it and Forget It Settings

Most of the time, I prefer Semi-Automated day trading with the assistance of bots.

How I Earn $6,000/mo from with Semi-Automated Crypto Trading on my Mobile Device

There is no upsell at the end of this blog.

When I want to walk away and not worry about my bot being stalled out at a loss, I change the settings of my bot to keep it in range during a possible large price flux.

Lets say I’ll be gone for a month, and the largest movement in the last few months has been 20% inside of 30 days.

For my Martingale bots, I would widen the spread by changing my price scale percentages, increase my total buy ins, and this would distribute my risk across 20% or so.

Now I can “Set it and Forget it”

I will likely be less profitable while my settings are widened this way, but if the market dips back down or up by 20%, I will be able to ride that wave without my bot being stalled, unable to buy/sell.

HONK HONK, Very Important Detail Coming Up>>>>

For the Set it and Forget it method to work, I have to be trading on BTC, ETH, or LTC.

Anything else, who knows what will happen.

You should only attempt this with coins that you are VERY confident about, and always be VERY careful when trading Altcoins with bots.

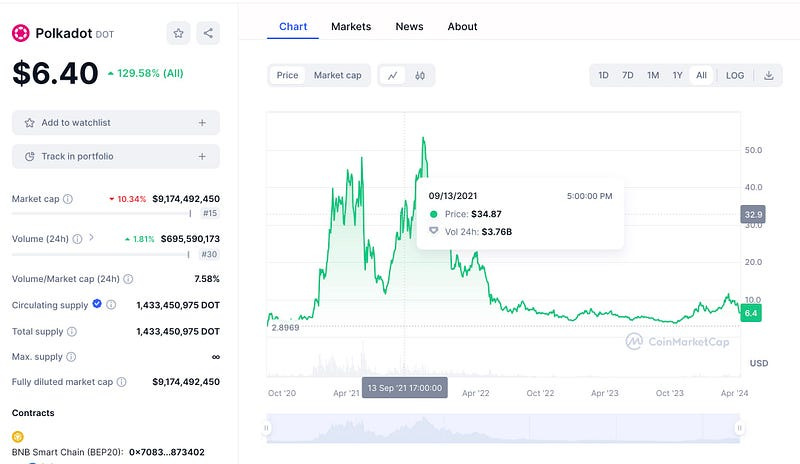

Example : I once believed in DOT. I still do — the Polkadot ecosystem is still growing, but I bought into DOT and started running a bot on it in 2021 when it was around $30.

DOT soon fell to $6, and is now hovering $8 during the current bull market, no signs of returning to $30 anytime soon.

If I would have let the DOT Bot ride, I would have lost big time.

I pulled out at $20, taking a 30+% loss and biting the bullet hard.

BTC and ETH — I have been in the red for entire months and then still come out with strong profits at the end of the year, even though I don’t generally leave my bots too much in the red for too long anymore. I know I can recoup with semi automated strategy better than just waiting.

But lets say I didn’t stop the bot and restart — I have a quiet peace of mind because I know that BTC and ETH, absent some catastrophic event, will continue to increase in value over time.

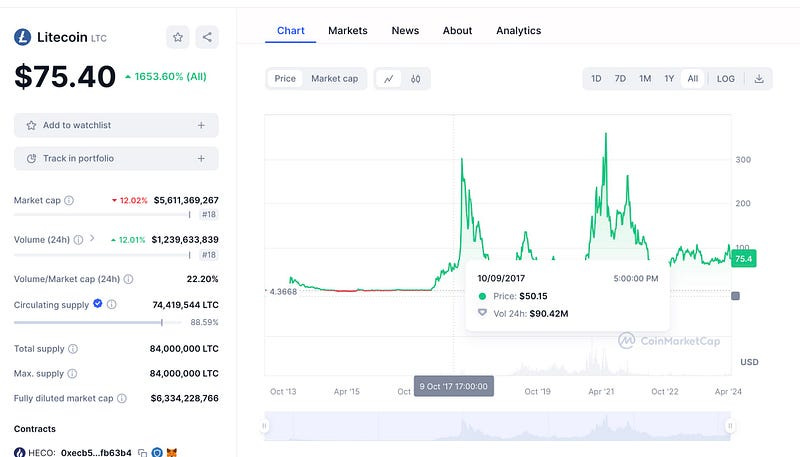

LTC — the same, only I know LTC is going to bob up and down in the $50–$100 range rather predictably…. it reminds me of the physical silver markets.

Why that happens to be, I have no idea, but this is what LTC has been doing historically for almost 7 years with a few glorious spikes up to $125 and beyond.

As a result, the “Set it and Forget it” strategy for my LTC bot is a bit different than my configuration for my BTC or ETH bots.

LTC has a tendency to bounce 10% and then plateau for a bit, keeping my bots frustrated often, even when I am watching them.

When I need to walk away, I go super-wide by default — 20% spread, with 8 buys or so, regardless of the recent market movement.

You can technically always do that if you want to lean on the side of safety.

Alternative to Widening Spread on Martingale

Sometimes I up a Grid Bot with lots of grids (you can usually do up to 1000 grids), and set the profit-per-grid low.

Each grid will only invest a portion of your balance — technically your balance divided by 1000, and you will average out the gains/losses across the invested balance and typically end up with anything from 5–30% gains over an entire year.

I have been profitable with Grid bots at the end of every year that I have tested them. Not huge profits, but gains all the same.

Grid Bots can also go into the red, but the same is true — my grid bots were almost never in the red more than 5% or so, and tended to not be red for long — it’s hard for the grid bot to end up sunk into a big price hole because most of your balance is not invested at any given time, unlike the Martingale.

Your full balance may be locked in limit orders, but full position is rarely attained. That itself is good assurance against major losses.

Disclaimer : This is not financial advice and I am not a financial advisor. This is just what I am doing with my own money. I am NOT an expert. I am some dude on the internet who sees a path sometimes, and takes it.

🖥️ My Pionex (USA) referral link : https://www.pionex.us/sign/ref/Nlyjd7Fh referral code = Nlyjd7Fh

Thank you for reading!

Until next time….

Onward and Upward Everybody!

-Chris

Automated Income Lifesyle w/ Chris Morton YouTube

#tradingbots #crypto #bitcoin #litcoin #trading #lifestyle #daytrader #cryptotrader