Litecoin is…. a squirrely coin!

This squirreliness can be to your advantage…. with a little patience.

Ok, so that title was a bit of a click bait title.

Litecoin has gained 10% in a day, but with my bot strategy that has been a bit harder to capture.

It took time and a bit of experience / observation for me to learn this.

I still refer to LTC as my lucky coin, even though in bot-land, I am not as profitable with it. I wanted to share my results.

Fun fact : my LTC experience is why I started paper trading more this year using Crypto Trader (a trading simulator app), so I can observe and get the feel of a coins movement in a simulated space before I start putting real money there.

I realized that different coins may need different strategies to maximize what I can get.

If I don’t know how to better detect the nuances of price movement on a particular coin, it’s hard to configure a bot.

I am still in the green overall with my LTC Martingale bot, and I have more than ROI’d, but the LTC bot is definitely proving harder to capture profit the same way I do with BTC and ETH.

When I first started running an LTC bot last year — the first 2 months were great.

It was earning about as much as my ETH bot, which was pulling about 2k per month.

Then… LTC price jumped out of range by almost 10%.

Then it did that again.

And again.

I have been in drawdown and consecutive losses enough to cancel out half of it’s higher earning months, thus averaging only $750-$800 profit per month. Sadly.

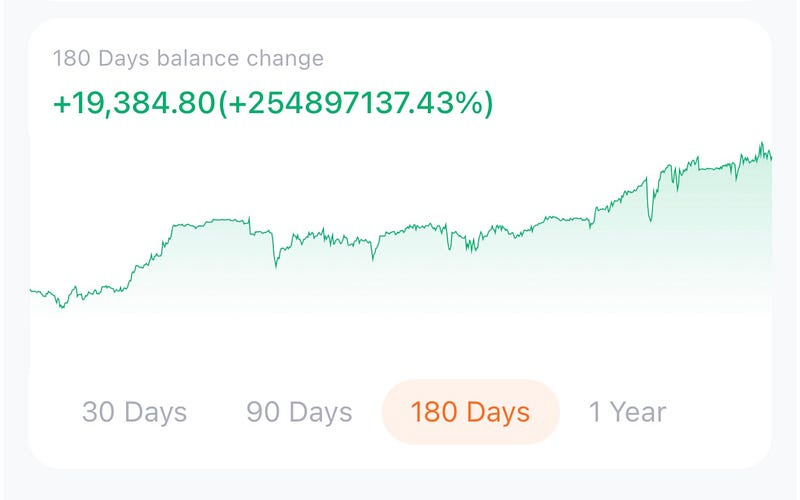

LTC 180 Day Chart

Ouch.

This is even when widening my spread to default settings and having about 10% of LTC value in my range.

Why is this bot so much less profitable?

Simply put, LTC can jump out or range by 5-10% unexpectedly, and when attempting to capture profit on a flatter market condition (which is about 70% of the time), it’s almost inevitable that the bot will not just go out of range, but go out of range by -$200 or more.

Like…. today.

LTC has done this has done this more than few times in the last year.

I can keep my BTC and ETH bots in range fairly easily, and don’t have as much unexpected 10% +- movement with them.

Sure it can still happen, but so infrequently that it doesn’t have a huge impact my overall average.

ETH Bot 180 Chart

The Advantages of LTC Price Squirrely Movement

There have been good times with LTC too, such as when I set my profit % to 10%, on a lark, and LTC actually increased by 10% in less than a week.

That kicked a$$.

But, that was a FLUKE.

(Unless there was some kind of market mover trigger I was unaware of)

My rationale for configuring my bot for 10% sell off : if LTC can go down 10% in a day or two, of course it can go up 10%, but if it jumps in a single day, then any Martingale bot configured to capture only 1% might miss out on that completely.

Martingale’s aren’t great for steep increases unless you set the profit percent where you think the price might go.

However, I kept my bot set up that way for two consecutive months and the profit would have been basically nothing if I didn’t manually stop the bot in the green to capture every single cent.

The bot almost missed an opportunity to capture a 5% increase too.

If I didn’t slam stop on the bot, it would have missed it.

So, keeping the bot configured this widely, not great overall for a flat market.

But that is the crux of the biscuit here.

When I set up my bot to capture a flatter market condition by thinning the spread, LTC jumps out of range.

LTC thwarts me fairly often.

When I predicted a nice increase post LTC halving, nothing happened. It certainly had no correspondence to what we are seeing in BTC world right now.

It is not sustainable to run my bot strategy on LTC in flat market conditions for now….. easier to do limit orders.

Litecoin, the Limit Order King

I’ve had a far better return on Litecoin keeping a balance and setting limit orders.

This is in part due to the 5–10% jumping that Litecoin does.

Not so great for the particular bots and strategy I am running, but excellent for well timed limit orders.

I buy LTC around $50 or $60 (this last time I bought at $62) — and I hold until LTC hits $80 or $100.

Pretty predictable return, I just have to wait for the sell to happen.

I have bought and sold LTC about 6 times that way in the last 3 years, and have doubled my balance a few times.

Pretty passive, much more-so than my Semi Automated bot strategy.

I currently have a $100 limit order open for LTC, and I’m hopeful that it will be pushed above $100 as long as the BTC Parade continues to Bull.

So far it’s looking like I will close out of my LTC bots when this run is in decline, and just set limit orders on LTC.

Disclaimer : This is not financial advice and I am not a financial advisor. This is just what I am doing with my own money. I am NOT an expert. I am some dude on the internet who sees a path sometimes, and takes it.

Thank you for reading!

If you enjoyed, here are three ways you can help me out:

Drop me a follow → Automated Income Lifestyle

Leave an appreciation and a comment if you enjoyed

Receive an e-mail every time I post on Medium → Click Here

Until next time….

Onward and Upward Everybody!

-Chris

Automated Income Lifesyle w/ Chris Morton YouTube

#cryptotrader #cryptobots #litecoin #kingoflimitorders #tradingsecrets #notfinancialadvice